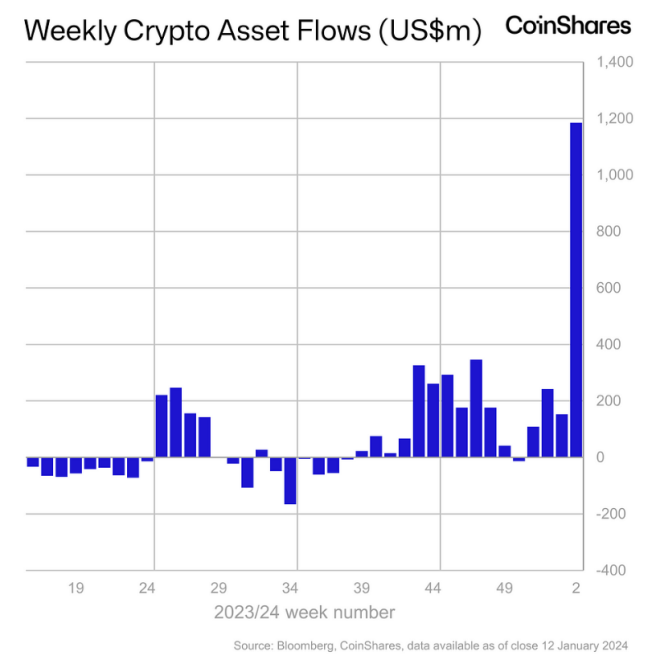

In a week marked by the historic debut of spot Bitcoin ETFs on Wall Street, the cryptocurrency market witnessed a surge in inflows, with Bitcoin, Ethereum, and XRP leading the charge.

Despite failing to shatter records set by futures-based ETFs, the $1.18 billion influx paints a picture of cautious optimism cautiously welcoming the alpha crypto into the financial fold.

James Butterfill, the head of research at CoinShares, said that this figure was still a far cry from the $1.5 billion record of futures-based Bitcoin ETFs in October 2021.

Bitcoin Leads The Pack

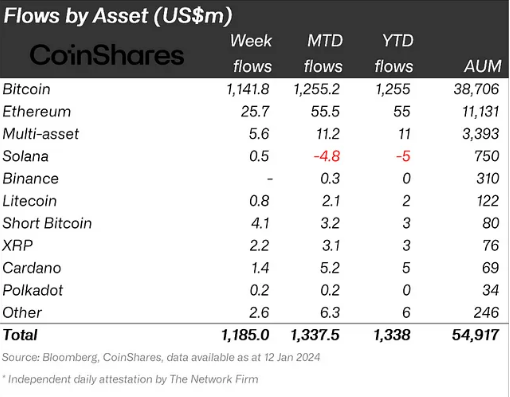

While Bitcoin reigned supreme with $1.16 billion in inflows, its price dipped slightly, hinting at investor apprehension. Ethereum, however, painted a contrasting picture, its inflows of $26 million pushing its price above $2500. XRP, the resurgent underdog, saw inflows of $2.2 million, the largest among altcoins, and its price jumped 1%.

The surge in trading volumes across the three prominent cryptocurrencies signals a resounding resurgence in market activity. Within a mere 24-hour span, Bitcoin experienced an impressive 40% spike in trading volume, underlining a notable uptick in investor interest.

Ethereum mirrored this enthusiasm with its trading volume doubling, indicating a significant surge in transactional engagement within the ecosystem. Not to be outdone, XRP witnessed an extraordinary 90% climb in its trading volume, further intensifying the overall market dynamics.

Shift In Market Dynamics

This frenetic surge in trading activity serves as a compelling indicator of a market reawakening, with investors cautiously repositioning themselves and testing the waters. The palpable anticipation is evident as investors hover on the brink of decisive actions, with their fingers poised above the buy button.

The market seems to be undergoing a shift, as participants actively respond to evolving trends and opportunities, marking a potentially pivotal moment in the trajectory of these cryptocurrencies.

But the party isn’t for everyone. Altcoins like Cardano and Solana, once the darlings of the cryptosphere, saw their inflows dwindle. This selective enthusiasm highlights investors’ newfound discerning palates, prioritizing established players like Bitcoin and Ethereum over the speculative glitter of lesser-known coins.

Geographically, the picture is no less intriguing. The US, the land of opportunity for Bitcoin ETFs, unsurprisingly led the charge with $1.24 billion in inflows. Europe, however, painted a different picture, with Germany, Canada, and Sweden recording notable outflows.

The jury’s still out on the long-term impact of spot Bitcoin ETFs. Some experts anticipate long-term gains, while others remain wary, questioning the sustainability of the current rally.

One thing’s for sure: the crypto market has taken a tentative step towards Wall Street, but the path ahead remains shrouded in uncertainty. Will Bitcoin become a Wall Street darling, or will its allure fade under the harsh glare of scrutiny?

The next chapter in the crypto saga is just beginning.

Featured image from Shutterstock