Marathon Digital Holdings recorded a net loss of $21.3 million for the second quarter, despite its Bitcoin (BTC) production surging by over 300%, according to an Aug. 8 statement.

Earnings breakdown

Per the financial statement, the miner earned $81.8 million during the three months, slightly less than the $83.4 million estimated by market analysts. However, it is significantly higher than the $24.9 million it made during the second quarter of last year.

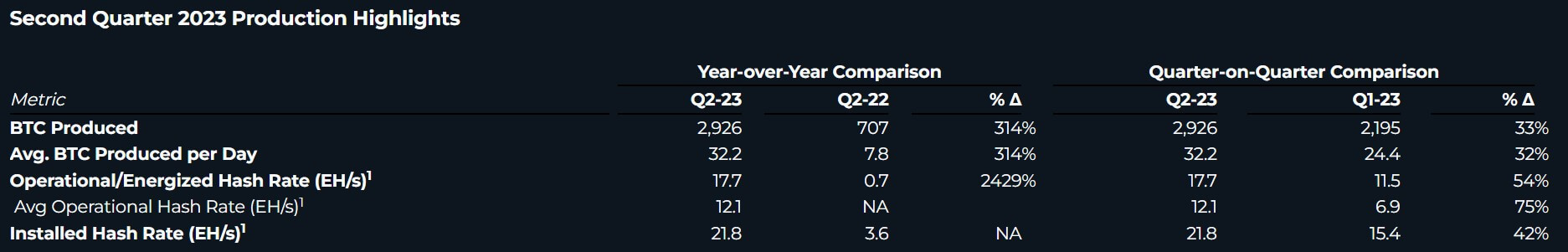

The miner continued that its BTC production soared by 314% to 2,926 BTC, offsetting the current year’s 14% lower average BTC prices. It added that it sold 63% of its mined BTC for a $23.4 million gain.

Marathon CEO. Fred Thiel, discussing the company’s Q2 performance, stated that its financial position improved as it exited the quarter with $113.7 million in unrestricted cash and cash equivalents and approximately 12,538 Bitcoin, valued at $380 million as of June 30. Thiel said:

“In Q2, we grew our energized hash rate 54% from 11.5 to 17.7 exahashes. By growing our hash rate faster than the rest of the network and improving our uptime, we also increased our bitcoin production. We produced a record 2,926 bitcoin during the second quarter, representing approximately 3.3% of the Bitcoin network rewards available during the period.”

Thiel disclosed that Marathon had successfully met its target of 23 exahashes for the month, adding that its miners in Garden City would soon begin production while its joint venture in Abu Dhabi is already hashing and producing BTC.

In response to the Q2 financial reports, Marathon (MARA) shares rose by 4.13%, ending trading at $15.72 on Aug. 8. The miner’s stock value is up more than 300% on the year-to-date metric, according to Tradingview data.

The post Marathon Digital posts Q2 losses amid record-breaking Bitcoin production appeared first on CryptoSlate.