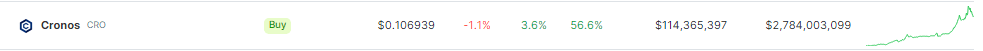

Cronos has experienced a robust and sustained bullish trajectory over the recent weeks. Over the course of the past seven days, it has consistently surged, reaching a solid pinnacle, a level not witnessed in months.

At the time of writing, Cronos (CRO) showcased its impressive strength, outperforming some of the most prominent names in the top 100 cryptocurrency ranking over the weekend.

With a remarkable 7% surge in the last 24 hours and a commanding 57% rally within the seven-day timeframe, as reported by Coingecko, Cronos is not just making waves but also setting itself apart as a standout performer in the current market dynamics.

Cronos’ Outstanding Performance In The Crypto Market

Notably, the CRO token has surpassed the descending trendline, which links the highest points observed since February. This positive momentum underscores the current strength and upward momentum of Cronos, indicating a significant shift in its market dynamics.

The market’s perception of the asset as overvalued at its current levels is suggested by the notably high Relative Strength Index (RSI) at 97.45, firmly placing it within the overbought zone.

This could lead to a potential retracement or consolidation in the near future. However, in the short term, the cryptocurrency exhibits a robust bullish trend, as indicated by the 50-day Exponential Moving Average positioned at $0.0630, with the current trading price of approximately $0.1033 surpassing previous resistance levels.

Targeting the key resistance point at $0.10, buyers are likely to drive the coin’s outlook to continue soaring. The ADX indicator has been consistently rising, and the Stochastic Oscillator has reached the overbought point.

This, coupled with the increased volume, is a positive signal. Additionally, the CRO price has surged above all moving averages, indicating strong momentum in the market.

Market Dynamics And Potential Scenarios

The future course of cryptocurrencies is contingent upon the distribution of power between bulls and bears. In the case of Cronos, if the bulls are able to successfully move the price above $0.08352, we may expect more upward momentum, which would be good.

Furthermore, the coin’s ability to sustain its current level could potentially act as a catalyst for a robust push towards testing the resistance at $0.0900 before the month concludes.

On the contrary, if the bears seize control and initiate a trend reversal, causing the price to lose momentum, a test of the $0.07390 support level becomes probable.

Looking ahead, a continued decline might prompt the coin to challenge the lower support level of $0.06696 in the upcoming days, emphasizing the importance of monitoring market dynamics for potential shifts in sentiment and price action.

(This site’s content should not be construed as investment advice. Investing involves risk. When you invest, your capital is subject to risk).

Featured image from Vauld