Data shows altcoins have been losing correlation with Bitcoin recently, and among them, XRP and BNB have seen particularly pronounced decoupling.

XRP & BNB Have Seen Largest Drops In 60-Day Correlation To Bitcoin

As pointed out by an analyst in a post on X, BTC has recently seen a drop in correlation with the altcoins. The “correlation” here refers to an indicator that keeps track of how tied the prices of any two assets are right now.

When the value of this metric is positive, it means that the given assets respond to moves in each other’s price by moving in the same direction. The closer the indicator’s value is to 100%, the stronger this correlation is.

On the other hand, negative values imply that there is a negative correlation between the assets, as their prices are moving opposite to each other. In this case, the extreme is -100%, so the more negative the value, the more tight the relationship is.

The 0% mark represents the point where no correlation exists between the prices, implying that movements in one have no bearing on how the other might perform.

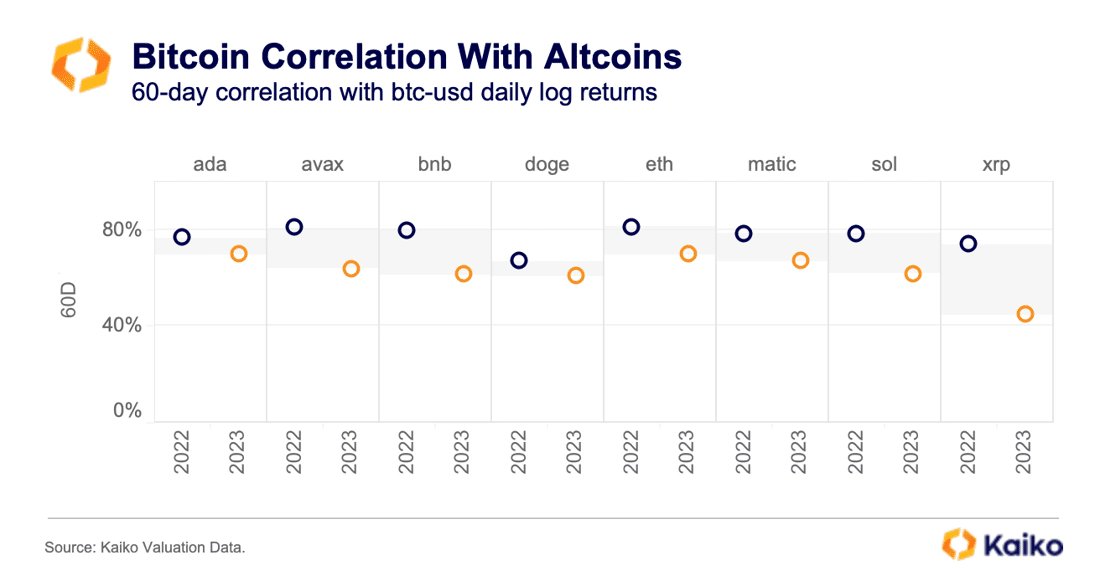

Now, here is a chart that shows what the 60-day correlation between Bitcoin’s daily log returns and various altcoins looks like right now, as well as how it compared a year back:

As displayed in the above graph, the 60-day correlation between Bitcoin and XRP appears to have significantly decreased in this period, as it has plunged from nearly 80% to almost 40%. This means that XRP’s price has been moving much more independently of BTC during the past 60 days.

BNB (BNB), Avalanche (AVAX), and Solana (SOL) have also seen some decoupling from the original cryptocurrency. Still, these alts have seen the indicator decline by much less than XRP has observed.

Cardano (ADA) and Dogecoin (DOGE) are the altcoins that have observed the least amount of change. However, in the case of the memecoin the correlation was lesser than the other assets to begin with, so even with the small decoupling, its correlation level is still matching that of BNB.

Generally, correlation is something to watch for whenever an investor is trying to diversify their portfolio, as two assets with significant correlation wouldn’t provide much safety.

Thus, as XRP is currently the cryptocurrency least correlated with Bitcoin on this list, it might be a better diversification option than coins like Ethereum (ETH) or Polygon (MATIC), which have the 60-day value of the indicator at relatively high levels still.

XRP Price

Just a few days back, XRP had revisited the territory above the $0.63 mark, but it wasn’t long before it slipped again and went under the $0.60 level. Since this low, though, the cryptocurrency has seen some recovery, as it has now neared $0.61 once again.