Quick Take

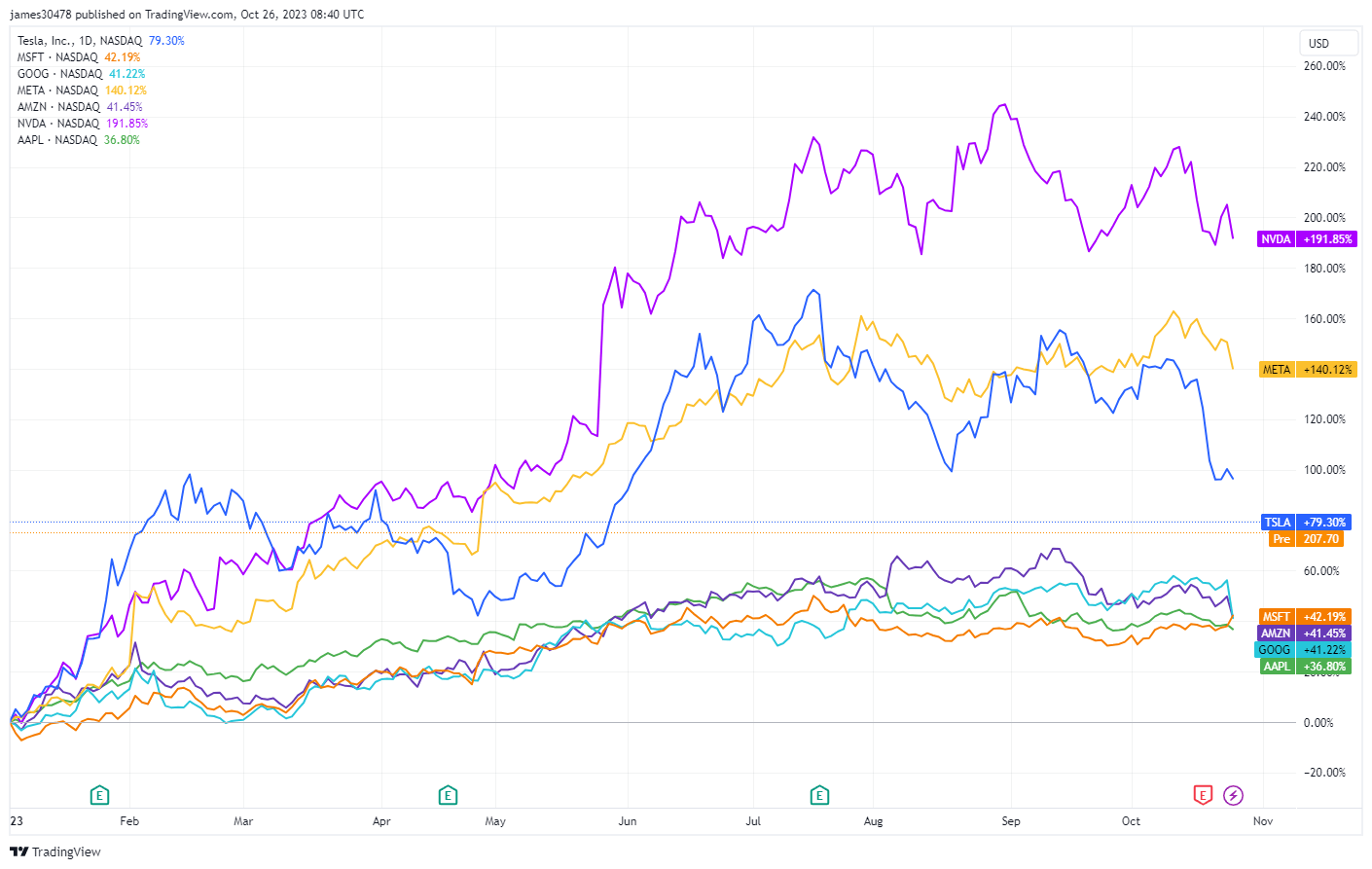

The ‘Magnificent 7’, a moniker for the top 7 tech stocks – Apple, Tesla, Nvidia, Amazon, Meta, Google, Microsoft – have been a beacon of robust performance with impressive year-to-date gains.

Nvidia, leading the pack, surged with a rise of 191%, followed by Meta at 140% and Tesla at 79%. The remaining titans, including Microsoft, Amazon, Google, and Apple, also reported substantial gains between 36% to 42%.

However, the optimistic narrative took an unexpected turn in October but has steadily declined since the second half of 2023.

Despite the year’s robust performance, earnings reports revealed a less-than-ideal picture, leading to significant market cap reductions.

An aggregation of the losses experienced in October highlights a staggering wipeout of roughly $800 billion in market cap. Google and Microsoft bore the brunt of the hit, with market caps declining by approximately $370 billion and $350 billion, respectively.

Meanwhile, Apple, Amazon, and Nvidia saw about $200 billion erased from their market cap. Tesla and Meta weren’t spared either, facing a contraction of around $120 billion each.

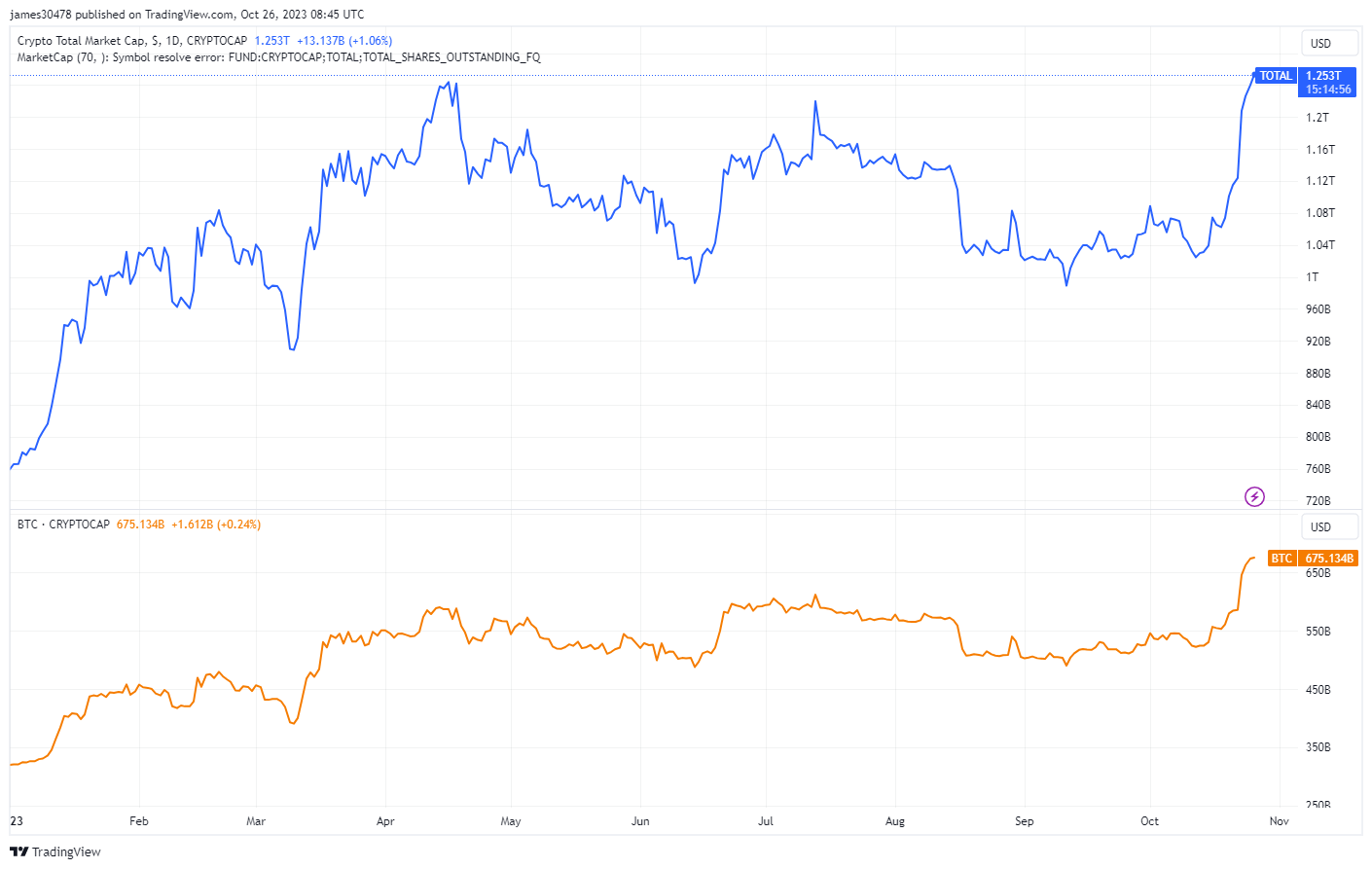

Over this year, we’ve observed a trend of investors shifting their focus from cryptocurrencies to Artificial Intelligence (AI).

However, recent trends hint at a possible reversal, suggesting a shift from AI to cryptocurrencies. The overall market capitalization of cryptocurrencies has seen a significant surge, growing by approximately $250 billion, from around $1 trillion to $1.25 trillion.

Bitcoin, the pioneer digital asset, has driven most of this increase.

The post Digital asset market cap surges by $250 billion in October as tech stocks plummet appeared first on CryptoSlate.