Quick Take

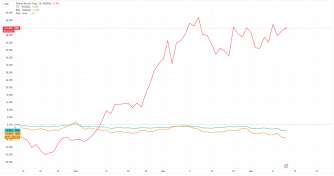

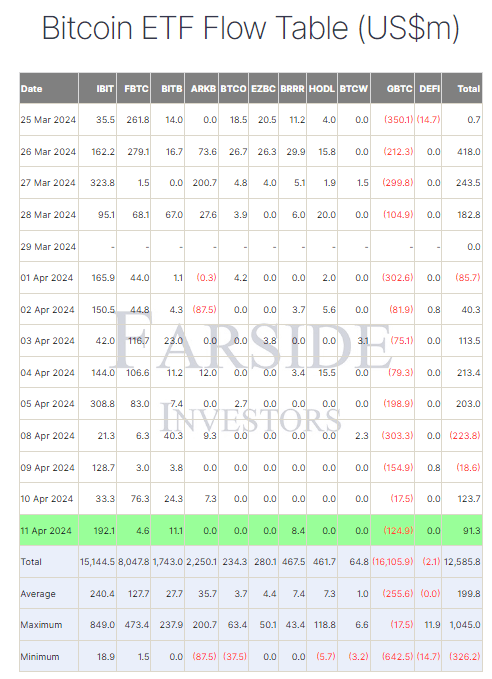

Farside data shows that on April 11, Bitcoin (BTC) exchange-traded funds (ETFs) saw a total inflow of $91.3 million. BlackRock’s IBIT experienced a $192.1 million inflow, its largest since April 5, surpassing $15 billion in inflows with an exact amount of $15,144.5 billion. Since its launch, IBIT has averaged $240.4 million a day in inflows, a level not seen since April 5.

Farside data reports that Valkyrie’s Bitcoin Fund (BRRR) saw an $8.4 million inflow, its biggest since March 26, bringing its total net inflow to $467.5 million. However, Grayscale’s GBTC faced a $124.9 million outflow, contributing to its total net outflows of $16,105.9 billion. The total net inflows of all ETFs now stand at $12,585.8 billion.

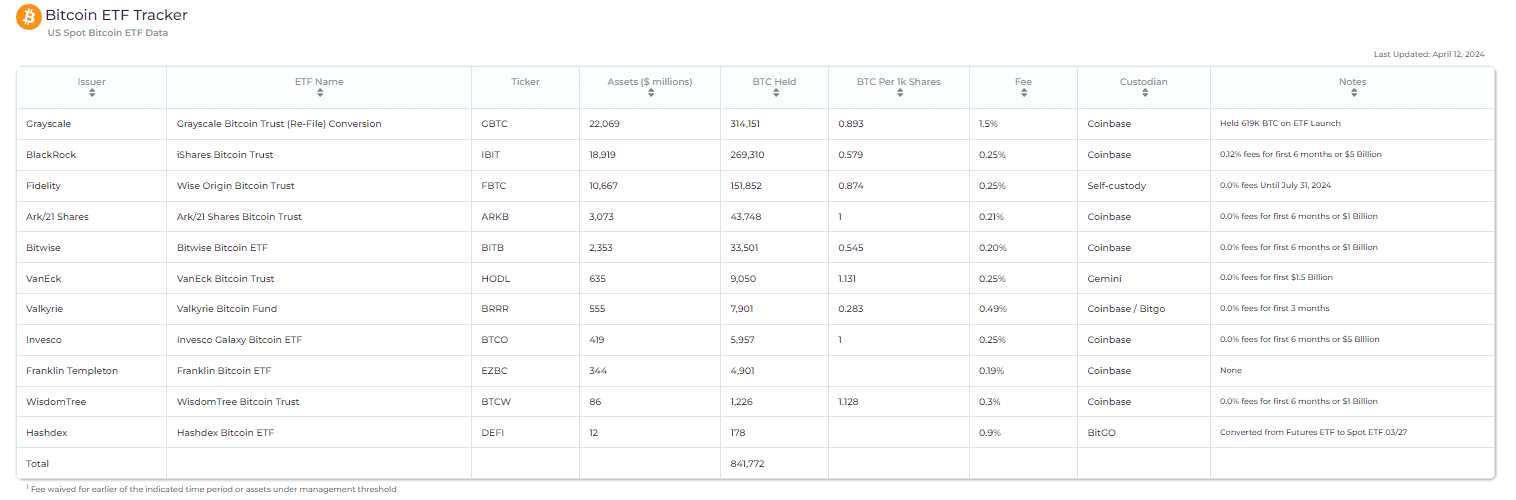

According to heyapollo data, GBTC holds 314,151 BTC, while IBIT holds 269,310 Bitcoin, resulting in a 44,841 Bitcoin difference between the two funds.

The post BlackRock’s IBIT surpasses $15 billion in inflows appeared first on CryptoSlate.