Quick Take

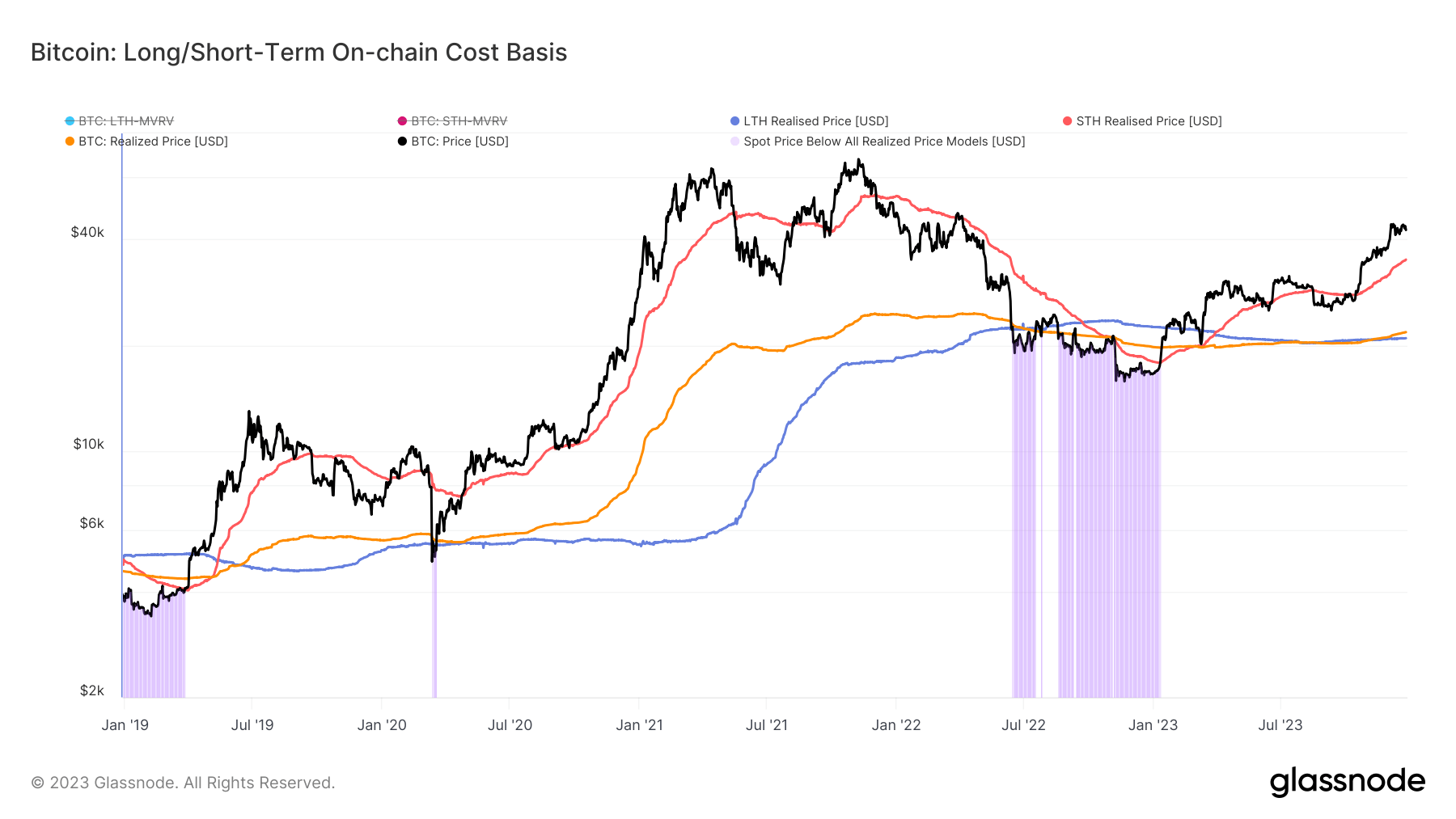

The Realized Price, a crucial metric in digital market analysis, denotes the aggregate price at which each Bitcoin was last spent on-chain. This metric provides a nuanced picture of investor behavior, particularly when dissected through the lens of Short- and Long-Term Holder heuristics.

The Short-Term Holder Realized Price, reflecting the average on-chain acquisition price for coins likely to be transacted within a recent period (155 days in this case), has just surpassed the $35,000 mark. Interestingly, this price was last seen in March 2021 when Bitcoin traded around $49,000.

Now, despite Bitcoin’s price hovering around $43,000, $6,000 lower than its previous value, the Short-Term Holder Realized Price remains at the same level. This suggests a more sustained cycle devoid of the previous exuberance that characterized 2021’s bull market.

In contrast, the Long-Term Holder Realized Price, calculated for coins unlikely to be transacted within a recent period, hints at the enduring faith of investors with a longer-term vision and a realized price level of just $21,000.

The Realized Price of long-term holders consistently trails behind the overall Realized Price, which is currently at $21,802. Notably, the overall Realized Price has been on a steady upward trajectory, signifying higher-priced coin transactions. This clear uptrend, indicative of bull runs, underscores an active market with a constant exchange of coins at increasingly higher prices.

The post Short-Term Holder Realized Price soars past $35,000 appeared first on CryptoSlate.