Quick Take

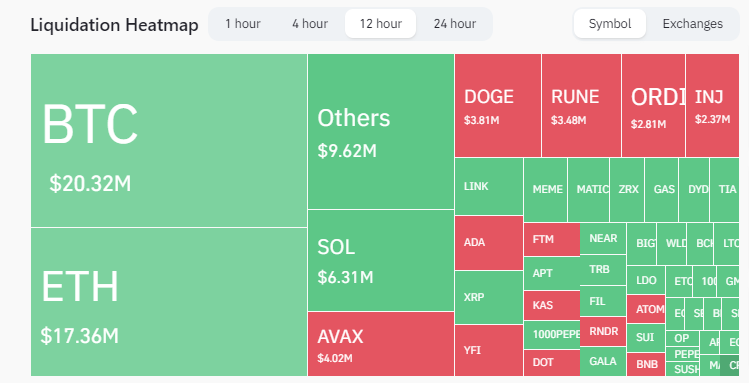

In the past 12 hours, trading markets in Europe and Asia witnessed approximately $100 million in liquidations, intriguingly split into $65 million long and $30 million shorts. The dominant digital asset, Bitcoin, bore the brunt of these liquidations with $20 million, predominantly in long positions, just ahead of Ethereum with $17 million longs liquidated.

This surge in Bitcoin liquidations comes as the world turns its focus towards the U.S. market open, where Bitcoin has historically seen substantial price fluctuations. The correlation between the increase in Bitcoin liquidations and its significant price movement in the U.S. market is a point of curiosity. This trend could be indicative of a strategic shift, as traders potentially adjust their positions in anticipation of the U.S. market’s reaction.

Bitcoin is currently 3% down today, trading around $36,600

The post Market braces for U.S. impact after Bitcoin longs face $20 million liquidation wave appeared first on CryptoSlate.