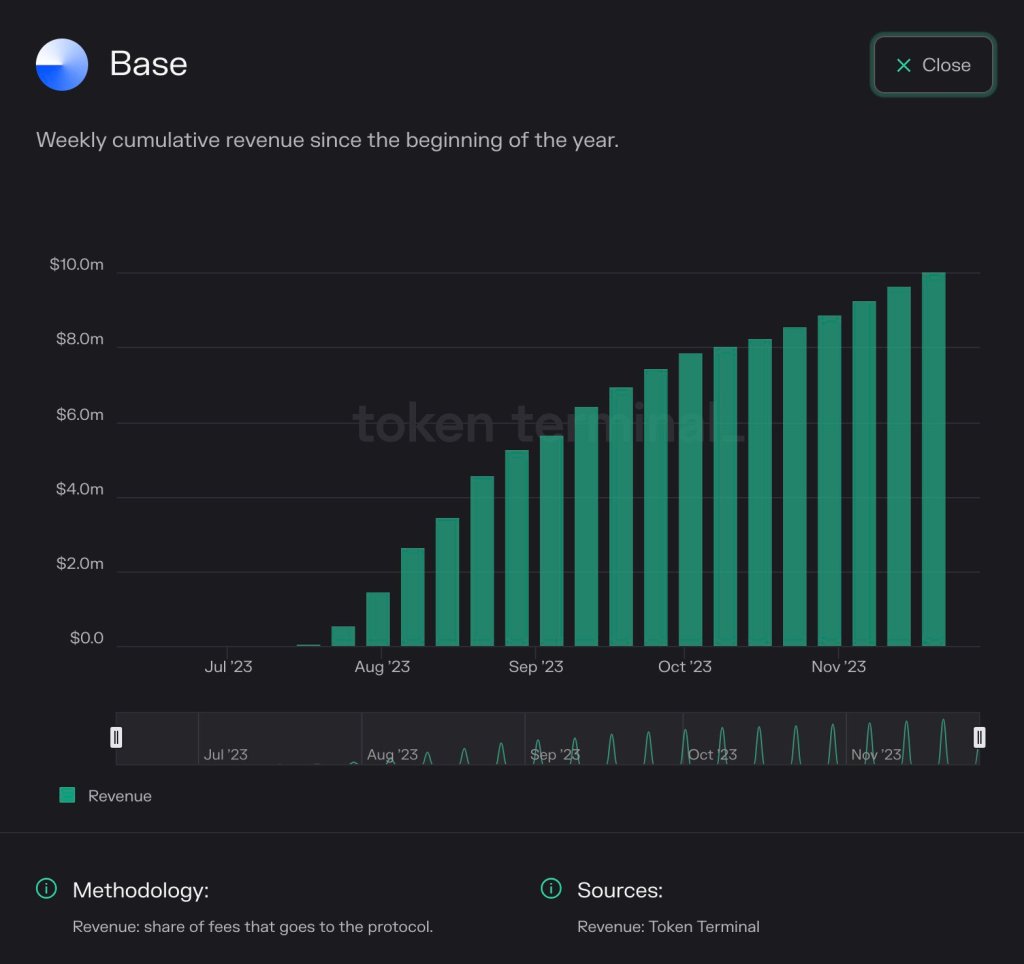

Base, a layer-2 scaling solution for Ethereum built using the Optimism technology stack, has earned over $10 million in cumulative revenue since launching in early August 2023.

Taking to X on November 28, Erick Smith, the chief investment officer of 401 Financial, citing Token Terminal’s data, shared layer 2’s steady growth in revenue. Notably, as of late November, there was an impressive expansion in revenue, but the platform has an average of over 1 million monthly active users.

Base Cumulative Revenue Exceeds $10 Million

Looking at Token Terminal data, Base’s revenue growth indicates the increasing popularity of layer-2 solutions. By default, Ethereum’s scaling solutions, which rollups are the technology powering some of the blockchain’s leading options, are critical for enhancing user experience and gradually lowering gas fees on the mainnet.

As Ethereum developers prioritize and promote the development of solutions that scale the base layer, protocols, and users also increasingly prefer options like Base. As mentioned, Base, for instance, can help protocols seeking highly scalable environments launch quickly, benefiting from relatively lower gas fees. To illustrate, according to L2fees, a simple transaction on the mainnet costs $2.10, while the same on Optimism is $0.20.

Over the months, Bald, the first meme token on Base, was deployed before asset prices crashed and deployers rugged early supporters. However, prominent protocols, including Aave, a leading decentralized finance (DeFi) protocol that enables users to lend and borrow coins, and Friend.tech, a decentralized social media platform that’s one of the most intensive dapp, have since launched on Base.

According to Dune Analytics, Friend.tech has accumulated over $25 million as protocol fees from the more than 12.3 million unique transactions. While growth was explosive in the first months, active buyers and sellers, looking at trends, have stabilized but remain above 1 million.

Will Base’s TVL Follow Ethereum Prices?

Meanwhile, looking at statistics from the Ethereum-Base bridge from DeFiLlama, the number of tokens deposited has rapidly dropped over the past few months. In late November, the bridge locked $1.32 million of assets, mainly in wrapped Ethereum (wETH).

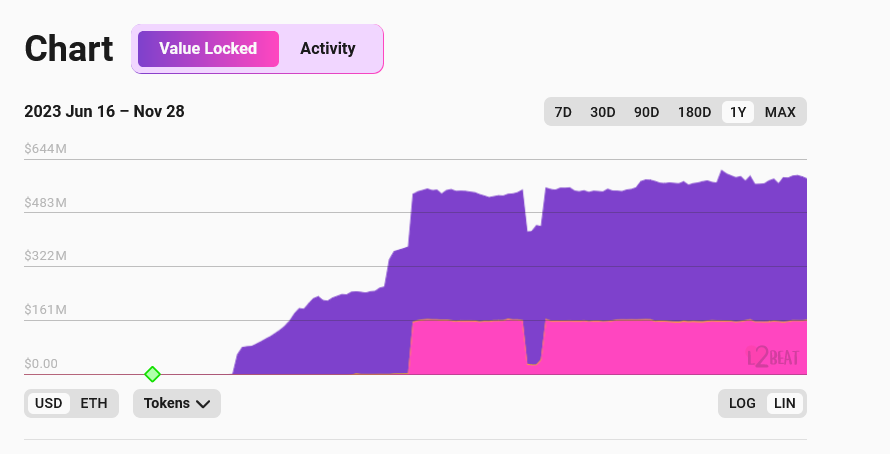

The same trend can be observed based on the total value locked (TVL) on Base from L2 Beat data. TVL steadily rose weeks after launching before plateauing above $580 million.

For now, Base’s TVL is stable and generally firm. Even so, there is a direct correlation between ETH’s stop rates and the protocol’s TVL. In the future, and as ETH gains momentum, breaking above April 2023 highs, it is highly likely that Base will manage more assets, driving revenue even higher.