While most crypto market analyses predominantly focus on Bitcoin and Ethereum, given their stature as the two largest and most influential cryptocurrencies, it’s crucial to underscore that stablecoins are an equally pivotal market force.

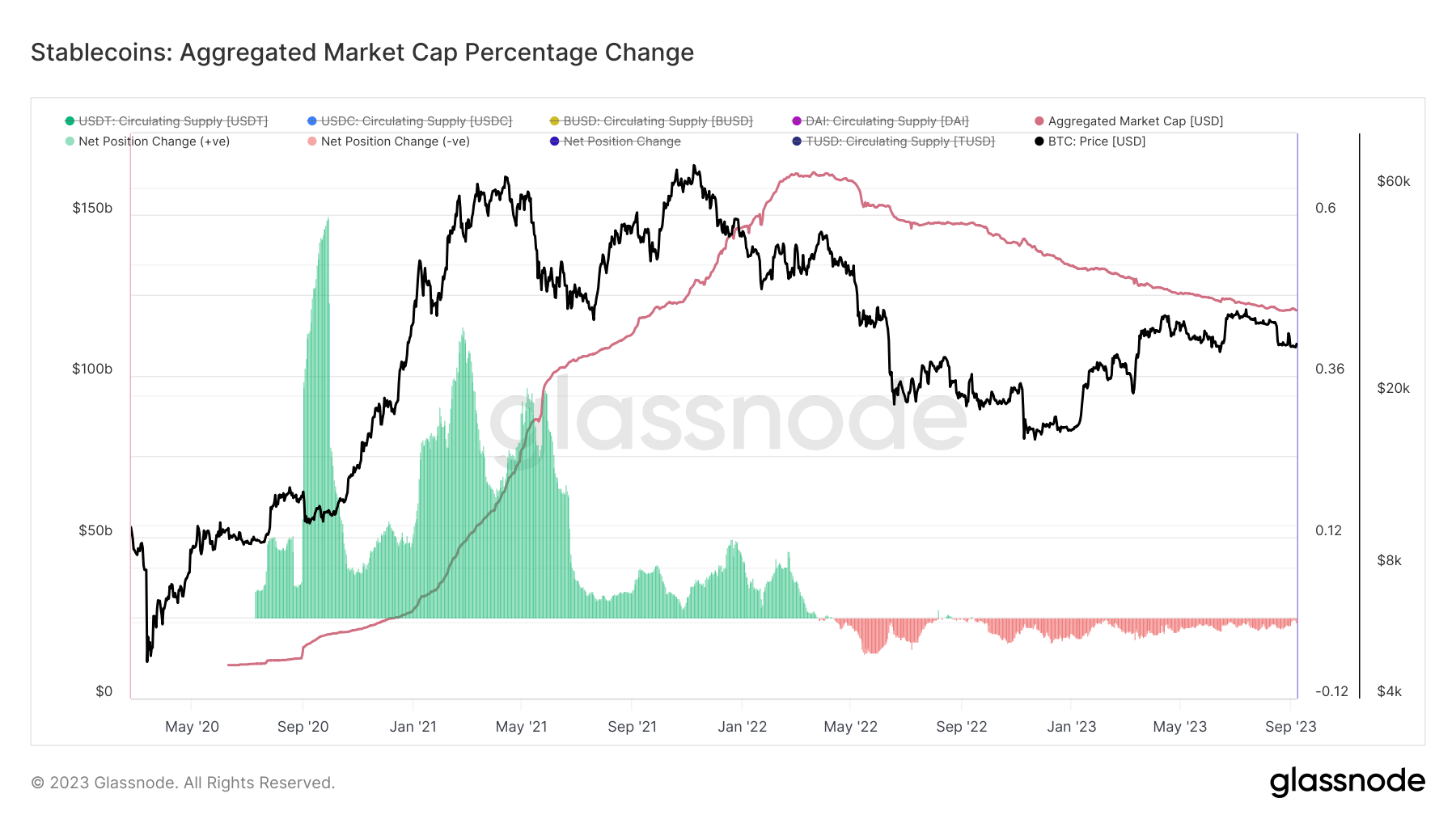

Stablecoins saw their all-time high in March 2022. At that time, the combined market capitalization of the top five largest stablecoins reached $162.8 billion. To put this in perspective, a year prior, in March 2021, this aggregate market cap stood at $55 billion. However, the tides began to shift in April 2022, when the aggregate stablecoin market cap embarked on a downward trajectory. Barring a few short-lived positive net position changes, this decline has persisted until today.

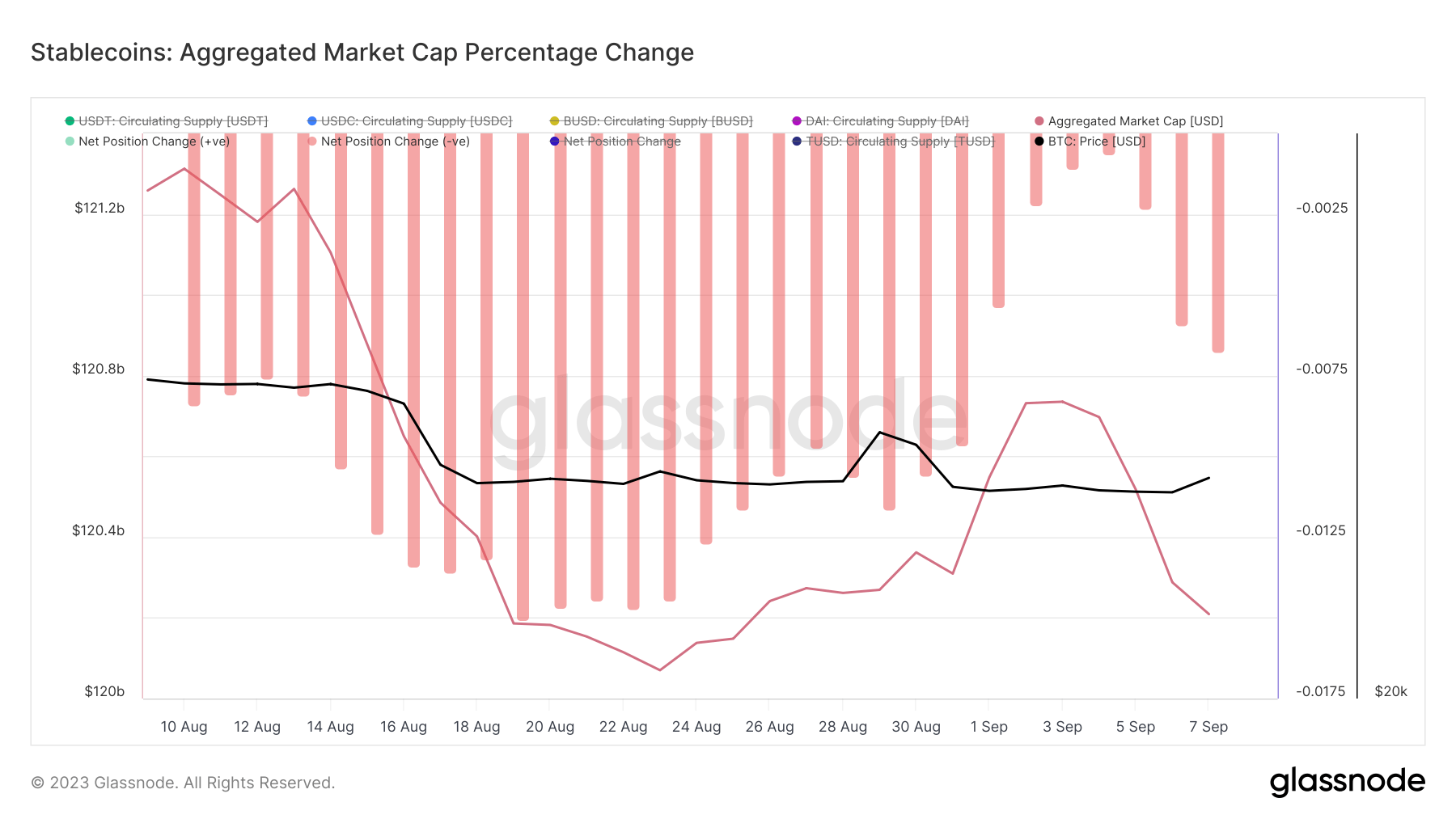

As of Sep. 8, the collective market supply of the top five stablecoins is valued at $120.2 billion. A closer examination of recent fluctuations reveals that between Aug. 23 and Sep. 1, the aggregate stablecoin market cap increased by approximately $661 million. However, the growth was short-lived, and $526 million was wiped from the market cap since the beginning of September.

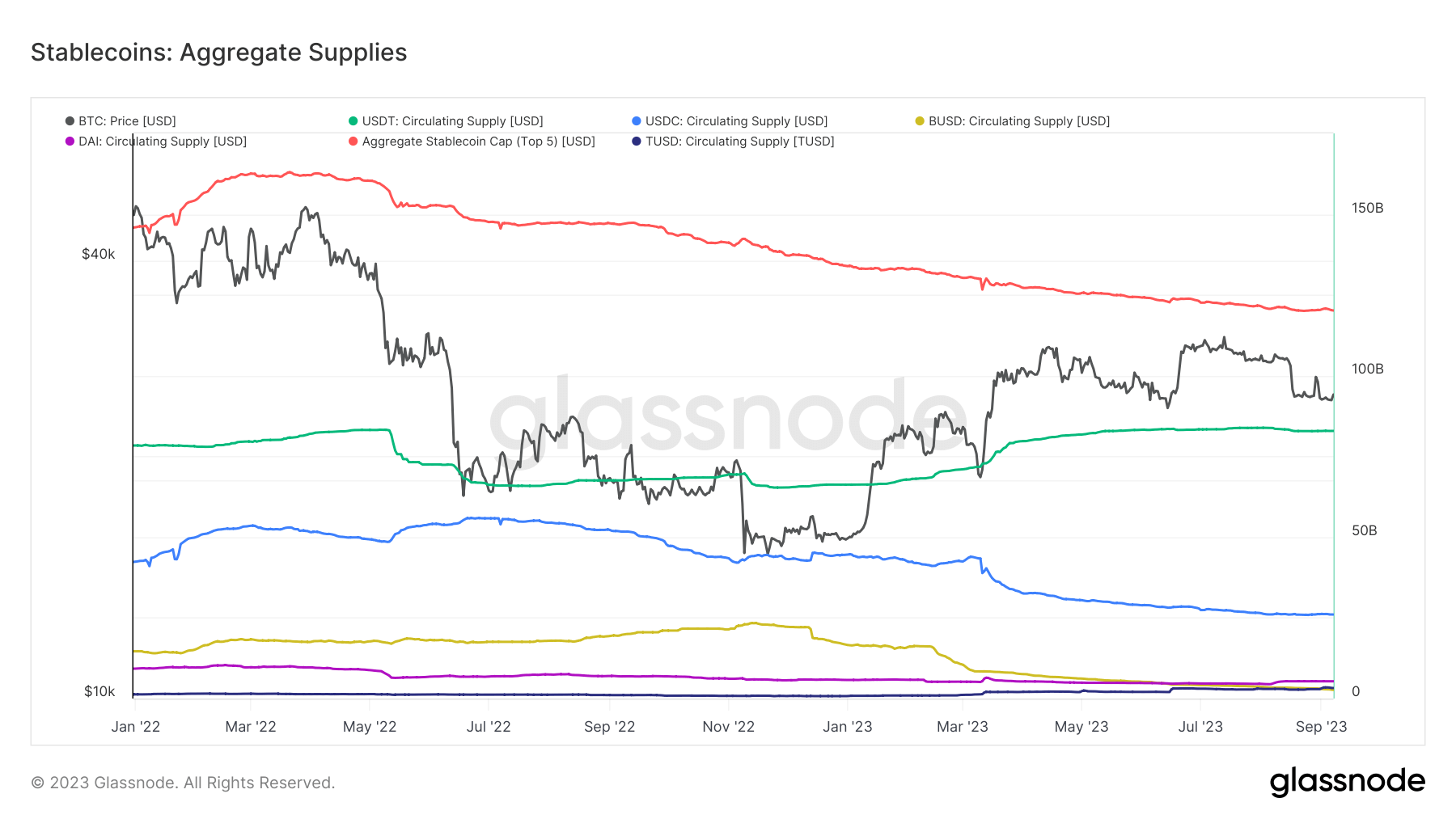

Analyzing each of the five stablecoins that constitute this aggregate metric shows that Tether (USDT) was the only stablecoin to witness a net increase in its market cap. Since the beginning of the year, USDT’s market cap grew by $16.6 billion and currently stands at $82.8 billion. Notably, Tether is inching closer to its all-time high (ATH) of $83.2 billion, established in May 2022.

TrueUSD (TUSD) has also seen a notable increase. Starting the year with a slightly over $762.2 million market cap, it has now grown to $3.26 billion.

However, not all stablecoins have fared well this year. BUSD witnessed a significant contraction in its market cap, plummeting from $16.5 billion to $2.6 billion as it began its wind-up. Circle’s USDC experienced a substantial reduction, with its market cap dwindling from $44.5 billion to $26 billion within nine months. In contrast, DAI maintained its stability, with its market cap hovering consistently around the $5 billion mark.

The fluctuations in stablecoin supply highlight the dynamic nature of the crypto landscape, particularly as they often correspond to broader market trends or reactions to specific industry developments. While some stablecoins like USDT and TUSD are expanding their foothold, others like BUSD and USDC are seeing significant reductions. These changes can be attributed to various factors, including regulatory challenges, market sentiment, and the evolving landscape of decentralized finance (DeFi) platforms.

In conclusion, while Bitcoin and Ethereum often steal the limelight, the role of stablecoins in shaping the crypto market cannot be understated. Their supply dynamics offer a barometer for gauging market sentiment and liquidity.

The post A closer look at the changes in stablecoin supply as TUSD gains on market appeared first on CryptoSlate.