Quick Take

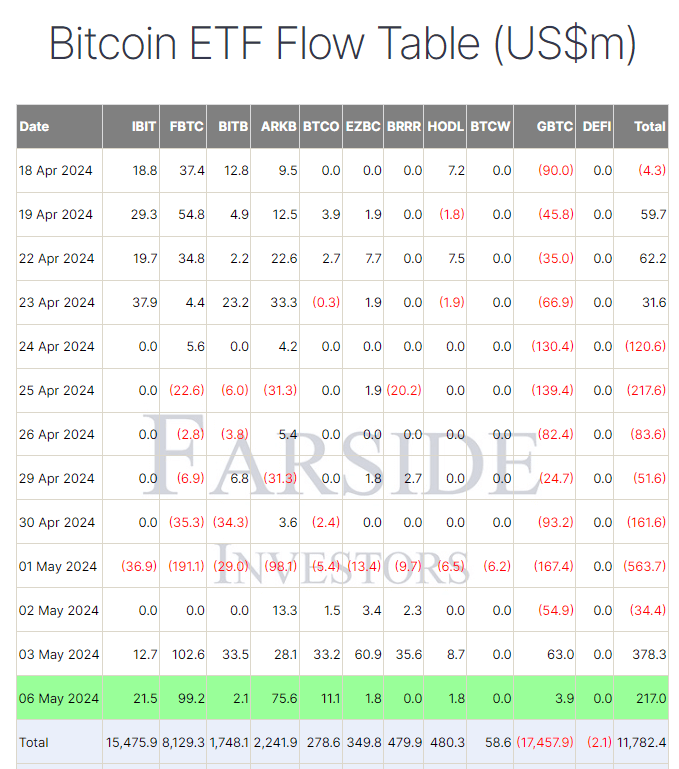

According to Farside data, the Bitcoin ETFs (Exchange-Traded Funds) in the US witnessed another net inflow day on May 6, reaching $217.0 million. This massive influx comes just days after another significant inflow was recorded on May 3.

Grayscale’s GBTC saw an inflow of $3.9 million, marking back-to-back inflows for the fund. Despite these positive developments, GBTC has still recorded total outflows of $17.4 billion. Fidelity (FBTC) emerged as the leader, attracting the largest inflow of $99.2 million on May 6. This marks the second consecutive trading day that FBTC has led the daily inflows across all ETFs, bringing its total inflows to $8.3 billion, according to Farside data.

Farside data reports that ARK’s (ARKB) also had a remarkable day, experiencing its biggest inflow of $75.6 million since March 27. This substantial influx has brought ARKB’s total net inflows to $2.2 billion. BlackRock’s (IBIT) resumed its positive trajectory, recording an inflow of $21.5 million, marking back-to-back inflows for the fund. IBIT’s total net inflows now stand at $15.4 billion. Notably, no outflows were recorded from any of the ETFs for two consecutive trading days.

According to Farside data, the total net inflows across all ETFs have now reached $11.7 billion.

The post Fidelity leads with inflows as Bitcoin ETFs capture $217M in one day appeared first on CryptoSlate.