Digital asset investment products recorded significant outflows totaling $168 million last week, marking its largest outflow since March, according to CoinShares’ latest weekly report.

CoinShares analyst James Butterfill attributed the substantial deficit mainly to recent delays by the U.S. Securities and Exchange Commission (SEC) in deciding a multitude of pending spot BTC ETF applications.

Earlier in the month, the SEC delayed its decision on the Ark 21Shares spot Bitcoin(BTC) ETF application and requested public opinion. Since then, the financial regulator has yet to provide new updates about the other applications before it.

Bitcoin, Ethereum lead outflows

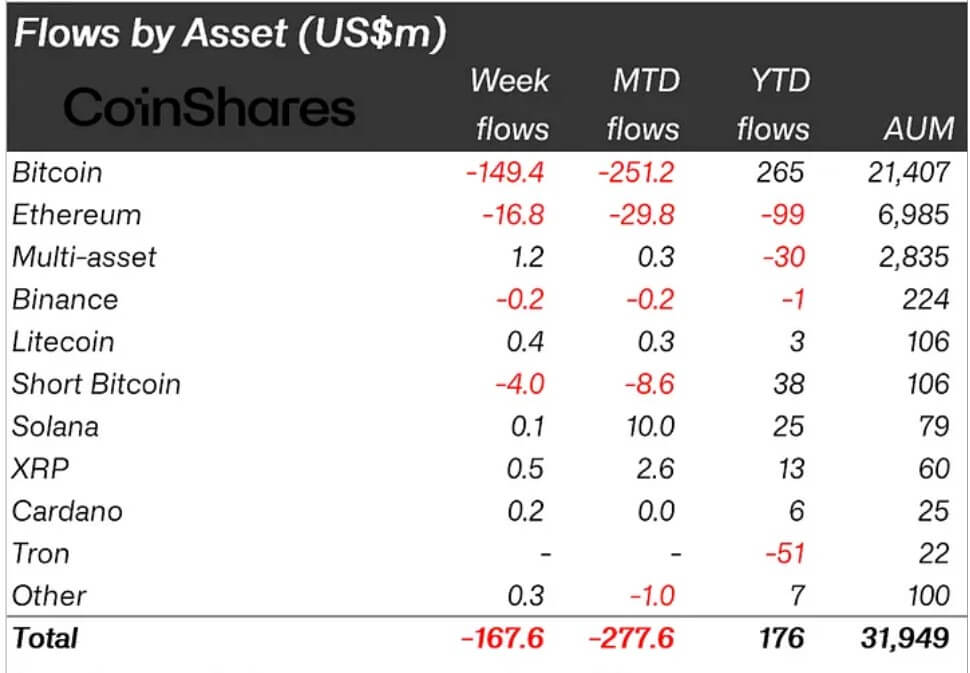

Per the report, Bitcoin and Ethereum (ETH) were responsible for most outflows, as the flagship digital assets saw roughly $166 million in total outflows.

The massive outflows highlight the bearish sentiment permeating the market since the crypto market’s flash crash of Aug. 17. At the time, traders who held positions in the market lost over $1 billion as BTC and ETH’s prices fell to multi-week lows.

However, altcoins such as Cardano, Litecoin, XRP, and Solana saw minor inflows ranging from $0.5 million to $100,000. Multi-asset investment which had consistently experienced weeks of outflows, turned a corner with a $1.2 million positive flow last week.

Despite the prevailing bearish sentiment, investors persistently reduced their short Bitcoin positions, marking the 18th consecutive week of outflows for this products. Last week, $4 million was withdrawn from this product class, taking its total outflows to 89% of the assets under management.

Meanwhile, the outflows have come amidst a market with very low trading volume. The overall trading volume for the week was $1.3 billion, which is 16% below the year average.

Across regions, European and North American investors dominated the sell-off. German investors led the line with $68 million in outflows, while Canada is a close second with $61.2 million in outflows. The U.S. completes the top three with an outflow of $19.5 million.

The post Digital asset investment products see massive $168M in outflows appeared first on CryptoSlate.