The battle for supremacy in the nascent spot Bitcoin ETF market just kicked into high gear. BlackRock’s iShares Bitcoin Trust (IBIT) has emerged as the clear leader in terms of daily trading volume, leaving the initially dominant Grayscale Bitcoin Trust (GBTC) scrambling to catch up. Fidelity Investments’ Wise Origin Bitcoin Fund (FBTC) remains a strong contender, further intensifying the rivalry in this high-stakes arena.

Bitcoin ETF Landscape: Record Volume, BlackRock Dominance

Fueled by a staggering $1 billion in daily volume and nearly $2 billion in inflows on February 7th, the spot Bitcoin ETF landscape is brimming with activity. At the heart of this frenzy lies BlackRock’s IBIT, boasting a record-breaking $341.2 million in traded volume. This decisive move dethroned Grayscale’s GBTC, which previously held the crown with $296.5 million, marking a significant shift in the power dynamics.

Big volume day for $IBIT. Total volume over $1 billion for the group. https://t.co/Fv8G4P7cvb pic.twitter.com/EGzt431oOr

— James Seyffart (@JSeyff) February 7, 2024

The competition wasn’t always this one-sided. Following the historic SEC approval in January, Grayscale initially surged ahead, leveraging its established presence in the crypto space. However, BlackRock’s deep roots in traditional finance and its massive investor base seem to have given IBIT a significant edge.

BlackRock’s ETF Flows In The Spotlight

Furthermore, data from YCharts reveals that BlackRock’s ETF flows so far place it in the top 0.16% of all ETFs currently trading in the United States (3,109 ETFs), highlighting its exceptional performance even beyond the Bitcoin sphere. Analysts believe the convenience and familiarity of the ETF structure offered by BlackRock are also attracting traditional investors wary of directly accessing crypto exchanges.

Despite the setback, Grayscale isn’t throwing in the towel. The company actively promotes its experience and deep understanding of the cryptocurrency market, emphasizing the potential benefits of its GBTC product. Moreover, its existing $28 billion+ asset base, accumulated before converting its trust into an ETF, provides a substantial financial cushion.

Fidelity’s FBTC is another force to be reckoned with. Securing a respectable $200.5 million in daily volume, it firmly holds the third position, demonstrating its commitment to capturing a significant share of the market.

Spot Bitcoin ETFs: Smaller Players Emerge

Beyond the top three, smaller players like Valkyrie’s BRRR ($3.6 million) and Franklin Templeton’s EZBC ($5.3 million) are also witnessing increased activity, indicating a general upswing in investor interest across the board.

Looking ahead, analysts predict an even fiercer battle between BlackRock, Grayscale, and Fidelity. With the total volume for all ten spot Bitcoin ETFs reaching $32.7 billion and inflows exceeding $1.6 billion, the market is poised for explosive growth.

Whether BlackRock can maintain its lead, Grayscale can reclaim its dominance, or Fidelity can emerge as a surprise disruptor remains to be seen. One thing is certain: the race for supremacy in the spot Bitcoin ETF market has just begun, and the coming months will likely witness exhilarating twists and turns in this evolving financial landscape.

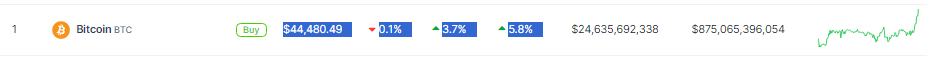

At the time of writing, Bitcoin was trading at $44,480, up 3.7% and 5.8% in the last 24 hours and seven days, respectively, data from Coingecko shows.

Featured image from Adobe Stock, chart from TradingView