Quick Take

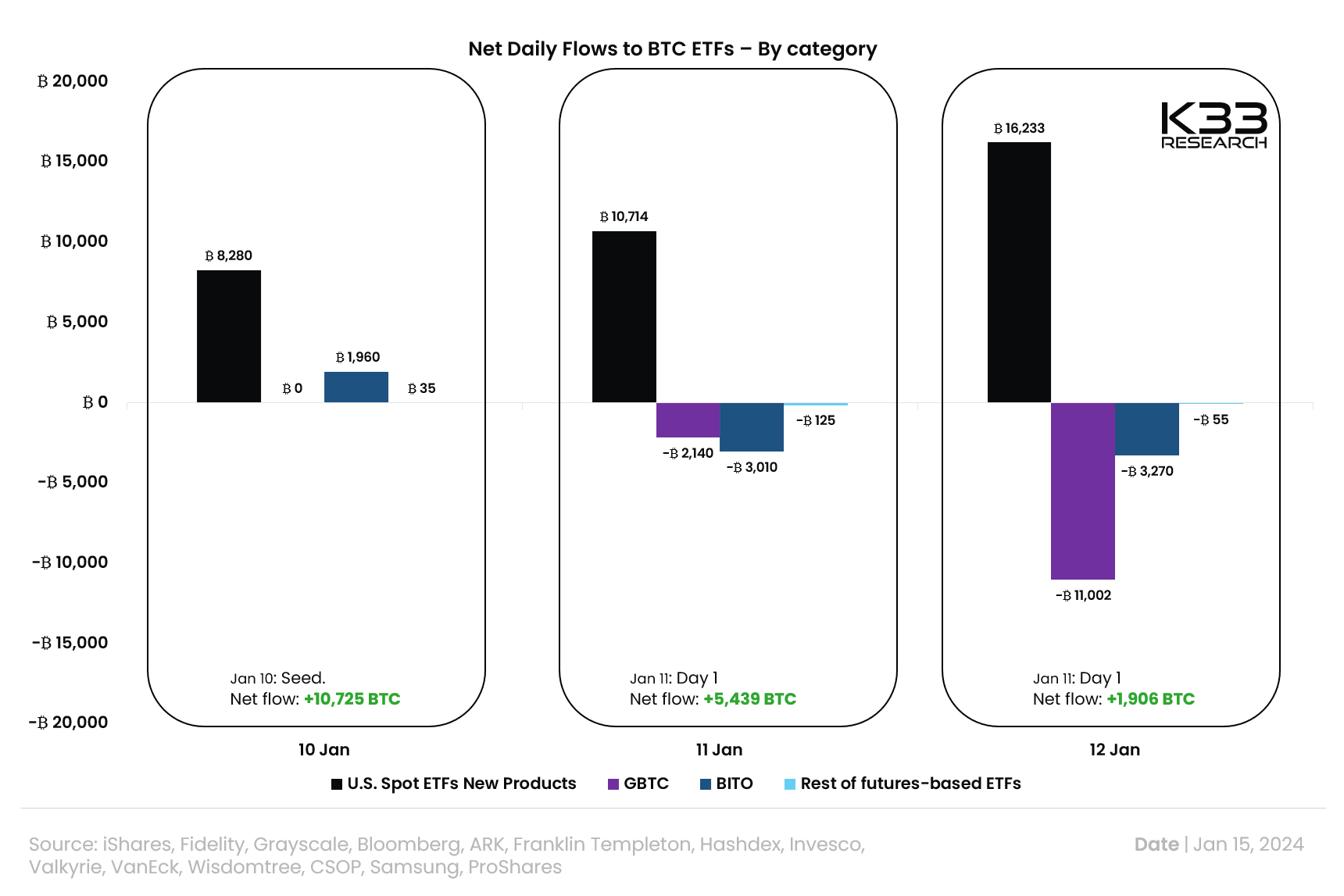

In the latest week of financial assessment, the digital asset market saw a substantial total net inflow of $1.2 billion. This figure is yet to be finalized due to the T+2 settlement period. Amid this significant net inflow, Grayscale experienced a bit of an anomaly, with outflows hitting $579 million, making it an outlier in a sea of otherwise net inflows. K33 Research has the net inflows for new ETFs at roughly 17,619 BTC, with outflows from GBTC and futures ETFs at a combined 19,000 BTC.

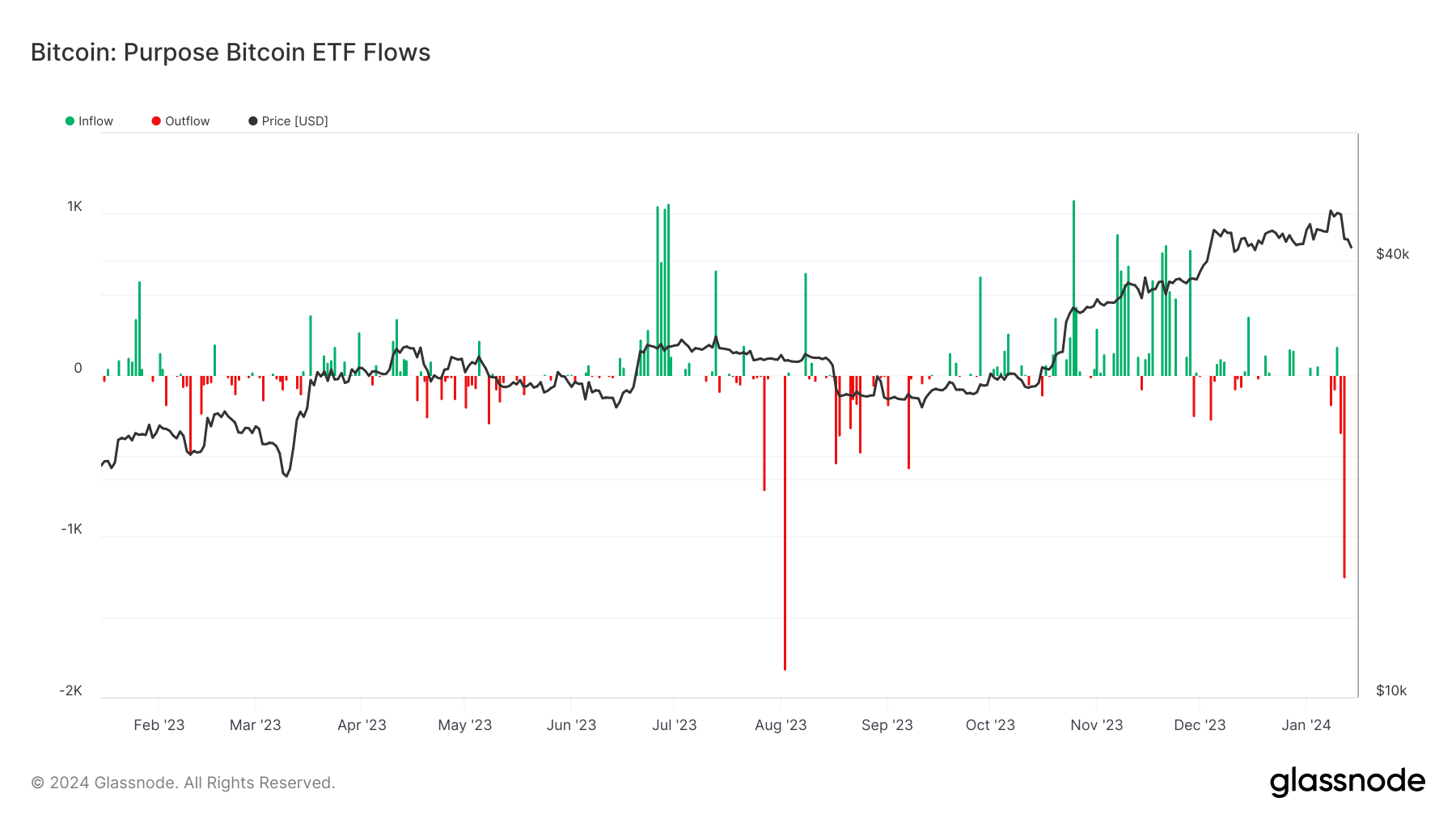

In the case of the Purpose Bitcoin ETF, based out of Canada, despite the overall positive inflow trend, it experienced consecutive outflows, with over 4,000 BTC departing the fund between Jan. 11 and 12 — the second-highest outflow in a year. This follows a significant inflow period around October and November, suggesting a possible anticipation of the ETF trend.

Meanwhile, spot ETF inflows recorded an impressive debut, with BlackRock spearheading this surge. Notably, the $1.2 billion aggregate inflow encompasses all crypto flows per provider, extending beyond just spot ETFs.

The post Grayscale and Purpose Bitcoin see strong outflows amid spot ETF launches appeared first on CryptoSlate.