The crypto industry went through a period of evolution in 2023 to reiterate its position in the global market. This evolution was particularly spearheaded by Bitcoin’s dominance, with the crypto registering gains in the last quarter that were practically absent in the earlier parts of the year.

All the signs are there; interest is picking up, big money from institutions is sniffing around again, several important technical and on-chain pricing models this year have been confirmed, and the dust seems to have finally settled from the prolonged bear market in 2022.

The Crypto Winter Thaws: Signs of Life in 2023

2023 was majorly a year of correction for the extended bear market in 2022 which saw Bitcoin fall 76% from its all-time high to trade at a bottom of $15,883. According to a report from Glassnode, major market structure shifts are now taking place within the crypto industry to reflect growing optimism.

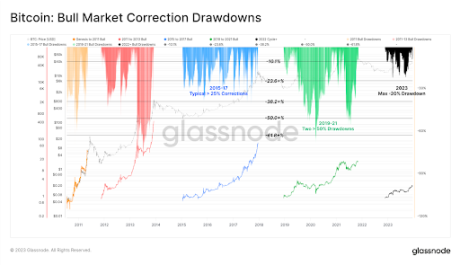

Bitcoin, for one, is showing a strong interest from its long-term holders, as the industry awaits the launch of spot Bitcoin ETFs in the US. One particular feature of the year that indicated a strong bullish momentum was the shallow depth of market correction, indicating the industry is maturing into a more stable market in terms of price volatility.

Bitcoin’s deepest correction in 2023 closed just -20% below the local high, better than historical pullbacks of least -25% to -50%.

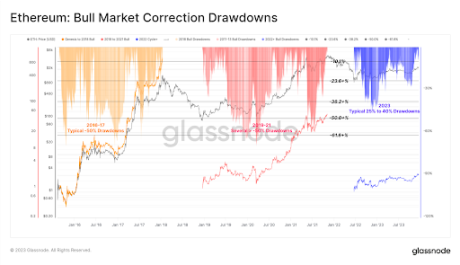

Ethereum also saw shallow corrections, with the deepest reaching -40% in early January.

From an on-chain perspective, the realized cap in the 2022 bear market for both assets showed a net capital outflow of -18% for BTC and -30% for ETH. The momentum kickstarted in October, as the news of various applications of spot Bitcoin ETFs turned the crypto market on its heels. As a result, Bitcoin finally broke above the $30,000 level which it had traded below for the majority of the year.

This cascaded into the altcoin market, with Solana, Cardano, and Ethereum all seeing renewed interest and growth in prices and DeFi TVL. According to Glassnode, the total value locked into Ethereum’s layer-2 blockchains increased by 60%, with over $12 billion now locked into bridges.

According to CoinShares, the bullish sentiment has also flowed into institutions. October’s rally sparked an 11-week run of inflows into digital asset investment funds. At the time of writing, the year-to-date inflows now sit at $1.86 billion.

The crypto industry, particularly Bitcoin, is primed for astounding growth in 2024, with various price catalysts like the SEC’s approval of spot Bitcoin and Ethereum ETFs in the US, and the next Bitcoin halving. The altcoin market should also follow, spearheaded by Ethereum.

At the time of writing, Bitcoin is up by 159% this year, outperforming other asset classes. On the other hand, Ethereum and Solana have dominated the altcoin market, up by 82% and 616% respectively.