In 2022, the cryptocurrency realm encountered a major hurdle with the collapse of FTX, triggering industry-wide repercussions. This adversity posed challenges for Solana, one of its standout blockchains, disrupting its course.

Known for its innovation and tech strength, Solana had received a lot of praise, especially from important figures like the former FTX big boss Sam Bankman-Fried.

But when the crypto exchange unexpectedly fell, a platform closely linked to Solana, it brought a gloomy cloud over the blockchain’s previously positive future.

Solana Emerges Strong: 800% Recovery

Today, a lot of investors in digital assets are positioning SOL as the cryptocurrency industry’s success story. This is because of its incredible recovery from last year’s more than 90% loss.

The value of SOL has experienced a remarkable increase, rising by more than 800% since then.

As the network gains from significant activity and considerable demand in memecoins, Solana prices have recently showed some significant growth, rising to their highest level – a 20-month peak – since April 2022.

The Solana network has seen an increase in transaction activity as traders take advantage of its speed and cheap fees to trade obscure and risky tokens known as “shitcoins” in the cryptocurrency community.

Hosam Mahmoud, a research analyst at CCData, clarified that there is a direct correlation between the rise in SOL prices recently and an increase in on-chain activity on the Solana blockchain.

He cited figures from the DeFi data aggregator DefiLlama, which indicated that the Total Value Locked on the platform had increased significantly over the previous seven days.

According to Anatoly Yakovenko, CEO of Solana Labs, developers are still adding features to Solana, and the introduction of new platforms and products has increased public interest in blockchain technology.

Analyst Unveils SOL Tech Triumphs

The author of “Crypto is Macro Now,” Noelle Acheson, has written about Solana’s revolutionary journey and the significant technological advancements achieved by the blockchain.

These advancements follow earlier difficulties Solana faced, such as network disruptions and performance problems.

According to the Solana Status tracking website, there haven’t been any incidents since February, demonstrating the blockchain’s resiliency, as Acheson notes.

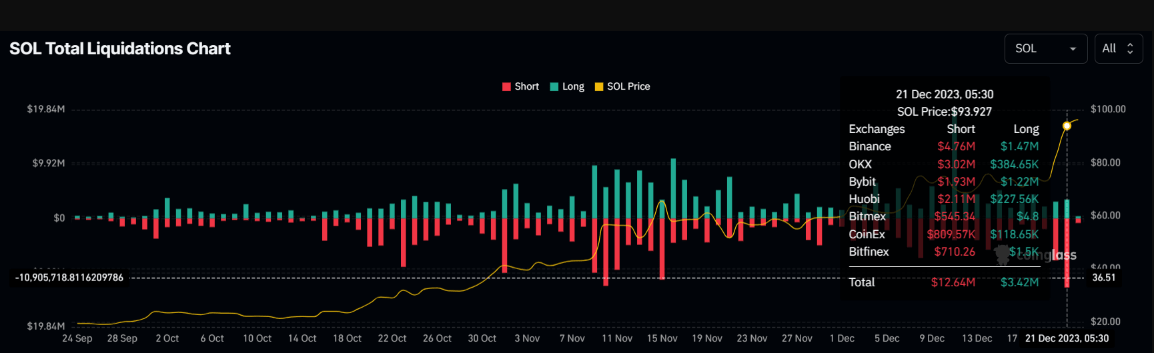

On December 21, the price of SOL and a few other altcoins surged by double digits. As a result, short sellers suffered large losses when their bearish wagers turned out to be unsuccessful.

As the alternative coin gets closer to a critical price threshold, SOL traders are currently seeing the largest short liquidations in the last three months.

Meanwhile, Solana has reported the liquidation of about $13 million worth of short contracts in the past day. Given the increasing level of optimism before the year’s end, this is the largest single-day liquidation that traders have seen since October of this year.

At the time of writing, the price of SOL was a little over $96. Bullish signals swept the cryptocurrency market, leading to a 14% surge in just one day. A number of altcoins, including SOL, saw price rallies, and the cryptocurrency is now getting closer to the $100 level.

Featured image from Shutterstock