Samson Mow, the CEO of JAN3, has identified a series of crucial indicators that could shape Bitcoin’s trajectory in the coming months. Among the many, Mow lists how capital flows to Bitcoin via spot ETF issuers, real inflation, hash rate evolution, and others.

Spot Bitcoin ETF Inflows Is A Metric To Monitor Closely

Taking to X on January 28, Mow believes that the influx of capital into Bitcoin-linked exchange-traded funds (ETFs) could play a pivotal role in driving adoption and price in the coming weeks and months. Specifically, the CEO emphasizes the importance of the spot Bitcoin ETF inflow metric. The United States Securities and Exchange Commission (SEC) recently approved several spot Bitcoin ETFs for the first time in over ten years.

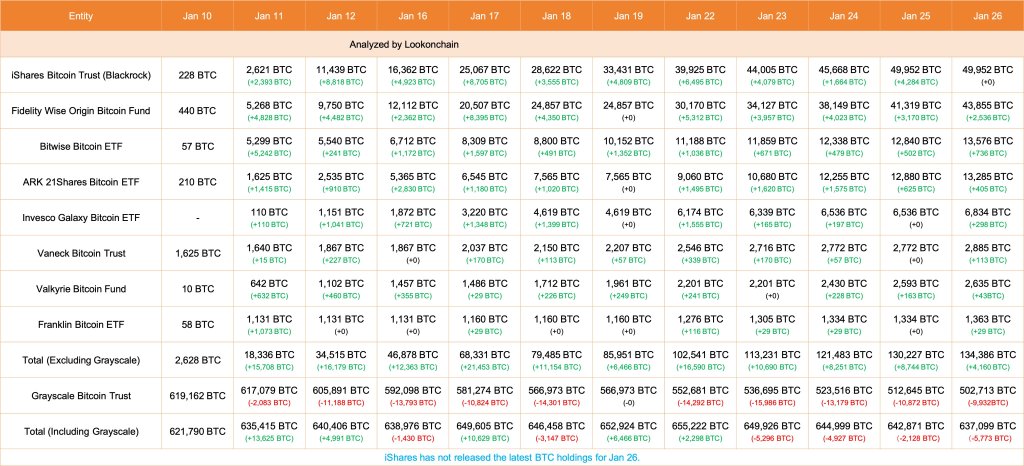

Some of the top Wall Street players, including BlackRock and Fidelity Investments, have been leading the table, buying more coins in the past three weeks. According to Lookonchain data, eight spot Bitcoin ETFs bought 4,160 BTC as of January 26. At the same time, Grayscale Investments, the issuer of Grayscale Bitcoin Trust (GBTC) shares, offloaded 9,932 BTC.

Prices might increase as more institutional investors gain exposure to Bitcoin through regulated ETFs. However, for now, traders are watching out for how fast Grayscale Investments is shedding their GBTC shares, recouping BTC, and even distributing them to spot Bitcoin ETF issuers. GBTC conversion to BTC might impact prices, heaping more selling pressure and negating the general optimism among holders.

Hash Rate Is Rising Even As Miners Dump BTC

Ahead of the Bitcoin halving event set for early April 2024, Mow also watches the network’s hash rate. The hash rate measures the computing power channeled to the network, securing the blockchain.

Usually, the higher it is, the more healthy the mining ecosystem is. In turn, this could boost investor confidence, signaling that miners, though expecting a drastic revenue drop in the next three months, are still bullish on the network’s prospects. So far, the Bitcoin hash rate stands at over 559 EH/s, a slight decrease from the all-time high of around 632 EH/s recorded in January 2024, data from YCharts on January 29 shows.

Even so, despite the rising hash rate, CryptoQuant data shows that miners have been offloading their coins, selling them at spot rates. During the past week, miners sold thousands of BTC, contributing to the downtrend.

It remains to be seen whether this liquidation will continue in the weeks ahead. Usually, the more miners offload their coins via leading crypto exchanges, the more prices become depressed, impacting sentiment.

Beyond these, the CEO also tracks macro indicators like the United States M3 money supply, how fast countries adopt Bitcoin, and real inflation in the world’s leading economic powerhouse.

In the United States, money supply and real inflation have fallen moderately due to the relatively high-interest rate. However, this could change if the Federal Reserve slashes interest rates in the months ahead.