Quick Take

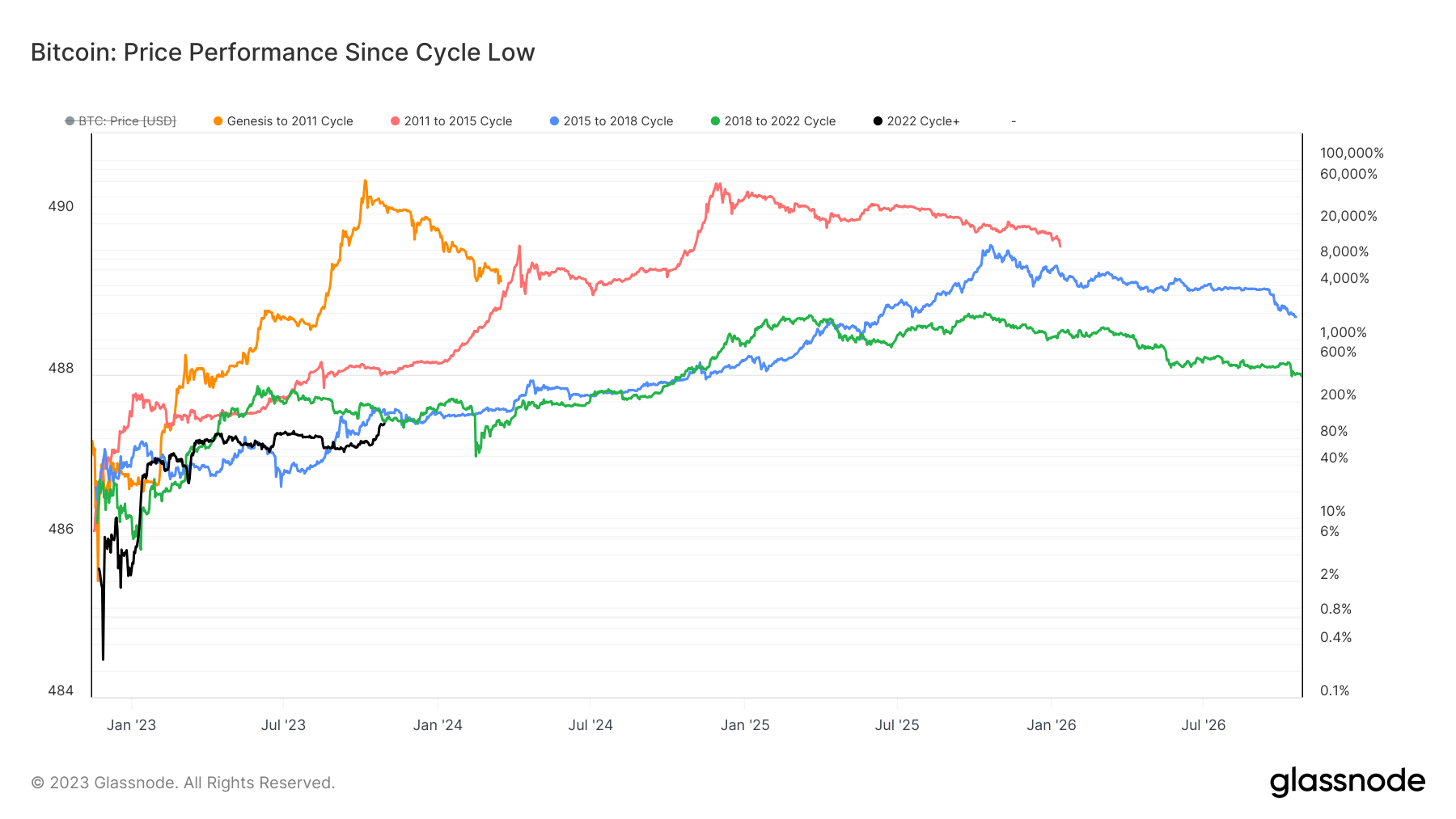

Bitcoin’s (BTC) resilience is once again underscored by recent data showing a 113% rally from the cycle low, sparked by the fallout from the FTX collapse in November 2022. This rise, strikingly, is commensurate with the performance during previous cycles, indicating an enduring robustness in Bitcoin’s market resilience.

In a historical context, when measuring from the same number of days past each cycle’s low, Bitcoin’s growth trajectory shows compelling patterns. During the 2015-2018 cycle, Bitcoin witnessed a 164% rise from its low point. Similarly, in the equivalent time span from the cycle low in the subsequent 2018-2022 cycle, Bitcoin saw a 116% surge.

Despite the sharp fluctuations and setbacks, the current performance since the cycle low has managed to stay consistent with past cycles. This demonstrates an impressive pattern of recovery, underlining Bitcoin’s inherent volatility yet consistent bounce-back potential.

However, it’s crucial to observe that measuring performance from cycle lows before 2015 could yield skewed results, given Bitcoin’s nascent stage as a highly volatile and immature asset during that time. Hence, the present analysis retains its focus on later cycles for a more accurate and balanced comparison.

The post Bitcoin’s post-FTX performance in line with previous cycles appeared first on CryptoSlate.