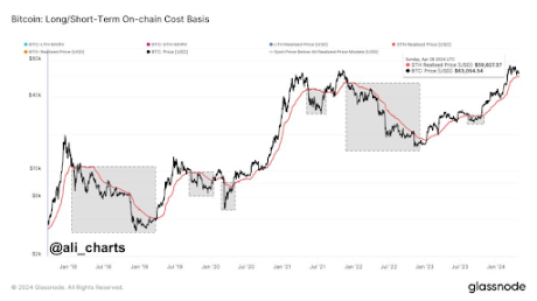

Crypto analyst Ali Martinez has provided insights into why $59,800 is a crucial price level for the Bitcoin future trajectory. The analyst revealed two things that could happen if the flagship crypto drops that low.

Why $59,800 Is An Important Level For Bitcoin

Martinez mentioned in an X (formerly Twitter) post that the Bitcoin short-term holder’s (STH) realized price is at $59,800. He added that BTC historically often bounces off this level during an uptrend, which would mean that the flagship crypto could experience a massive pump if it were to drop to that price level.

However, Martinez also warned of what could happen if Bitcoin fails to experience this bounce, noting that a fall below this level could “trigger notable Bitcoin price corrections.” Although the crypto analyst didn’t mention how low Bitcoin could drop, his choice of words suggests that a price breakdown for the crypto token could be severe.

STH is an important metric that measures the average price at which Bitcoin short-term investors bought the crypto token. A drop to that level suggests that these short-term investors have realized their profits, which leaves room for Bitcoin to make another run following this wave of sell-offs.

On the other hand, as Martinez warned, Bitcoin could drop further if it fails to establish support at that level. This brings crypto analyst DonAlt’s recent prediction into context. He hinted that BTC could fall between $52,000 and $47,000 if it eventually breaks the $60,000 support level.

Meanwhile, Martinez also drew the crypto community’s attention to the $61,900 mark, which he remarked has “consistently been a crucial support level for Bitcoin.” He further claimed that BTC could rise to as high as $71,000 if it continues to hold above that level.

Is The BTC Top In?

In a more recent X post, Martinez gave his opinion on whether or not Bitcoin has reached its market top. He tried to analyze it from both sides of the divide. First, he noted that a spike in BTC’s realized profits has “historically coincided with market tops.” He then revealed that Bitcoin’s realized profits skyrocketed to $3.52 billion when it hit $73,880 last month.

This would suggest that the market top was indeed in. However, Martinez added that he was waiting for another confirmation before confidently claiming that the market top is in. He claims that this confirmation will come if BTC achieves a sustained close below the short-term realized price, currently around $59,800.

Meanwhile, he further stated that this market top theory could be invalidated if Bitcoin surges above $66,250 and claims this area as support. Bitcoin rising above that price level will help it gain the strength it needs to move towards $69,150. If BTC eventually breaches that resistance level, Martinez claimed it could advance to a new all-time high (ATH) of $92,190.

At the time of writing, Bitcoin is trading at around $62,300, down in the last 24 hours, according to data from CoinMarketCap.