On-chain data shows the Bitcoin miners have just witnessed their second highest revenue day in the entire history of the cryptocurrency.

Bitcoin Miners Just Raked In Almost $76 Million In Total Revenue

As pointed out by CryptoQuant head of research Julio Moreno in a new post on X, the BTC miners have recently seen daily total revenues close to the all-time record.

The “daily revenue” here refers to a measure of the combined income that the Bitcoin miners are making from block rewards and transaction fees (both in USD) every day.

The block rewards are what miners receive as compensation for solving blocks on the network, while the transaction fee is what they get for handling individual transactions.

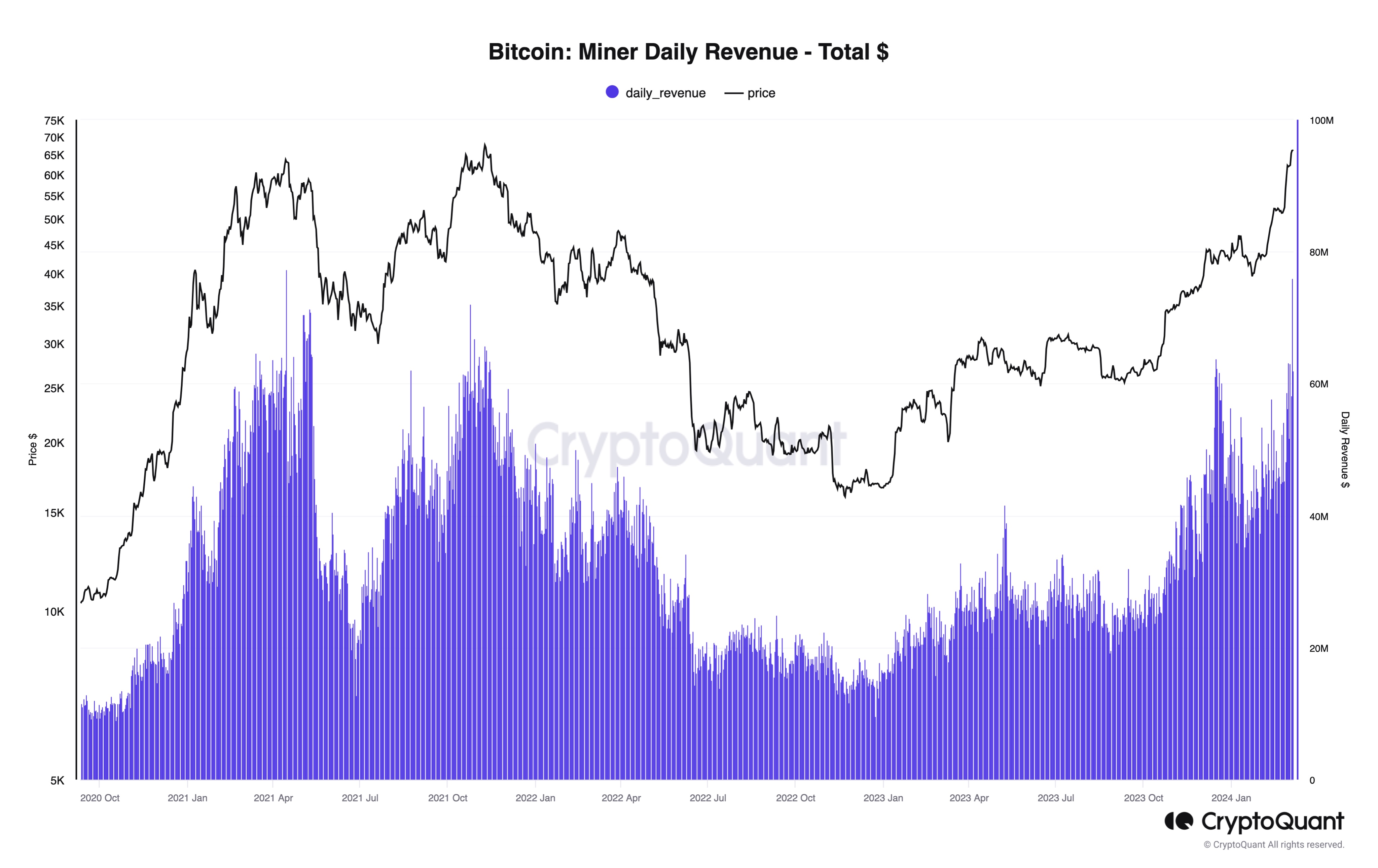

Now, here is a chart that shows the trend in the daily revenue for the Bitcoin miners over the past few years:

As displayed in the above graph, the Bitcoin miner revenue has observed a huge spike recently. During this rise, the miners earned $75.9 million inside a 24-hour window.

This wasn’t too far off from the $77.3 million all-time high of the metric set back in April 2021. In fact, this latest spike was greater than any spike observed in the entire history of the cryptocurrency, except for this record itself.

Now, what’s the reason behind this sharp surge in the Bitcoin miner revenue? One look at the chart makes it clear that the BTC rally to an all-time high would have been the main driver.

The effect of the rally, however, differs between the two components of the total miner revenue. For the block rewards, any increase in the price has a linear effect, as the USD value of these rewards also goes up alongside it.

Given that Bitcoin has sharply risen recently, it’s not unexpected that the block rewards would have also shot up in value. For the transaction fees, though, the relationship isn’t so simple.

The total fees is dependent on the amount of traffic that the blockchain is receiving currently. Traffic does tend to rise during rallies, as more interest is driven to the cryptocurrency, thus raising the network fees.

But it’s not always clearcut how much activity the blockchain would light up with when a rally happens. On top of that, there are other, and often stronger, factors that can drive the transaction fees, like demand for a network application like the Inscriptions.

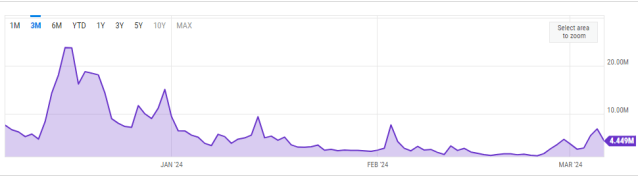

The transaction fees has notably risen with the latest rally, but the absolute value hasn’t been too high, according to data from YCharts.

On the day of the recent revenue spike, the transaction fees stood at almost $7 million. Clearly, though, this was only just over 10% of the total revenue. Thus, the block rewards have been the main driver behind the recent increase in the Bitcoin miner revenue.

While miners are enjoying high revenues right now, the next halving, an event where their block rewards will permanently be slashed in half, is scheduled to take place next month.

With current revenues being block-reward-heavy, Bitcoin miners may soon face a sharp drop in their incomes, unless the price can continue its sharp trajectory to make up for it, or somehow, the transaction fees can shoot up to close the gap.

BTC Price

At the time of writing, Bitcoin is trading at around $67,100, up 7% in the past week.