Quick Take

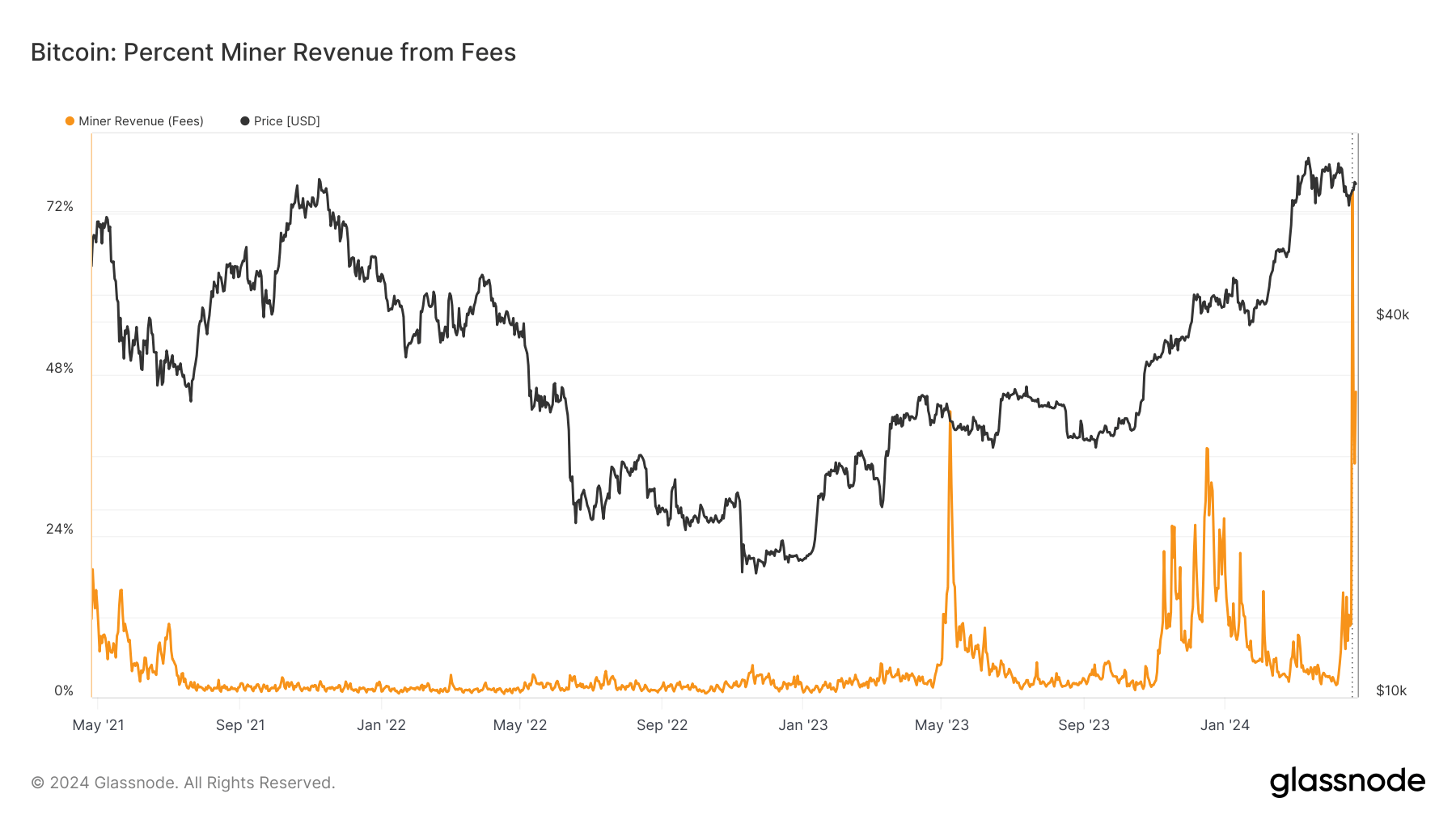

In the aftermath of the April 20 Bitcoin halving, the digital asset has experienced significant changes in its fee structure, transaction composition, and hash rate resilience. Data from Glassnode shows that miner revenue derived from fees reached an all-time high of approximately 75% on the halving day before settling at around 45%, indicating a substantial portion of miner revenue now originates from fees.

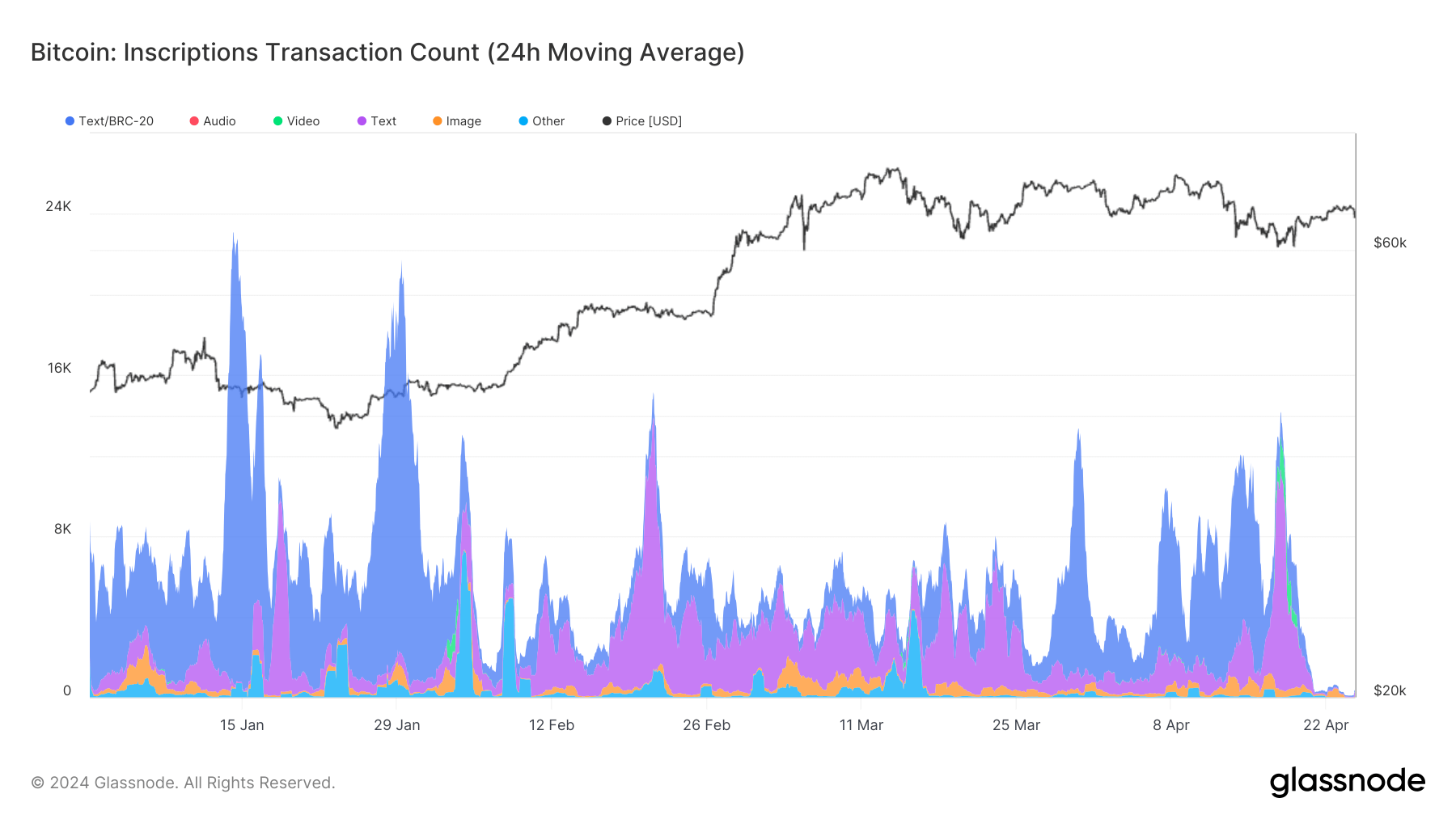

Inscriptions emerged on the Bitcoin blockchain in early 2023, experiencing significant surges in May and December, which led to notable increases in miner fees.

Tracking inscription transactions year-to-date exposes a marked downturn. While previously averaging around 8,000 transactions, with peaks exceeding 16,000 and lows falling below 6,000, activity has sharply declined following the halving event.

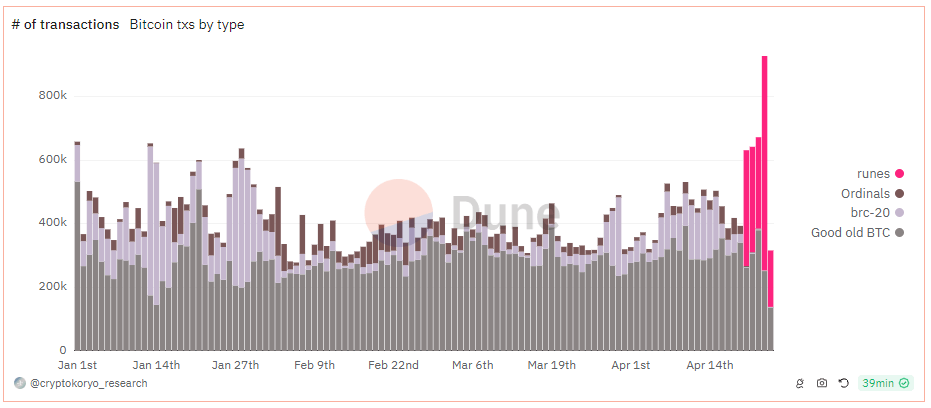

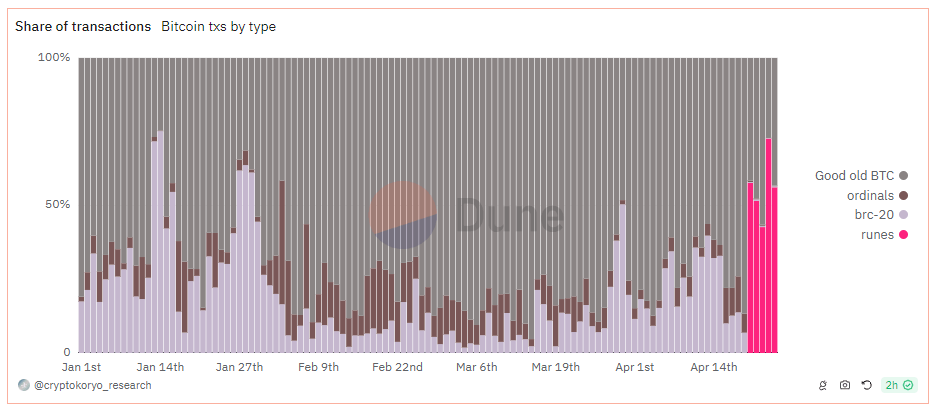

Data from Dune Analytics shows that since April 20, a shifting landscape in Bitcoin transactions has been revealed. Out of the roughly 900,000 total transactions on April 23, a year-to-date high, Runes accounted for a staggering 73% (675,000), while traditional BTC transactions on-chain comprised 27% (roughly 250,000). Inscriptions and BRC-20 tokens played a minor role, with 0.1% (769) and 0.2% (1,400) of transactions, respectively.

The impact of Inscriptions appears to be waning. As the Bitcoin network adapts to the post-halving environment, the question remains whether Runes will follow a similar trajectory.

The post Are Inscriptions following the path of the Dodo? appeared first on CryptoSlate.