The Shiba Inu faithful have reason to wag their tails. Over the past few days, the meme coin has witnessed a surge in buying pressure, hinting at a potential bull run. But should investors unleash their inner Doge and start digging for bones, or is this just a fleeting frenzy?

Crypto analyst Ali underscores a noteworthy development in the Shiba Inu (SHIB) ecosystem—a massive 8 trillion token exodus from exchanges since November. This signals investors’ inclination to retain SHIB in private wallets, reducing selling pressure and potentially paving the way for price appreciation.

This strategic move reflects a growing confidence in SHIB’s long-term prospects, creating an environment where the diminished circulating supply may contribute to significant market movements and capitalize on the anticipated bullish momentum.

#ShibaInu | Since November, there’s been a massive withdrawal of over 8 trillion $SHIB from known #crypto exchange wallets – that’s valued at approximately $88 million! pic.twitter.com/RLFA8N0dLI

— Ali (@ali_charts) December 24, 2023

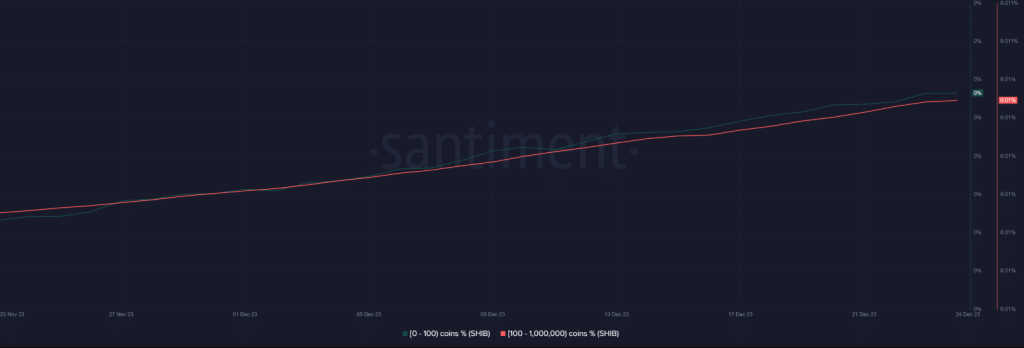

Further fueling the fire is the unwavering loyalty of the “shrimp and fish,” small-time investors steadily accumulating SHIB. Their growing numbers are reflected in the rising number of addresses holding modest amounts of the coin.

But a closer look reveals cracks in the bullish facade. Metrics like the MACD hint at a possible bearish crossover, suggesting a potential pullback. And while social buzz remains high, technical indicators like RSI and MFI hint at some choppy waters ahead.

NewsBTC also examined Santiment’s statistics. According to our research, the Supply on Exchanges for SHIB dropped sharply last month, even if its price rose.

Adding to the uncertainty is the recent price rally, which could simply be a natural correction after a sharp dip. Investors should remember that past performance is not necessarily indicative of future returns, and chasing momentum can be a recipe for disaster.

So, where does this leave us? While the recent buying spree and reduced exchange reserves are undoubtedly positive developments, a cautious approach is warranted. Investors should keep a close eye on technical indicators and market sentiment before diving headfirst into the SHIB whirlpool.

Here are some key takeaways:

- Reduced exchange supply: A positive sign, indicating less selling pressure.

- Strong retail interest: Shrimp and fish are accumulating, boosting long-term prospects.

- Technical indicators mixed: Potential for a pullback before further gains.

- Beware of chasing momentum: Don’t be swept away by hype.

The price of SHIB was $0.000010 at press time, up 12% in the last seven days. Its market cap rose to 16th place thanks to a 32% rise in value over the last month. That Shiba Inu had come back from a long-term downturn was also clear.

As Shiba Inu marks a solid climb on Christmas Day, the crypto landscape is left to ponder whether this surge is the herald of a brewing bull run or a fleeting false dawn.

Featured image from Freepik