The following is a guest post from Shane Neagle.

Regardless of an asset’s fundamentals, its value is governed by one underlying feature – market liquidity. Is it easy for the wider public to sell or buy this asset?

If the answer is yes, then the asset receives high trading volume. When that happens, executing trades at varied price levels is easier. In turn, a feedback loop is created – more robust price discovery boosts investor confidence, which boosts more market participation.

Since Bitcoin launched in 2009, it has relied on crypto exchanges to establish and extend its market depth. The easier it became to trade Bitcoin worldwide, the easier it became for the BTC price to rise.

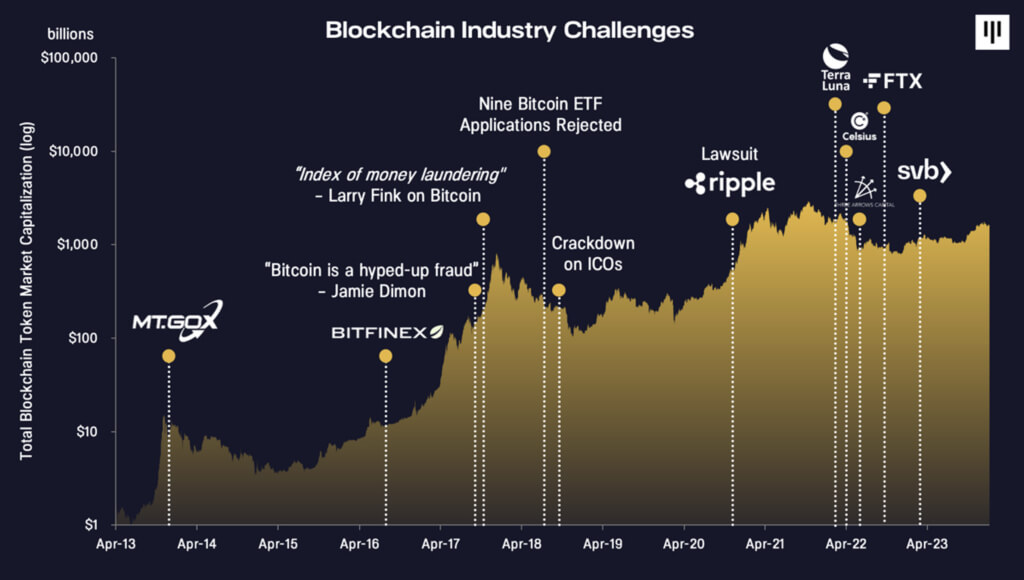

By the same token, when fiat-to-crypto rails such as Mt. Gox or FTX fail, the BTC price suffers greatly. These are just some obstacles to Bitcoin’s path to legitimization and adoption.

However, when the Securities and Exchange Commission (SEC) approved 11 spot-traded Bitcoin exchange-traded funds (ETFs) in January 2024, Bitcoin gained a new layer of liquidity.

This is a liquidity milestone and a new layer of credibility for Bitcoin. Entering the world of regulated exchanges, alongside stocks, ran the steam out of naysayers who questioned Bitcoin’s status as a decentralized digital gold.

But how does this new market dynamic play out in the long run?

The Democratization of Bitcoin Through ETFs

From the get-go, Bitcoin’s novelty has been its weakness and strength. On the one hand, it is a monetary revolution to hold wealth in one’s head and then be able to transfer that wealth borderless.

Bitcoin miners can transfer it without permission, and anyone with internet access can become a miner. No other asset has that property. Even gold, with its relatively limited supply resistant to inflation, can be easily confiscated as it happened in 1933 under Executive Order 6102.

This means that Bitcoin is an inherently democratizing wealth vehicle. But with self-custody comes great responsibility and space for error. Glassnode data shows that around 2.5 million bitcoins have become inaccessible due to lost seed words that can regenerate access to the Bitcoin mainnet.

This is 13.2% of Bitcoin’s 21 million BTC fixed supply. In effect, self-custody induces anxiety among both retail and institutional investors. Would fund managers engage in Bitcoin allocation with such risk?

But Bitcoin ETFs changed this dynamic completely. Investors looking to hedge against currency debasement can now delegate the custody to large investment firms. And they, from BlackRock and Fidelity to VanEck, delegate it to chosen crypto exchanges like Coinbase.

Although this reduces Bitcoin’s self-custody feature, it boosts investor confidence. At the same time, miners, via proof-of-work, still make Bitcoin a decentralized asset, regardless of how much BTC is hoarded within ETFs. And Bitcoin remains both a digital asset and a hard asset grounded in computing power (hashrate) and energy.

Bitcoin ETFs Reshaping Market Dynamics and Investor Confidence

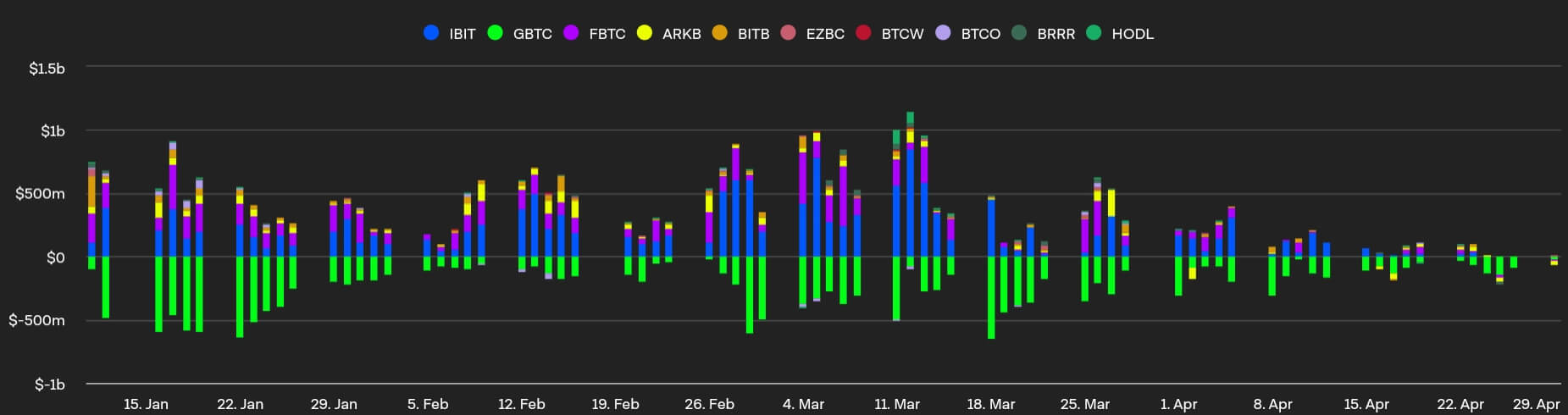

Since January 11th, Bitcoin ETFs opened the capital floodgates to deepen Bitcoin’s market depth, resulting in a $240 billion cumulative volume. This substantial influx of capital has also shifted the break-even price for many investors, influencing their strategies and expectations about future profitability.

Yet, despite the launch being widely successful in exceeding expectations, negative outflows have gained ground as Bitcoin ETF hype subsided.

As of April 30th, Bitcoin ETF flows netted negative $162 million, marking the fifth consecutive day negative outflows. For the first time, Ark’s ARKB outflow (yellow) outpaced GBTC (green), at negative $31 million vs $25 million respectively.

Considering this was after Bitcoin’s 4th halving, which reduced Bitcoin’s inflation rate to 0.85%, it is safe to say that macroeconomic and geopolitical concerns temporarily overshadowed Bitcoin’s fundamentals and deepened market depth.

This was even more evident when the Hong Kong Stock Exchange’s opening of Bitcoin ETFs failed to deliver. Despite opening capital access to Hong Kong investors, the volume accounted for only $11 million ($2.5 million in Ether ETFs), compared to the expected $100 million.

In short, Hong Kong’s crypto ETF debut was nearly 60x less than in the US. Although Chinese citizens with registered HK businesses could participate, mainland Chinese investors are still prohibited.

Likewise, taking into account that the New York Stock Exchange (NYSE) is approximately five times larger than HKSE, it is not likely that HKSE’s Bitcoin/Ether ETFs are going to exceed $1 billion flows in the first two years, according to Bloomberg ETF analyst Eric Balchunas.

Future Outlook and Potential Challenges

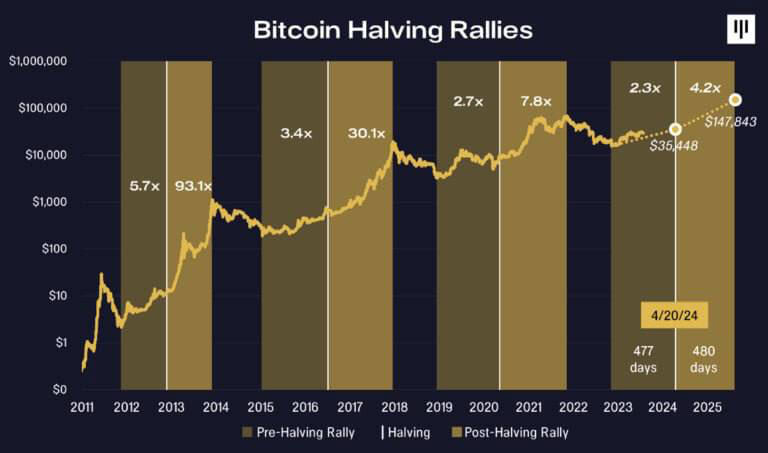

During the Bitcoin ETF liquidity extravaganza, BTC price probed the above-$70k threshold multiple times, achieving the new all-time high of $73.7k mid-March.

However, miners and holders took that opportunity to erect a selling pressure and reap gains. With spirits now subdued to the $60k range, investors will have greater opportunities to buy discounted Bitcoin.

Not only is Bitcoin’s inflation rate at 0.85% after the fourth halving, vs. the Fed’s USD target of 2%, but over 93% of BTC supply has already been mined. The mined BTC inflow turned from ~900 BTC daily to ~450 BTC daily.

This translates to greater Bitcoin scarcity, and what is scarce tends to become more valuable, especially after legitimizing Bitcoin investing on an institutional level through Bitcoin ETFs. So much so that Bybit’s analysis forecasts supply shock on exchanges by the end of 2024. Alex Greene, Blockchain Insights senior analyst said:

“The surge in institutional interest has stabilized and drastically increased demand for Bitcoin. This increase will likely exacerbate the shortage and push prices higher after the halving.”

After previous halvings in the absence of the Bitcoin ETF environment, Bitcoin price leveled up to 7.8x gains within 480 days. Although a higher Bitcoin market cap makes such gains less likely, multiple appreciation boosts remain on the table.

However, market volatility is still to be expected in the meantime. With Binance situation resolved, alongside leaving behind the string of crypto bankruptcies during 2022, the main FUD source remains the government.

Despite Tom Emmer’s efforts, as the GOP majority whip, even self-custody wallets could be targeted as money transmitters. The FBI hinted at this direction recently with the warning against using “unregistered crypto money transmitting services”.

Likewise, this year, the Federal Reserve’s course on interest rates could suppress the appetite for risk-on assets like Bitcoin. Nonetheless, the perception of Bitcoin and the market surrounding it has never been more mature and stable.

If the regulatory regime changes course, small businesses could even ditch solutions like invoice financing and move to a BTC ETF-supported system.

Conclusion

After years of Bitcoin ETF rejections for spot-trading, these investment vehicles erected brand-new liquidity bridges. Even suppressed by Barry Silbert’s Grayscale (GBTC), they have proven great institutional demand for an appreciating commodity.

With the fourth Bitcoin halving behind, increased scarcity and allocations from fund managers are now a certainty. Moreover, the prevailing sentiment is that fiat currencies will perpetually be devalued as long as central banking exists.

After all, how could governments keep funding themselves despite giant budget deficits?

This makes Bitcoin all the more compelling in the long run after holders take in the profits from new ATH points. Between these peaks and valleys, Bitcoin’s bottom will likely keep rising in the deeper institutional waters.

The post The rise of Bitcoin ETFs and future market implications appeared first on CryptoSlate.