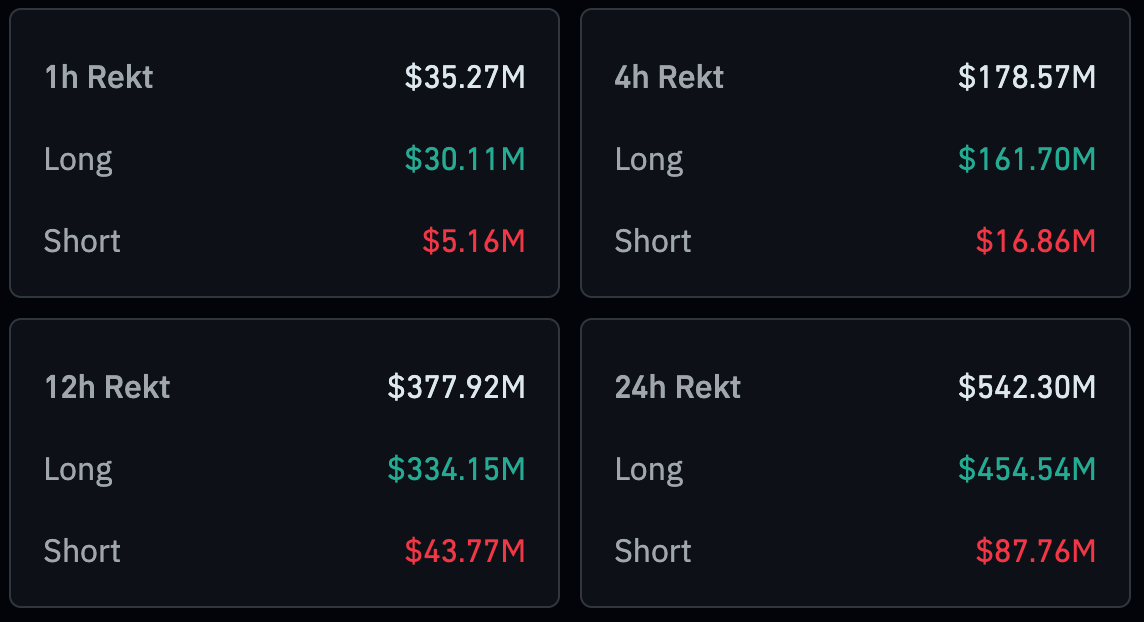

Update: A further $90 million was liquidated since press time, bringing the total liquidations to $623 million over the past 24 hours. $67 million longs and $23 shorts were liquidated in the past hour.

The market has weathered $542 million in Bitcoin and crypto liquidations over the past 24 hours as Bitcoin fell below $64,000 for the first time in roughly two weeks. On March 6, Bitcoin wicked down below the mark before continuing upward to record new all-time highs repeatedly.

Most liquidations were longs at $454 million, with just $87 million in short liquidations. Bitcoin made up $156 million of the total liquidations, according to Coinglass, as of press time.

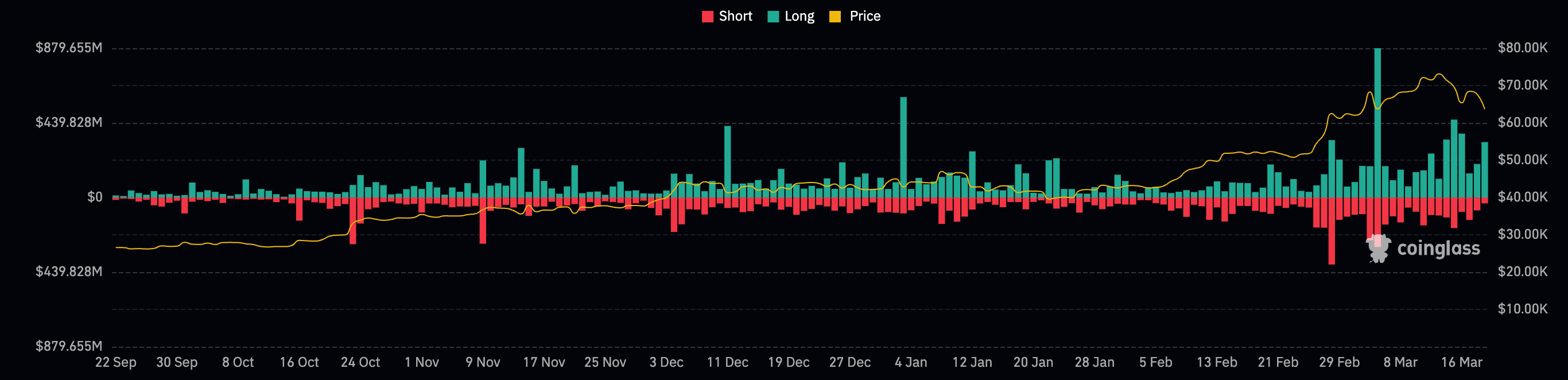

Over the last 30 days, liquidations have seen an uptick for both longs and shorts. The chart below shows the daily liquidation volumes for the market as a whole since September.

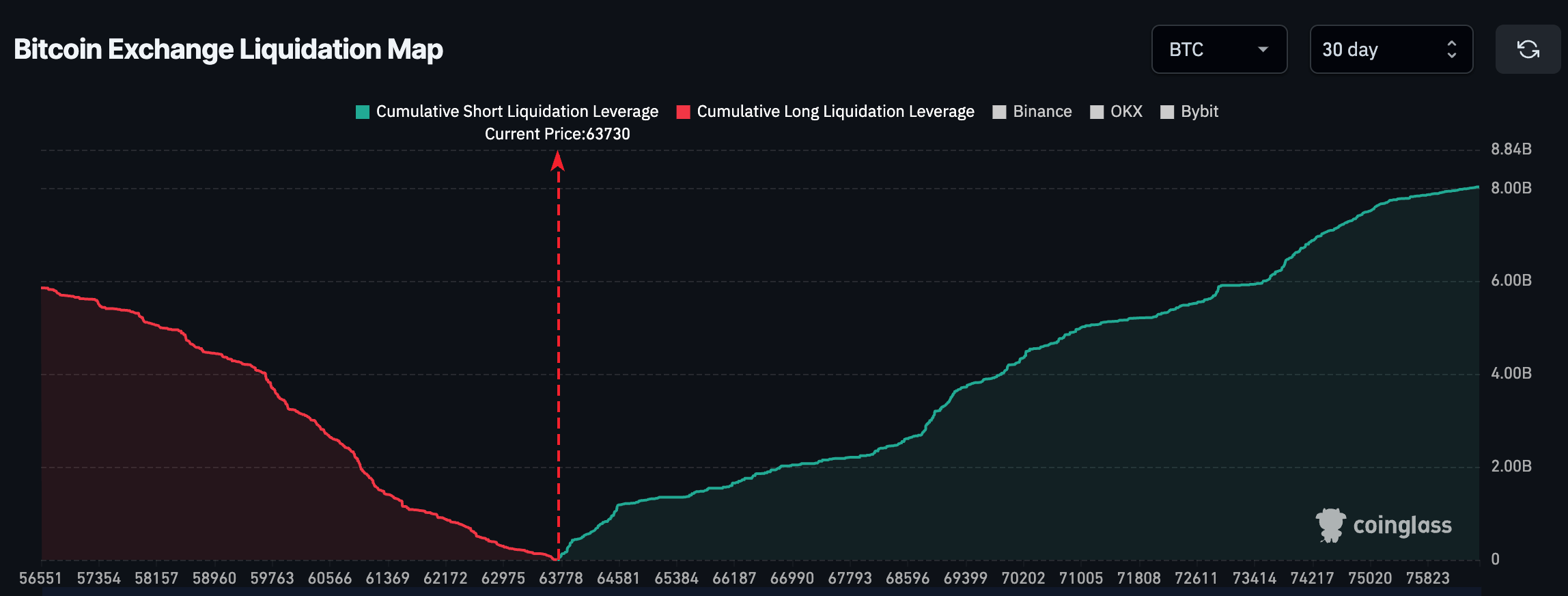

Across major crypto exchanges, there has been a surplus of short leverage in Bitcoin over the past 30 days. While the funding rate remains positive for now, this may change if bears can continue pressure on the Bitcoin price.

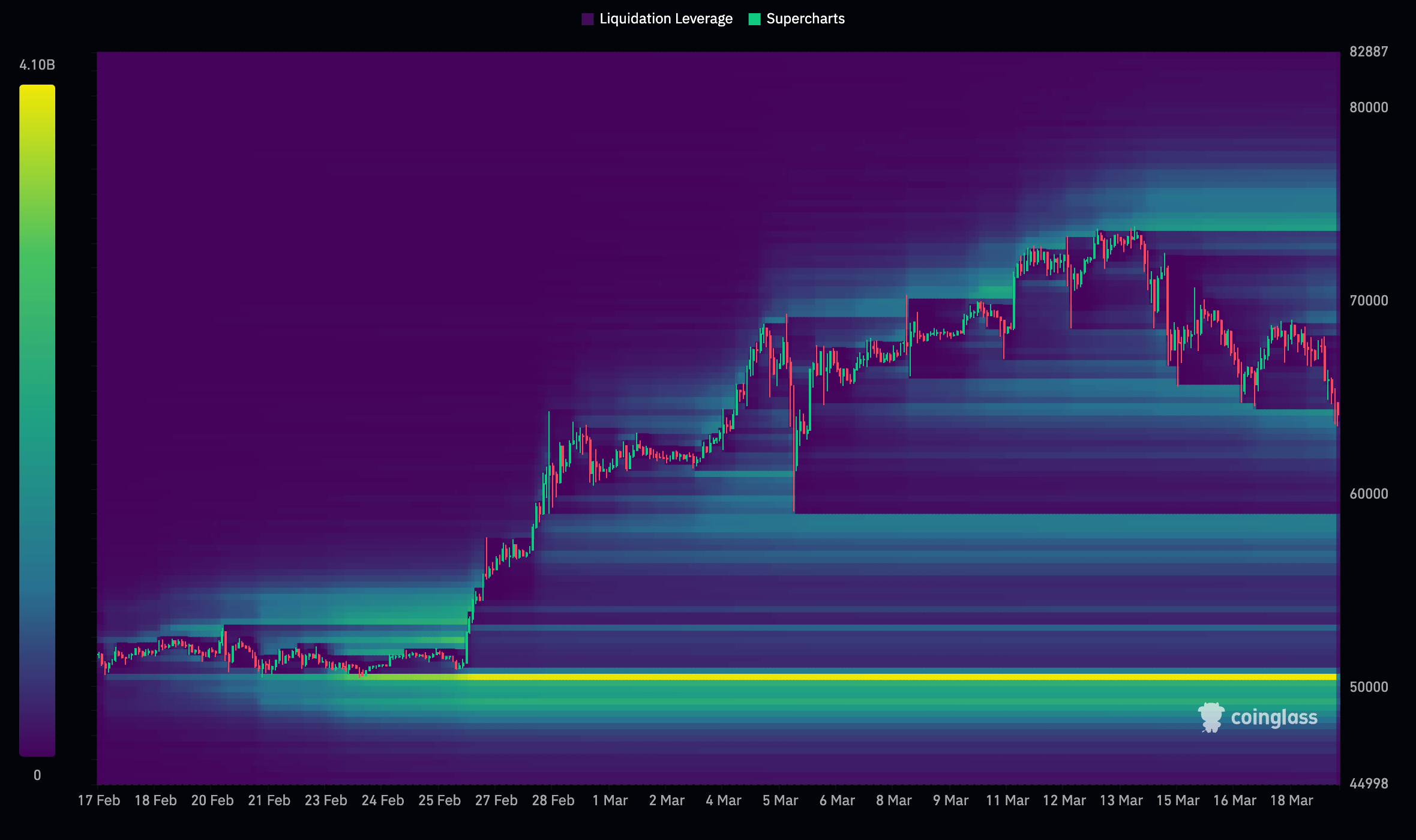

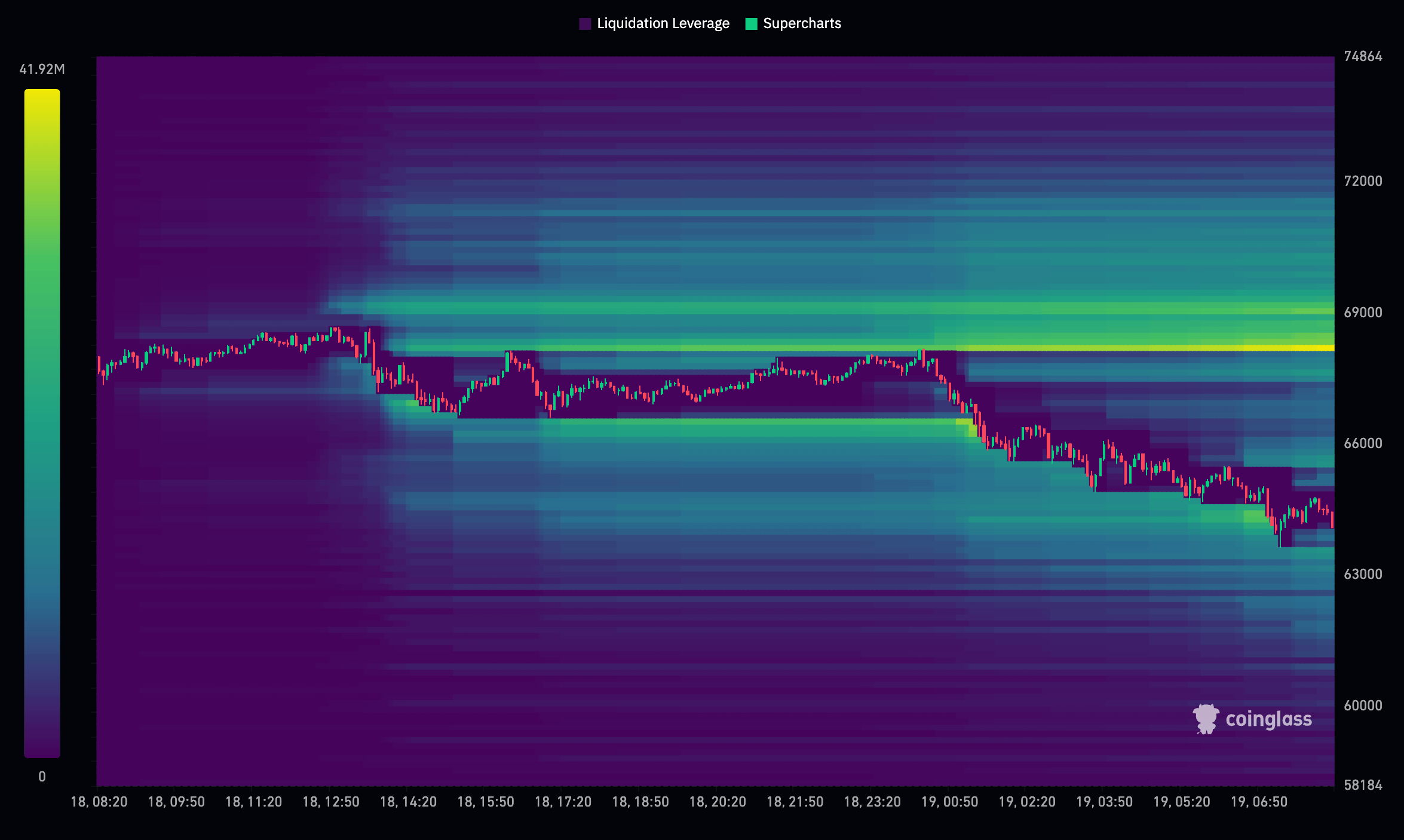

However, total leverage over a longer timeframe shows a critical band of long leverage around the $50,000 mark. Much of the leverage between $73,000 and $50,000 has now been flushed out. Yet, there are still hefty bands just below $60,000.

Looking at the 24-hour leverage heatmap chart, we see traders keen to re-enter the market amid the current volatility. Previously, sharp price movements had cleared out leverage almost entirely around liquidation levels. However, traders set new leveraged positions, long and short, at each new support and resistance.

The post $620 million liquidated as Bitcoin breaks below $64k appeared first on CryptoSlate.