Quick Take

The latest Bitcoin cycle, starting from the lows of November 2022 at approximately $15,500 and soaring to over $73,000, is drastically altering investor expectations as it deviates from the traditional bull market patterns.

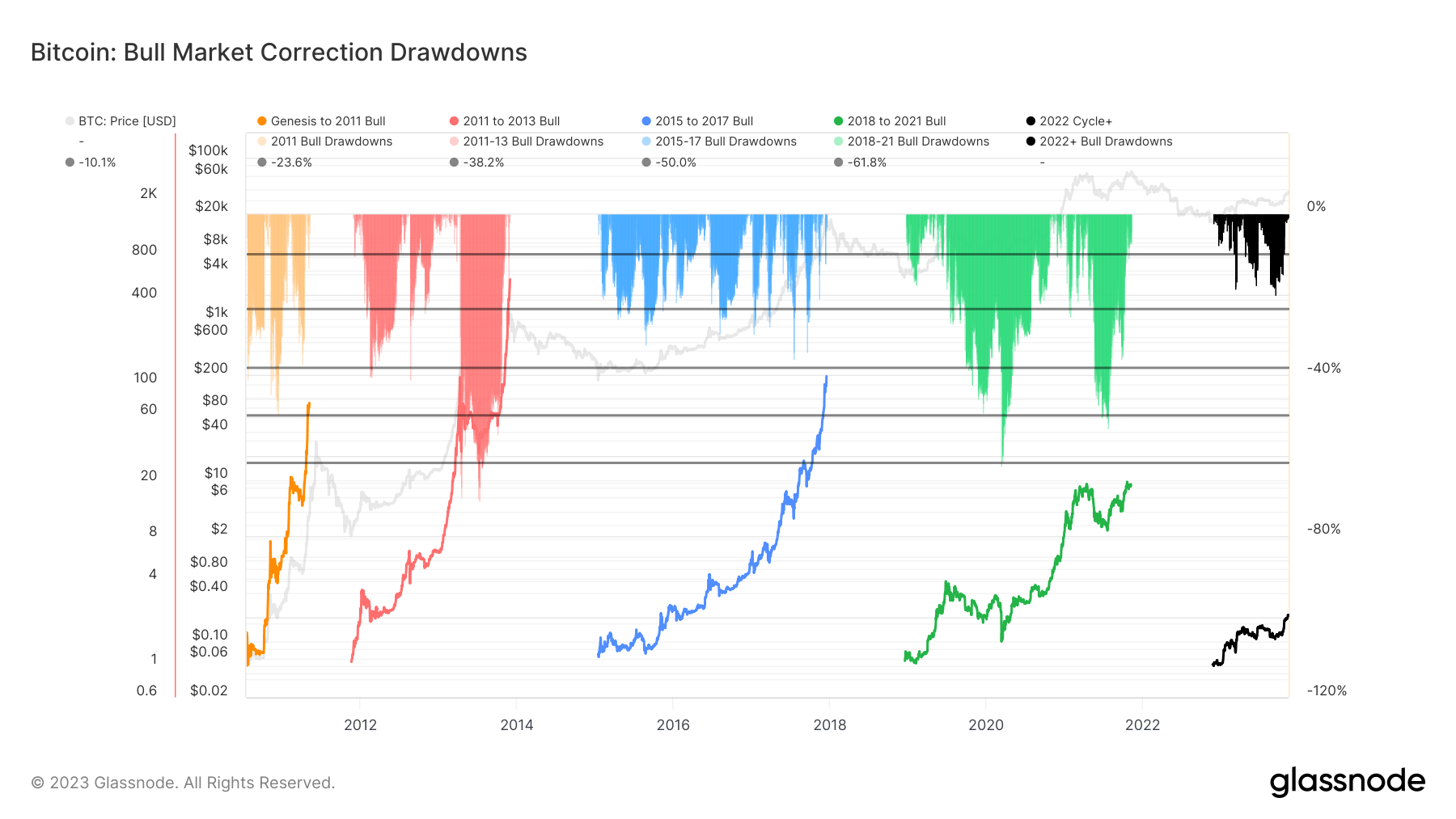

Historically, Bitcoin has seen 30% drawdowns in bull markets, which is a common occurrence. However, this cycle has left many investors on the sidelines, waiting in vain for the usual hefty drawdowns to happen.

The most significant drawdown of this cycle, a 20% dip, took place in September 2023, falling from $30,000 to $25,000 from its July peak.

Since October 2023, Bitcoin has embarked on an impressive climb, jumping from roughly $25,000 to a peak of roughly $73,000, but with two relatively modest drawdowns of 16%.

These occurred just after the ETF launch in January and again from the all-time high. Glassnode’s data captures the daily closing prices, indicating that the Bitcoin price may have dipped lower within the day.

However, the extent and duration of the drawdowns in this Bitcoin cycle have been notably shorter and shallower. This could be indicative of Bitcoin maturing as an asset.

The post Bitcoin’s latest rally upends traditional market expectations with shallower drawdowns appeared first on CryptoSlate.