A Bitcoin on-chain indicator is currently attempting a breakout that could turn out to be a bullish signal for the asset’s value.

Bitcoin Active Entities Is Trying To Escape Network Stagnation Range

In a new post on X, Jamie Coutts, a Bloomberg Intelligence analyst, has discussed the BTC active entities metric, and how it has a strong relationship with the coin’s price.

The “active entities” here are a measure of the unique total amount of Bitcoin addresses that are participating in some kind of transaction activity on the blockchain. Naturally, both senders and receivers are counted by the metric.

When the value of this metric rises, it means that an increasing number of users are engaging with the network. Such a trend is a sign of growing adoption for the asset.

On the other hand, declining values of the indicator imply that interest in the cryptocurrency may be waning, as fewer addresses are becoming active on the blockchain.

The analyst has pointed out that the active entities metric has a high r-squared value with Bitcoin.

From the table, it’s visible that the r-squared value for the active entities is 0.55. What this means is that 55% of all fluctuations in the cryptocurrency’s price can be explained by this variable.

There are only a few metrics with a higher r-squared value, making the active entities an indicator with one of the strongest statistical relationships with BTC. “Importantly, this is also a stable relationship over time (ex the wonky pre-2012 data),” Coutts notes.

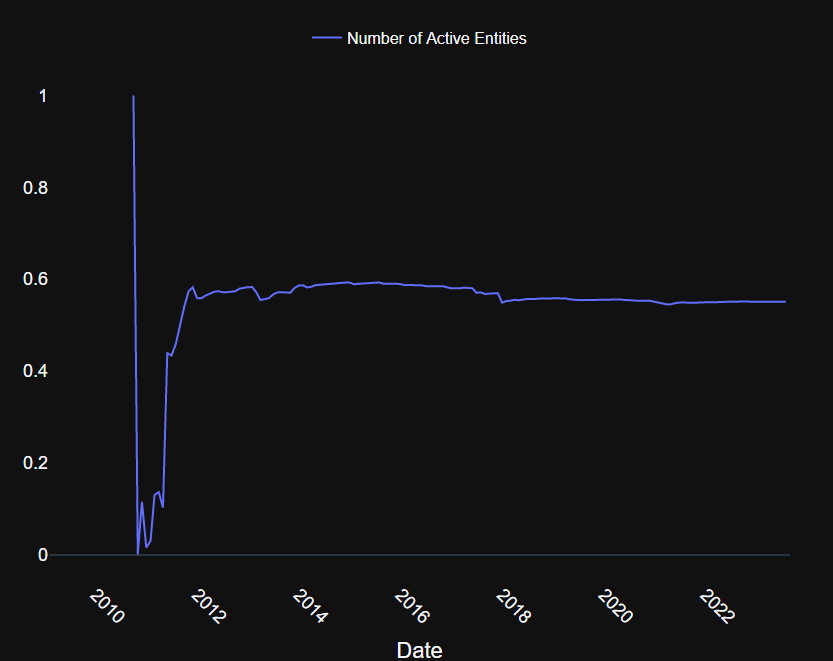

Now, here is a chart that shows how the Bitcoin active entities have changed during the history of the cryptocurrency:

As displayed in the graph, the Bitcoin active addresses have stagnated around each of the cycle lows, but in the periods between them, it has seen a rise, although the pace has been getting slower over time.

Since 2021, the indicator has been inside a rather long phase of stagnation, as the indicator has been unable to escape out of a particular range. It would appear, however, that things might be starting to change for the better.

The CMT explains that it’s looking like a TA-style breakout so far, but it’s not yet fully clear whether the Bitcoin active entities have truly escaped the stagnation range.

If the metric can manage to stay above the range for the next few weeks, it might be a confirmation that the extra entities that have started trading on the network are truly planning to stick around, and hence, that constructive adoption is finally picking up for Bitcoin.

BTC Price

At the time of writing, Bitcoin is trading at around $25,900, down 11% in the last week.