On-chain data shows 16,000 BTC, which have been dormant for 5-7 years, have finally shown some movement on the Bitcoin blockchain.

5-7 Years Old Bitcoin Age Band Has Made A Large Move

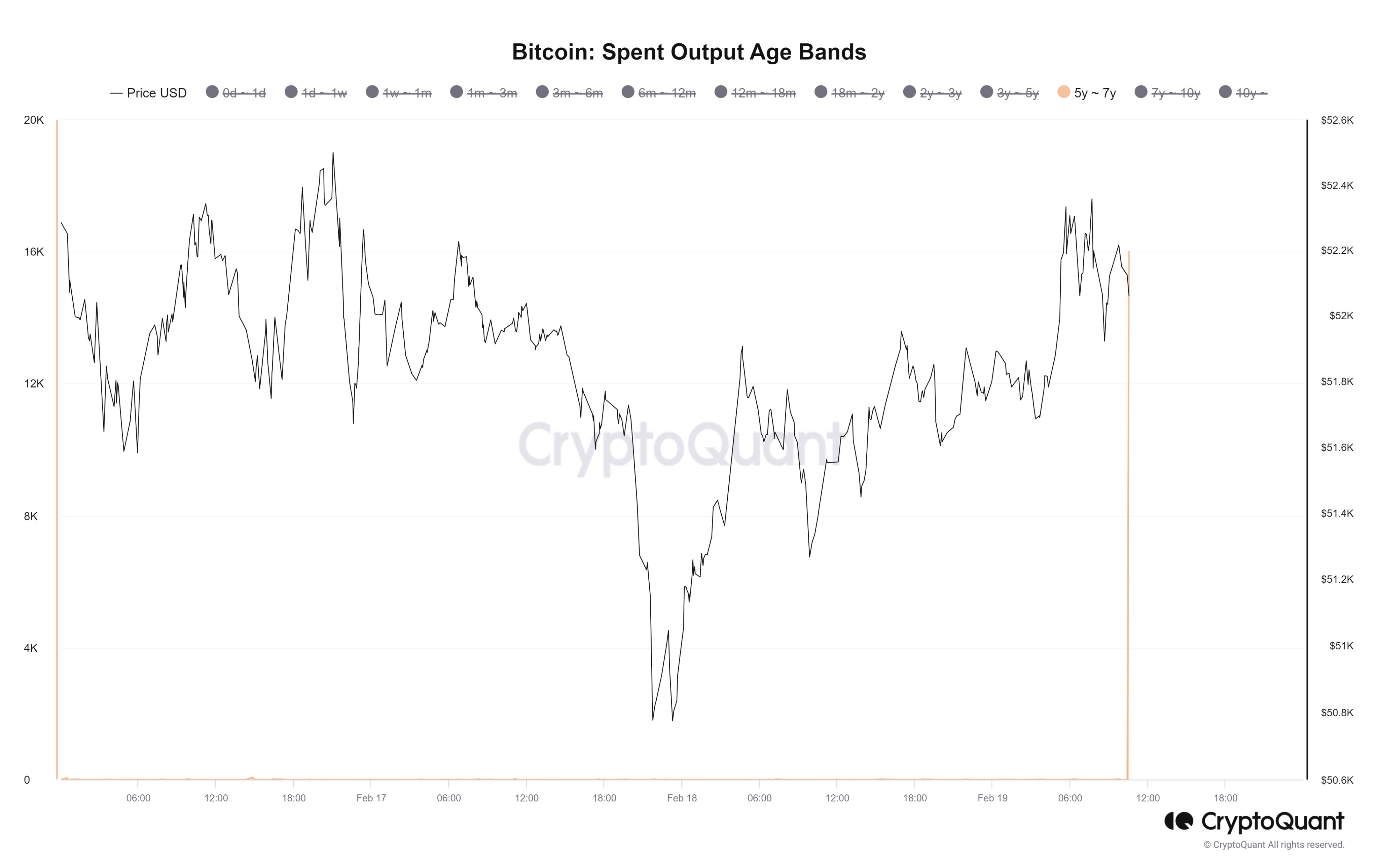

As pointed out by an analyst in a post on X, a large stack of dormant coins has moved across the network today. The relevant on-chain indicator here is the “Spent Output Age Bands” (SOAB), which keeps track of the movements of the various Age Bands on the blockchain.

“Age Bands” here refer to groups of coins divided based on their total holding time. For example, the 1-month to 3-month Age Band would include all coins that have been dormant (that is, staying inside the same address) since between one and three months ago.

If a large number of coins belonging to this holding time range would transfer on the blockchain, then the SOAB for this particular Age Band would register a spike. In the context of the current discussion, the 5-7 years Age Band is of interest.

The chart below shows the recent SOAB data for this Age Band specifically:

As displayed in the above graph, a large amount of coins aged between 5-7years old appear to have just been moved on the network as the corresponding Age Band has registered a spike.

This Age Band is a segment of the wider and “long-term holder” (LTH) group, which includes investors who have been holding onto their coins since at least 155 days ago.

Statistically, the longer a holder keeps their coins dormant, the less likely they become to sell at any point. As such, the LTHs are generally considered to be more resolute than the rest of the market (the “short-term holders“).

Since the 5-7 years Age Band would include coins that are old even in LTH terms, their owners would have to be diamond hands among diamond hands. Due to this reason, it can be something notable when such ancient entities finally decide to break their silence.

Related Reading: Cardano (ADA) To Break $8 In Bull Run: Analyst Predicts Timeline

During the latest SOAB spike, these investors have moved a massive stack of 16,000 BTC (around $837.8 million at the current exchange rate). Now, what implications this move may have on the market depends on what these investors intend to achieve with it.

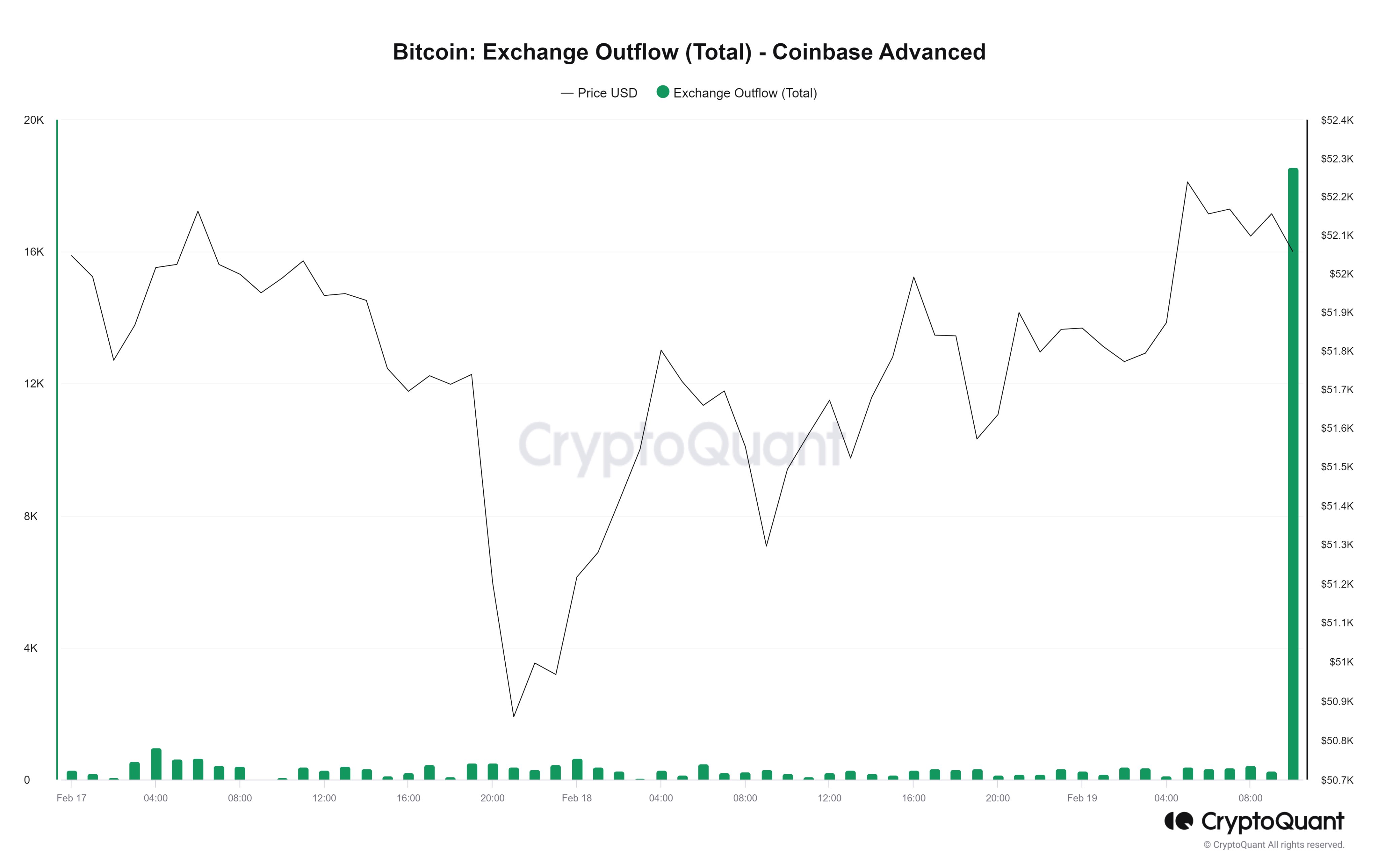

A dive deeper into on-chain data suggests the move was an outflow from the cryptocurrency exchange Coinbase, as the chart below shows:

The fact that it is an outflow may be a positive sign for Bitcoin, as it means that selling may not have been the goal here. Rather, the move implies the whale entity behind it may be moving towards self-custody to HODL further, or a large buyer like an ETF is gobbling this BTC up.

BTC Price

Bitcoin had made a visit down to $50,600 during the weekend, but the cryptocurrency already appears to have bounced back as its price is now floating around the $52,400 level.