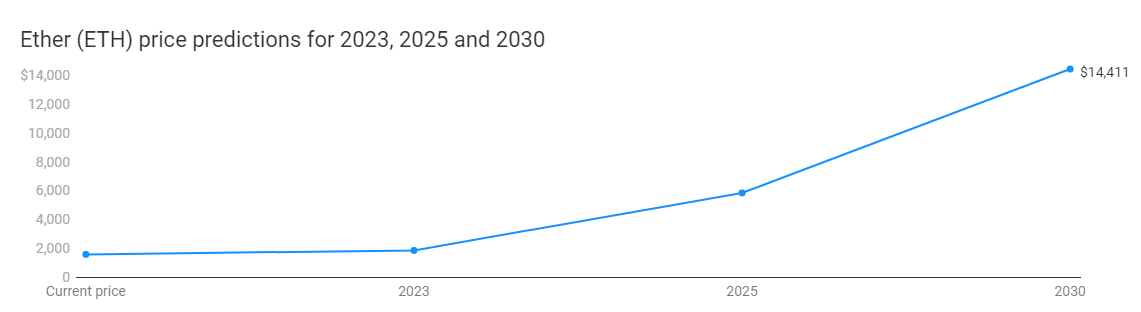

The U.S. dollar value of the cryptocurrency ether is predicted to end the year averaging $1,840 and $5,824 by the end of 2025, the latest Finder’s prediction report has said. Regulatory uncertainty and a challenging macroeconomic environment are likely to cause ether’s drop to “an average lowest price of $1,352.”

ETH to Surpass $5,800 by the End of 2025

According to Finder’s October 2023 survey findings, the U.S. dollar value of ether or ETH is predicted to end this year at around $1,840. This average price, obtained from Finder’s panel of 31 crypto specialists, is $611 lower than the July prediction of $2,451.

The surveyed panelists also foresee the crypto asset’s price hitting $5,824 by the end of 2025 and $14,411 in 2030. However, the figures are again lower than the July predictions of $5,845 by 2025 and $16,414 by 2030. At the time of writing (2:35 p.m. EST), the U.S. dollar value of ethereum (ETH) was $2,006 per unit.

Many of the respondents cite the macroeconomic factors as one of the primary reasons why they foresee a lower price in the short term. Commenting on why he is less optimistic about ETH’s prospects before the year ends, Ruslan Lienkha, chief of markets at Youhodler, said:

Growth is [currently] limited by high rates in Tradfi. In [the] case of reaching a soft landing by US authorities, ETH[‘s] price will increase dramatically, but not until the middle of next year.

Lienkha’s sentiments are shared by Ben Ritchie, managing director at Digital Capital Management Pty Ltd, who sees economic challenges leading “to a more cautious approach in the overall markets.” Pav Hundal, lead market analyst at Swyftx, said ETH’s price movements are consistent with trends often seen prior to the halving of bitcoin.

More Than 80% Assert Ethereum Is Either Underpriced or Fairly Priced

Meanwhile, when asked how high or low the cryptocurrency can go in the remainder of 2023, the panelists predicted an average peak price of $1,932 and an average lowest price of $1,352. Desmond Marshall, the MD at Rouge International and Rouge Ventures, said regulatory uncertainty and macroeconomic factors could see the price of ETH dropping to as low as $1,200.

However, despite predicting a significantly lower end of 2023 price, nearly 90% of the panelists believe now is the time to either hold or buy ETH. A slightly lower proportion (83%) of the panelists think ETH is either underpriced or fairly priced.

Concerning the prospects of ETH market capitalization flipping that of BTC, 43% of the panelists said they did not see this happening. About 23% said this will happen “but not until 2030.”

What are your thoughts on this story? Let us know what you think in the comments section below.