Quick Take

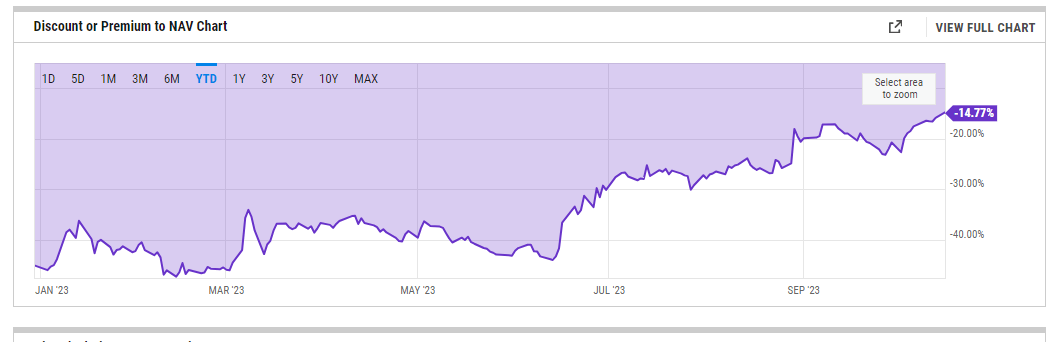

The Grayscale Bitcoin Trust (GBTC) fund ended the day yesterday, Oct. 16, up 7.7%. The substantial rise took GBTC’s year-to-date gains to a striking 166%. However, concurrently, the discount to Net Asset Value (NAV) has declined below 15% for the first time in the past two years, now standing at 14.77%, according to Y charts.

The current price action appears to be a reflection of investor sentiment regarding potential future developments. There is rising speculation that the GBTC fund could transform into a spot Exchange Traded Fund (ETF). This notable shift in market sentiment may be driving the increased activity in GBTC as investors position themselves in anticipation of a possible transition.

As the possibility of a spot ETF becomes increasingly plausible, financial markets may witness further volatility within the digital asset class.

The post For the first time in two years, GBTC discount to NAV drops below 15% appeared first on CryptoSlate.