Solana (SOL) has experienced an exceptional uptrend, with a staggering year-to-date (YTD) surge of 652%. However, the recent surge in meme coins has further amplified the blockchain’s growth narrative.

Solana-based tokens such as dogfight (WIF), Bonk Inu (BONK), and Boof of Meme (BOME) have witnessed remarkable growth rates of 574%, 3200%, and 49%, respectively, according to CoinGecko data.

Nevertheless, this unprecedented meme coin mania has its fair share of ramifications, including increased transaction failures, rising transaction fees, and the dominance of bot-driven activities.

Meme Coin Ecosystem Faces Challenges

The surge in meme coin popularity is evident through the rise in decentralized exchange (DEX) and meme coin volume on Solana. On March 16th, major meme coins like BONK, WIF, TREMP, BODEN, and BOME recorded a cumulative volume of $1.33 billion.

This surge in trading activity highlights investors’ significant interest and participation in the Solana meme coin ecosystem.

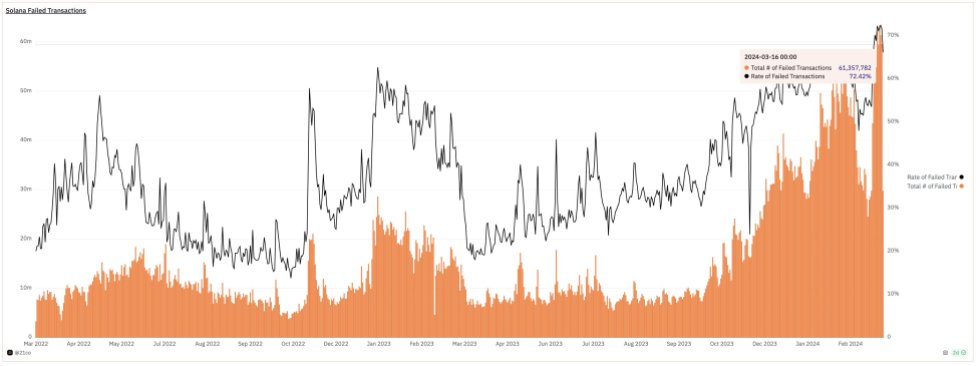

However, the influx of bots seeking to exploit potential opportunities has resulted in a notable increase in failed transactions within the Solana network.

On-chain researcher and analyst Tom Wan reveals that 72% of the failed transactions can be attributed to bot activities. Although this high failure rate has impacted the network’s efficiency, the effect on organic users has been relatively less severe than bots.

However, as the meme coin frenzy continues to grip Solana, the network has witnessed a substantial increase in average transaction fees.

While average users can still execute transactions without paying priority fees, Tom Wan highlights that the median transaction fee has tripled from 0.000005 SOL to 0.000016 SOL. As a result, the average transaction fee has risen to $0.065, reflecting increased demand and congestion on the network.

Ultimately, the surge in meme coin trading activity on Solana has brought benefits and challenges. While the DEX and meme coin volume growth signifies the increasing adoption and interest in these tokens, it has also exposed vulnerabilities within the network.

Solana Surpasses All Other Blockchain Ecosystems

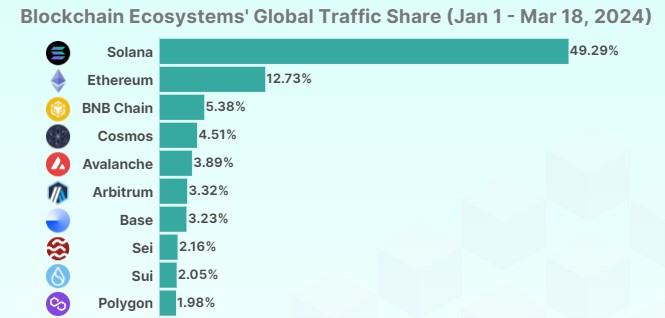

The competition between Ethereum (ETH) and Solana continues to intensify, as the so-called “Ethereum Killer” appears to be the latest to dominate global investor interest, outpacing other blockchain ecosystems.

According to recent research by CoinGecko, Solana’s growing popularity can be attributed to its recent rally, which has propelled it to reclaim its 2021 highs.

This resurgence has captured the attention of investors worldwide, who are drawn to blockchain’s potential for innovation and growth. In addition, the success of notable projects within the Solana ecosystem, such as Pyth, has further boosted investor confidence and interest in the platform.

While Solana has emerged as the most popular blockchain ecosystem, Ethereum holds a significant position in the industry. CoinGecko’s data reveals that Ethereum captures 12.7% of investor interest, ranking it as the second most popular ecosystem 2024.

According to the research, Ethereum’s continued relevance can be attributed to its well-established presence and familiarity among investors. However, attention within the Ethereum ecosystem is increasingly dispersed to layer 2 solutions built on top of the Ethereum network.

With a 5.4% share of investor interest year-to-date (YTD), the third most popular blockchain ecosystem is crypto exchange Binance’s BNB Smart Chain ecosystem.

Currently, the price of SOL stands at $171.80, reflecting a continuation of its price correction over the past seven days, which amounts to a 5% decline. This correction has also persisted over the past 24 hours, with a further decrease of 6.6% in price.

Featured image from Shutterstock, chart from TradingView.com