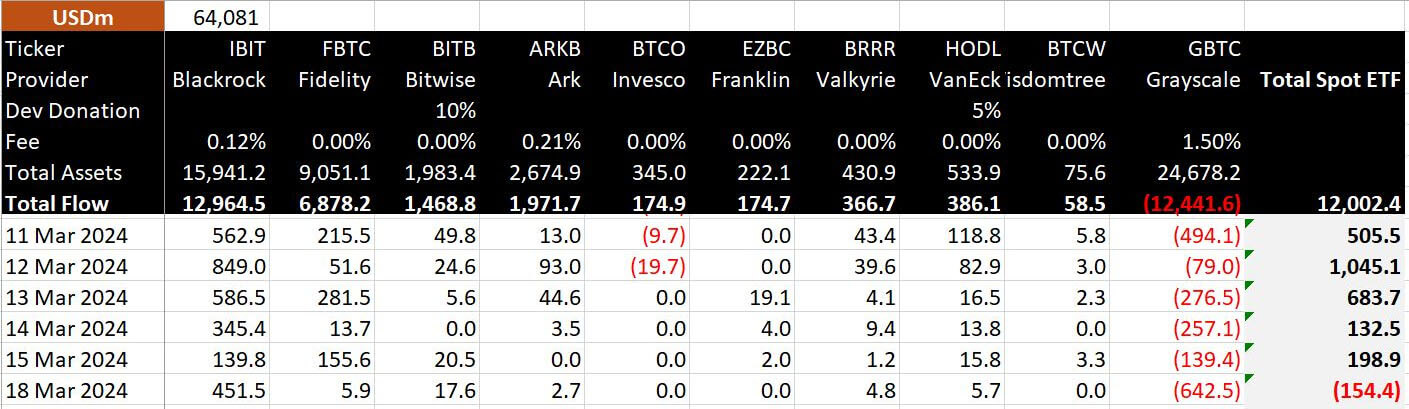

Bitcoin exchange-traded funds experienced a net outflow of $154 million on March 18, according to data from Bitmex Research. This marks the first outflow day since March 1, breaking a streak of consistent inflows. The outflow represents 2,229 BTC, based on the market reference rate.

Grayscale’s GBTC product accounted for the entirety of the outflows at $642.5 million, while most other providers saw modest inflows. BlackRock’s IBIT saw the largest inflows at $451.5 million. Fidelity FBTC had its worst-performing day to date with just $5.9 million in inflow. However, a lack of any outflows from the Newborn Nine is a positive sign for investor sentiment.

The recent outflow follows a period of sustained inflows throughout early March. Despite the notable outflow on March 18, the month-to-date (MTD) flows remain positive at $4.5 billion.

Despite the sizeable outflow from GBTC, the overall bitcoin ETF space remains healthy. The year-to-date (YTD) flows also remain in positive territory, with a net inflow of $12 billion, equivalent to 211,715 BTC.

The data suggests institutional interest in bitcoin exposure remains robust, though not without occasional volatility, as evidenced by Grayscale’s activity.

Market participants will likely monitor the situation closely to determine whether the March 18 outflow is an isolated event or the beginning of a trend reversal. The performance of Bitcoin ETFs serves as a gauge of institutional interest in the crypto market ahead of the impending halving.

The post No outflows for Bitcoin Newborn Nine ETFs as Grayscale forces $154 million net outflow appeared first on CryptoSlate.