Quick Take

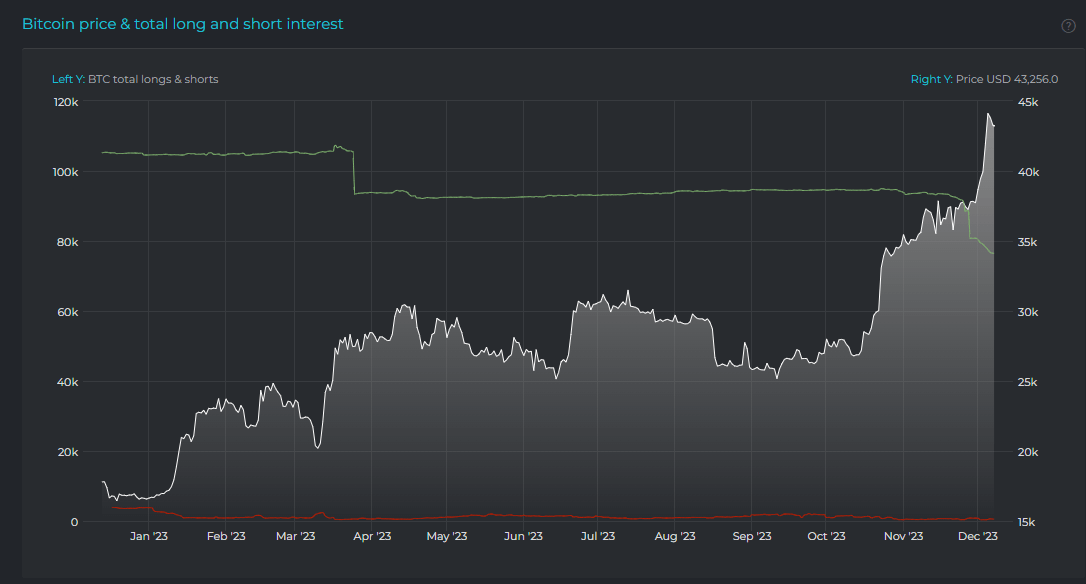

Analysis of recent data from Datamish offers an enlightening peek into the ongoing behavior of Bitfinex whales, particularly their continual move toward closing their longs.

Previously observed by CryptoSlate last week, it was noted that these industry heavyweights closed Bitcoin longs of approximately 12,000 BTC. At November’s end, the total stood at an impressive 80,000 BTC. However, the last week has witnessed a further reduction of 3,500 BTC being closed, bringing down the total to 76,500 BTC.

Alistair Milne, CIO of Altana Digital Currency Fund, also observed the movement in Bitfinex whales.

“The legendary plunge protection squad trading over at Bitfinex have started closing their epic longs (most of which caught the drop from 30k lower) At least one large 8000 BTC margin position looks to have been ‘claimed’ (using the USD profits to keep the BTC)”

Despite witnessing a consistent closure of longs, the market continues to project a bullish sentiment. This is evident in the subdued short positions, which currently sit at only around 500 BTC. Even with these closures, the weighty presence of 76,500 BTC still open in longs underscores the prevailing optimism in the market.

The post Significant drop in Bitfinex Bitcoin longs as whales cash in appeared first on CryptoSlate.