Huobi Global, a prominent cryptocurrency exchange, is at risk as investments in the staked USDT (stUSDT) project soar to $1.8 billion. The project, spearheaded by crypto entrepreneur Justin Sun, promises 5% returns tied to low-risk securities like government bonds.

However, according to a Bloomberg report, Huobi’s heavy involvement in the project raises concerns about the exchange’s ability to manage sudden outflows of funds and the transparency of its reserves.

Huobi’s Association With stUSDT Sparks Concerns And Triggers Institutional Withdrawals

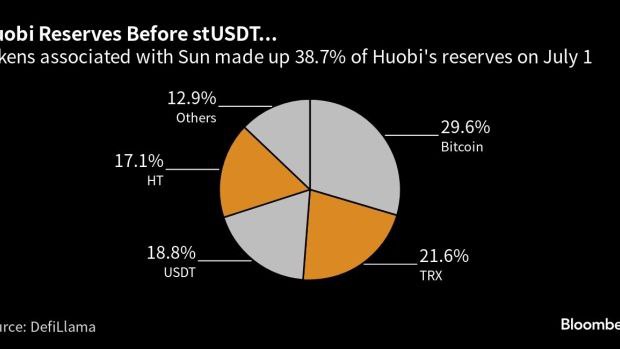

Per the report, Huobi’s close association with the stUSDT project has led to a significant transformation in the exchange’s crypto reserves.

Altering by this shift and the lack of transparency surrounding stUSDT, institutional traders have withdrawn a substantial portion of their crypto holdings from Huobi.

This withdrawal trend highlights the potential risks of Huobi’s concentration on the stUSDT platform. Notably, blockchain research firms have expressed concerns about the relative lack of transparency surrounding the stUSDT project.

The absence of comprehensive information about its investments raises questions about the source and sustainability of the advertised 4.2% yield. Huobi’s reliance on the project exposes the exchange to problems that may arise within stUSDT, further magnifying its potential vulnerabilities.

As investments in stUSDT have grown, Huobi’s Tether (USDT) reserves have plummeted, raising further concerns. While Huobi maintains that stUSDT is a separate project not overseen by the exchange, the heavy concentration of stUSDT in its reserves implies that Huobi’s fortunes are closely linked to the success or failure of the project.

The dominance of tokens associated with Justin Sun, such as TRON (TRX) and Huobi Token (HT), in Huobi’s reserves adds another risk layer, as market participants could perceive it as a higher exchange risk.

Huobi Global’s Average Daily Trading Volume Plummets

Institutional clients, including crypto funds and market makers, have expressed concerns about the dominance of stUSDT and other tokens associated with Justin Sun in Huobi’s reserves.

According to Bloomberg, these clients have withdrawn a significant portion of their digital assets from the exchange shortly after the launch of the staked Tether project. This departure from Huobi has contributed to a decline in the exchange’s average daily trading volume.

The stUSDT project’s rapid growth and lack of transparency raise questions about its underlying investments and the sustainability of its returns. Investors and industry experts emphasize the importance of increased transparency and oversight to understand the sources of yield and mitigate potential risks.

Per the report, the project’s management team intends to engage a reputable third-party verification entity to enhance community oversight. However, further details about the project’s structure and employees remain scarce.

What is certain is that Huobi Global’s involvement in the stUSDT project has significantly impacted the composition of its reserves, raising concerns among institutional traders and industry experts.

The heavy concentration of stUSDT, TRX, and HT tokens in Huobi’s reserves and the lack of transparency surrounding the project pose potential risks to the exchange’s financial stability.

To alleviate these concerns, greater transparency and oversight are essential, ensuring the sustainability and credibility of the stUSDT project and Huobi’s operations in the evolving crypto landscape.

Featured image from iStock, chart from TradingView.com