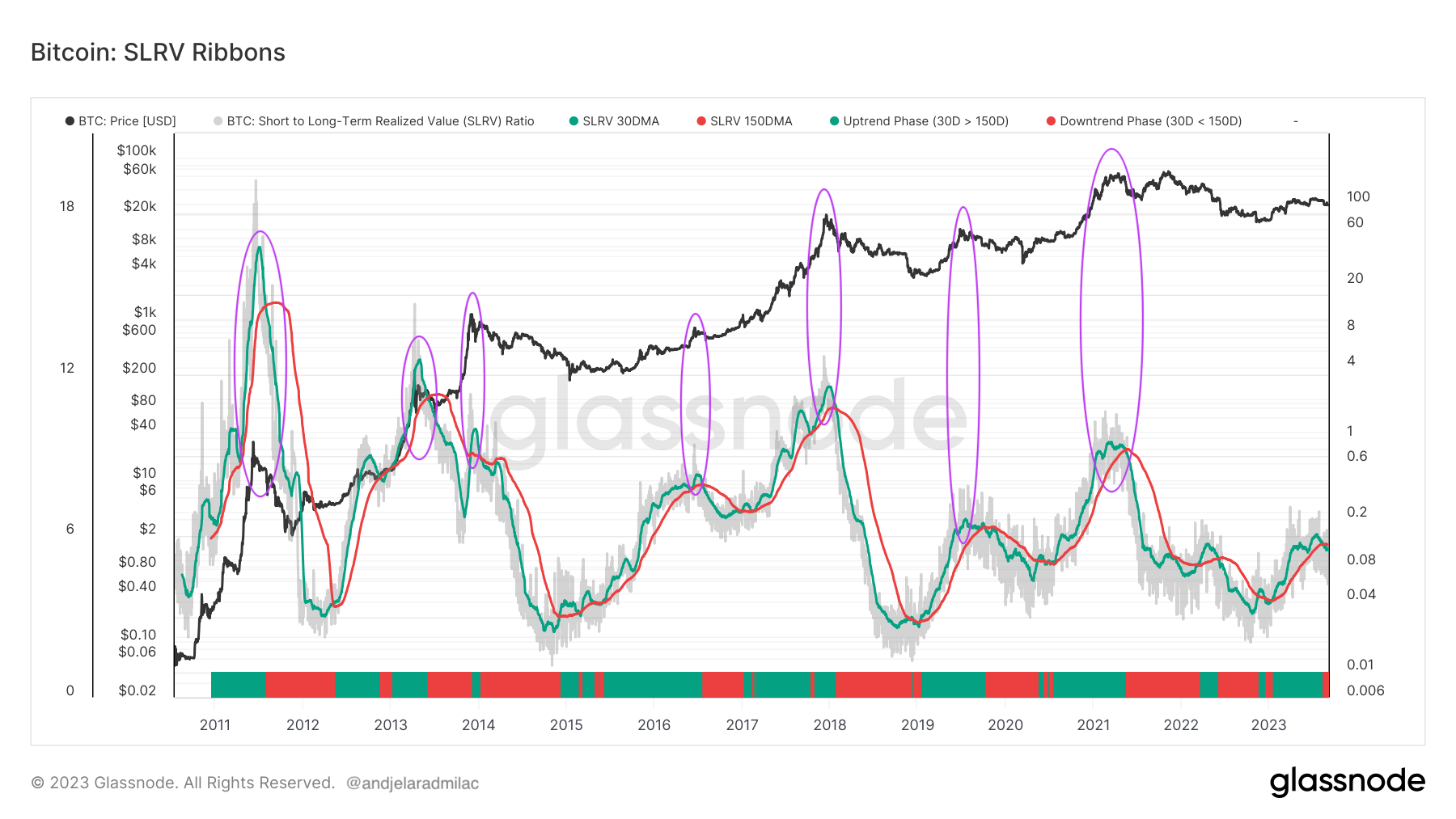

Spent Lifespan Relative Value (SLRV) offers a lens into the age of coins transacted on the Bitcoin network. Essentially, it helps differentiate the actions of long-term holders and short-term speculators, acting as a measure of market sentiment.

The SLRV ribbons are a visual representation of the SLRV ratio, plotted over different time frames, primarily the 30-day moving average (30DMA) and the 150-day moving average (150DMA). Their importance is underscored by their ability to offer a clear picture of market trends.

The 30DMA, representing a shorter time frame, captures the recent behavior of traders, typically associated with short-term holders or speculators who react to immediate market changes. On the other hand, the 150DMA, with its extended period, reflects the actions of long-term holders who base their decisions on prolonged market trends and are less influenced by short-term market fluctuations.

When the 30DMA is above the 150DMA, it indicates a bullish sentiment, with long-term holders not selling their coins. Conversely, when the 30DMA falls below the 150DMA, it signals a potential bearish turn, with older coins entering the market.

Historical data reveals a correlation between the peaks of the SLRV 30-day moving average (30DMA) and peaks in the Bitcoin price. As the SLRV 30DMA increases, a significant portion of long-term holders are selling their coins, often leading to a price peak. Following this, Bitcoin’s price tends to drop when the SLRV 30DMA dips below the SLRV 150DMA. This inversion of the ribbons acts as a precursor to a potential market downturn.

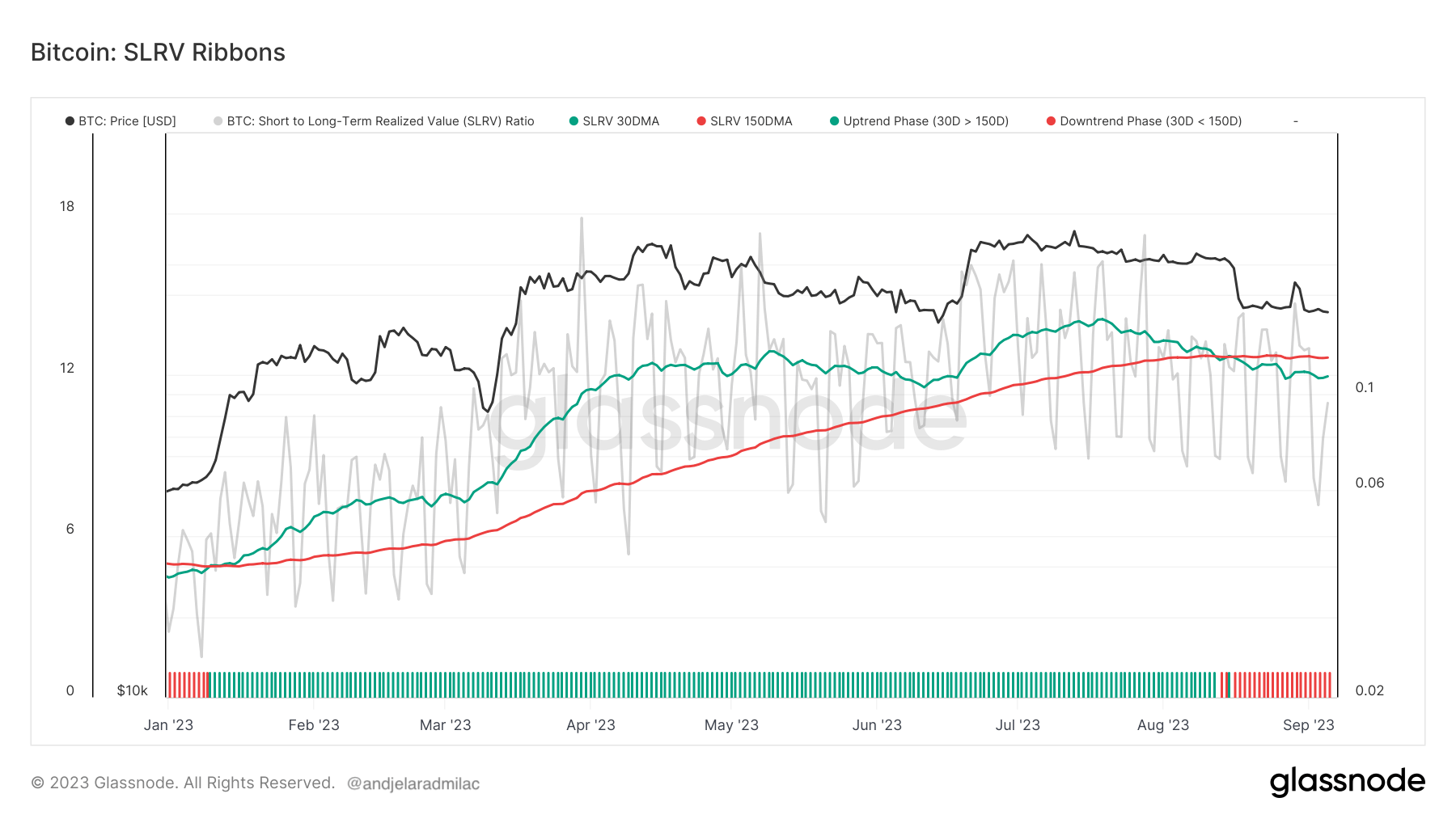

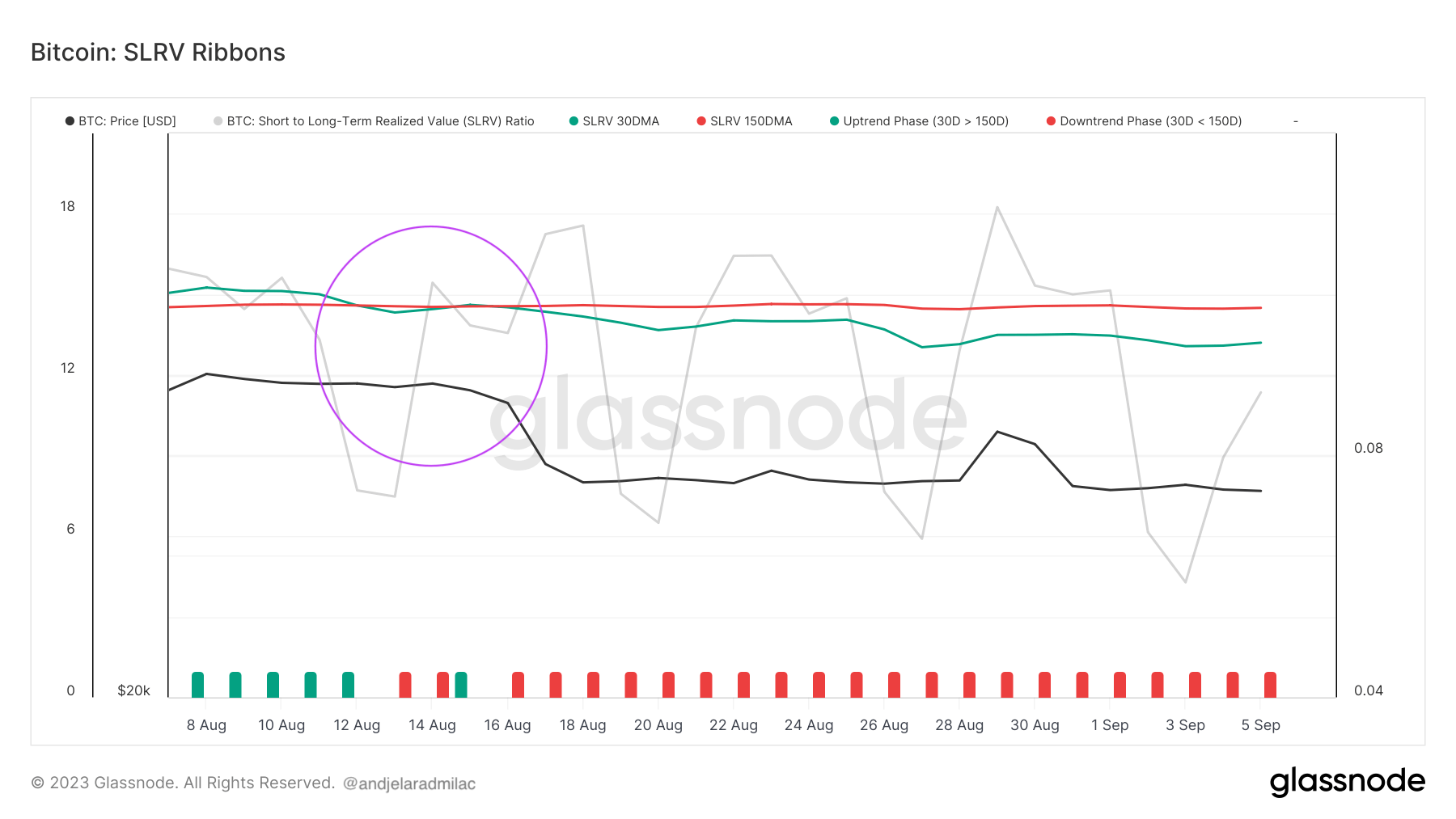

The SLRV 30DMA remained dominant over the 150DMA for most of the year.

However, a notable shift occurred on Aug.13, when the 150DMA briefly went above the 30DMA. Bitcoin’s price was oscillating around the $29,200 mark at the time, confined within a tight trading range set in mid-June. By Aug. 15, the SLRV ribbons were fully inverted, with the 30DMA plunging below the 150DMA. This inversion was mirrored in Bitcoin’s price, which took a hit, dropping from $29,200 to $26,000.

As of Sep. 6, the SLRV ribbons remain inverted, with the downtrend showing no immediate signs of reversal. For market participants, this could be a sign of caution. The inversion of the SLRV ribbons, coupled with Bitcoin’s price response, suggests that the market might be entering a phase where long-term holders are considering liquidating their positions. This could exert downward pressure on Bitcoin’s price in the near term.

The post Decoding SLRV Ribbons and what they mean for Bitcoin’s price appeared first on CryptoSlate.