Quick Take

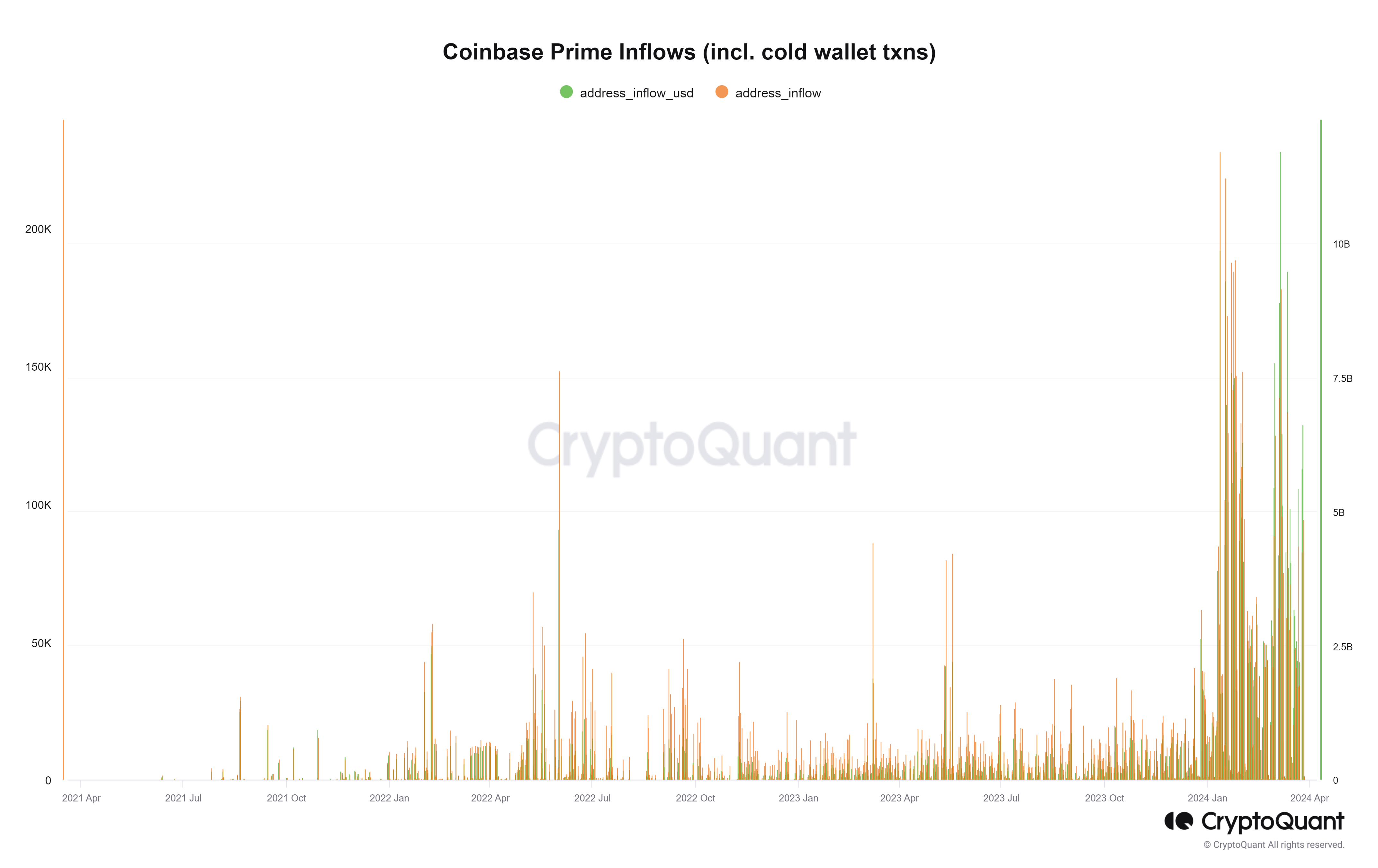

Significant Bitcoin inflows into Coinbase’s Prime Brokerage services, which cater primarily to US institutional investors, can be seen via CryptoQuant data. Coinbase Prime offers advanced trading platforms, over-the-counter (OTC) desks, and custody services – appealing features for institutional clients. This influx aligns with the launch of Bitcoin exchange-traded funds (ETFs) on Jan.11; CryptoQuant suggests that multiple OTC trades are also taking place.

Purchasing Bitcoin OTC minimizes slippage and allows the execution of large transactions without impacting the spot market price. Notably, large inflows into Coinbase Prime were observed during the 2022 bear market when Bitcoin traded around $20,000 amid the Luna collapse, according to CryptoQuant data.

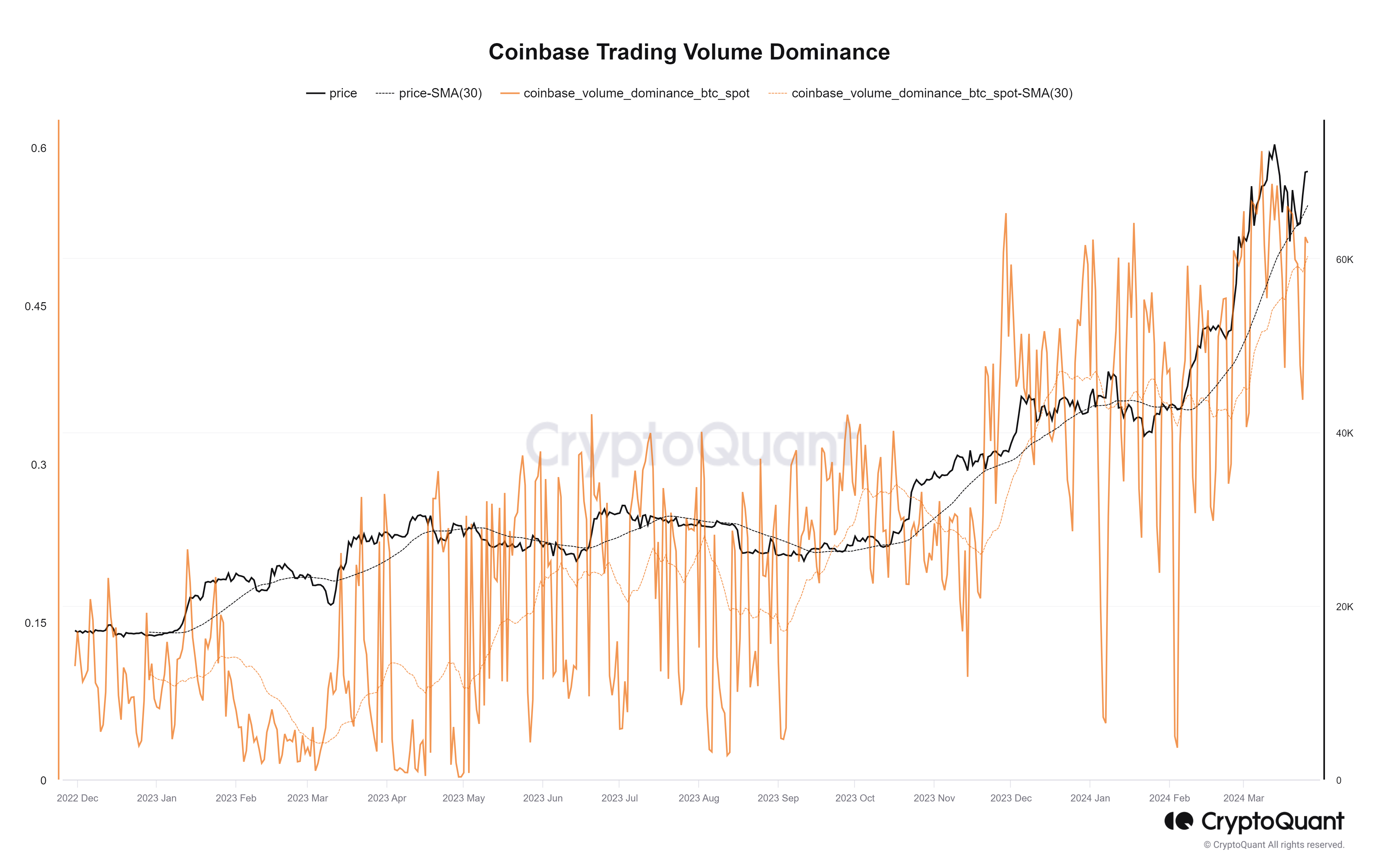

Moreover, Coinbase’s spot trading volume dominance has surged to around 50% market share since the ETF launch. This surge shows the impact of the involvement of US institutional investors in Coinbase’s platform and services.

The post Heavy Bitcoin inflow into Coinbase Prime service visibile on-chain after ETF launches appeared first on CryptoSlate.