Bitcoin dropping below $60,000 at the beginning of May spooked the market and led to significant volatility across trading products. However, despite the massive volatility in derivatives, the spot market seems to have led most of this recovery, with volumes and inflows helping stabilize BTC at around $66,000 in mid-May. After a choppy few days where BTC struggled to break through $66,000, we saw a sharp spike on May 20 that sent it above $70,000, injecting much-needed optimism into the market. While BTC settled at around $70,100 on May 21, the important psychological level remained breached.

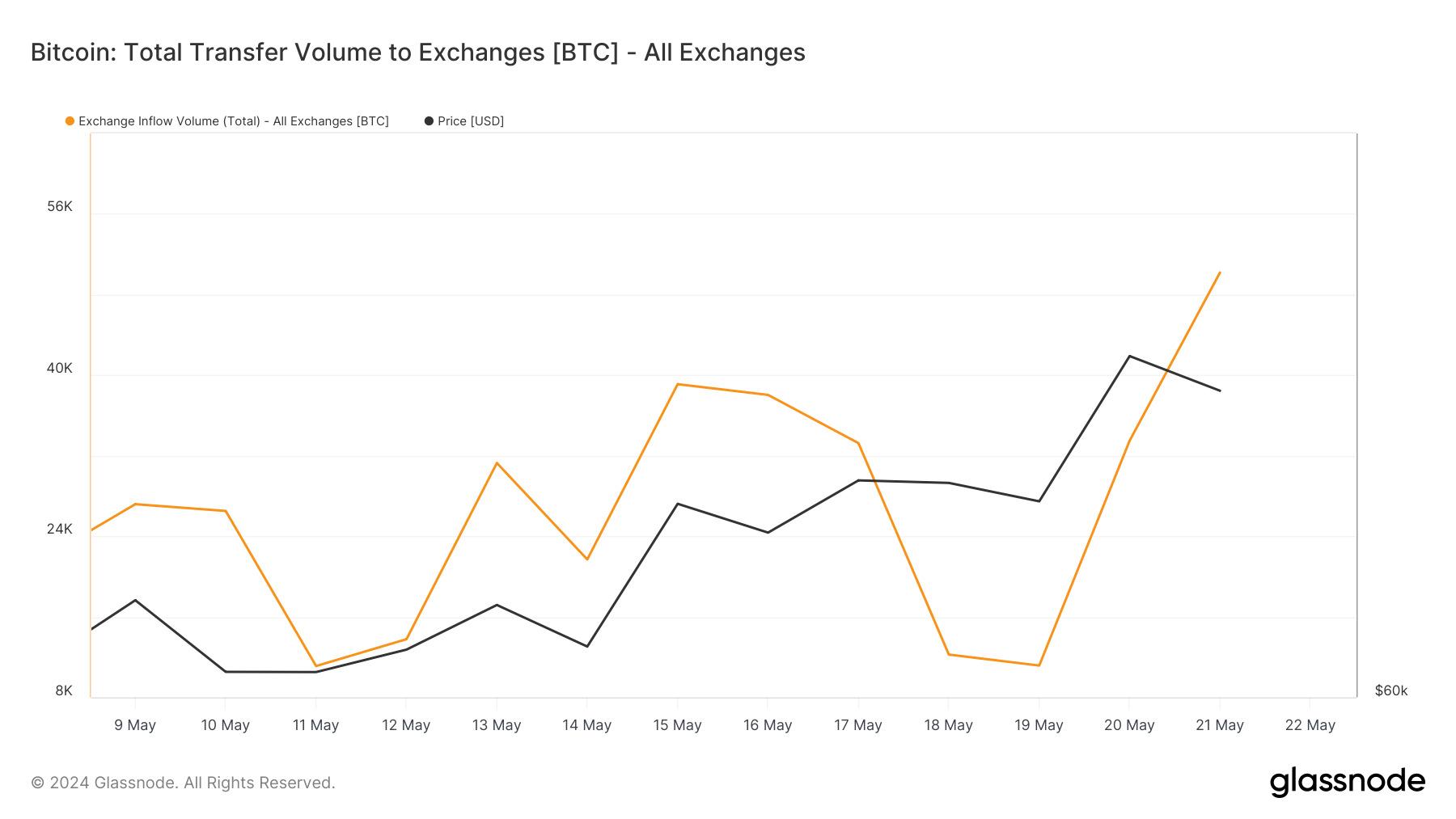

This optimism led to a notable increase in exchange activity, evident in the quick rise in inflows and volume.

Between May 15 and May 21, we saw quite a bit of volatility in transfer volumes into exchanges. On May 15, 39,095 BTC was transferred to exchanges, slightly decreasing to 38,031 BTC on May 16. The volume further dropped to 33,242 BTC on May 17, indicating a trend of declining transfer volumes. A dramatic drop occurred on May 18, with only 12,243 BTC transferred to exchanges, followed by an even lower 11,156 BTC on May 19. However, this trend reversed on May 20, with a substantial increase to 33,484 BTC, culminating in a peak of 50,186 BTC on May 2. These fluctuations show how small price changes lead to significant investor activity and sentiment fluctuations.

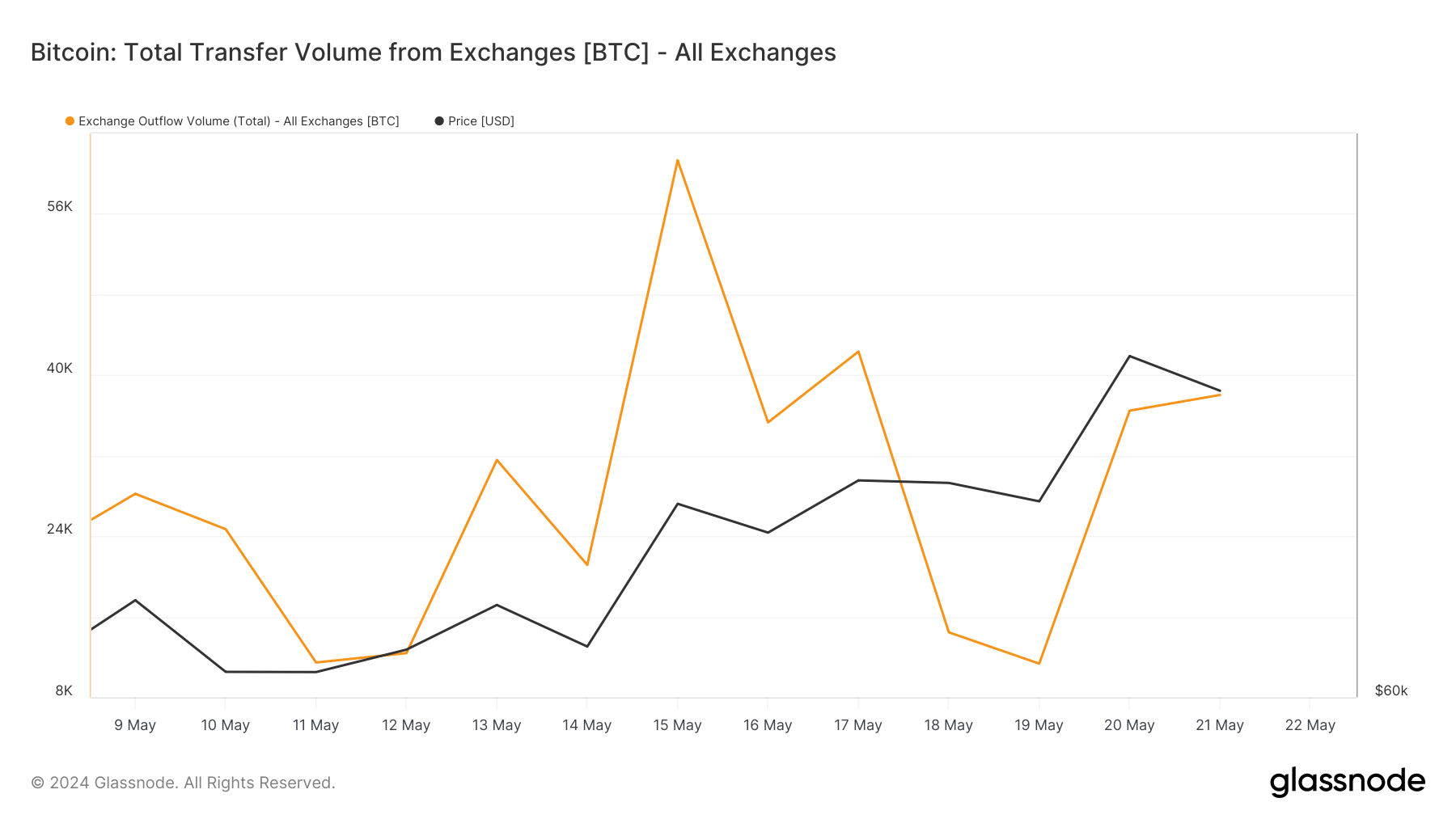

Transfer volumes from exchanges showed similar variations. Between May 15 and May 18, transfer volume out of exchanges dropped from 61,232 BTC to 14,454 BTC, followed by a further drop to 11,347 BTC on May 19. Similar to the inflow trend, the outflow volumes increased on May 20 to 36,468 BTC and slightly decreased to 38,027 BTC on May 21.

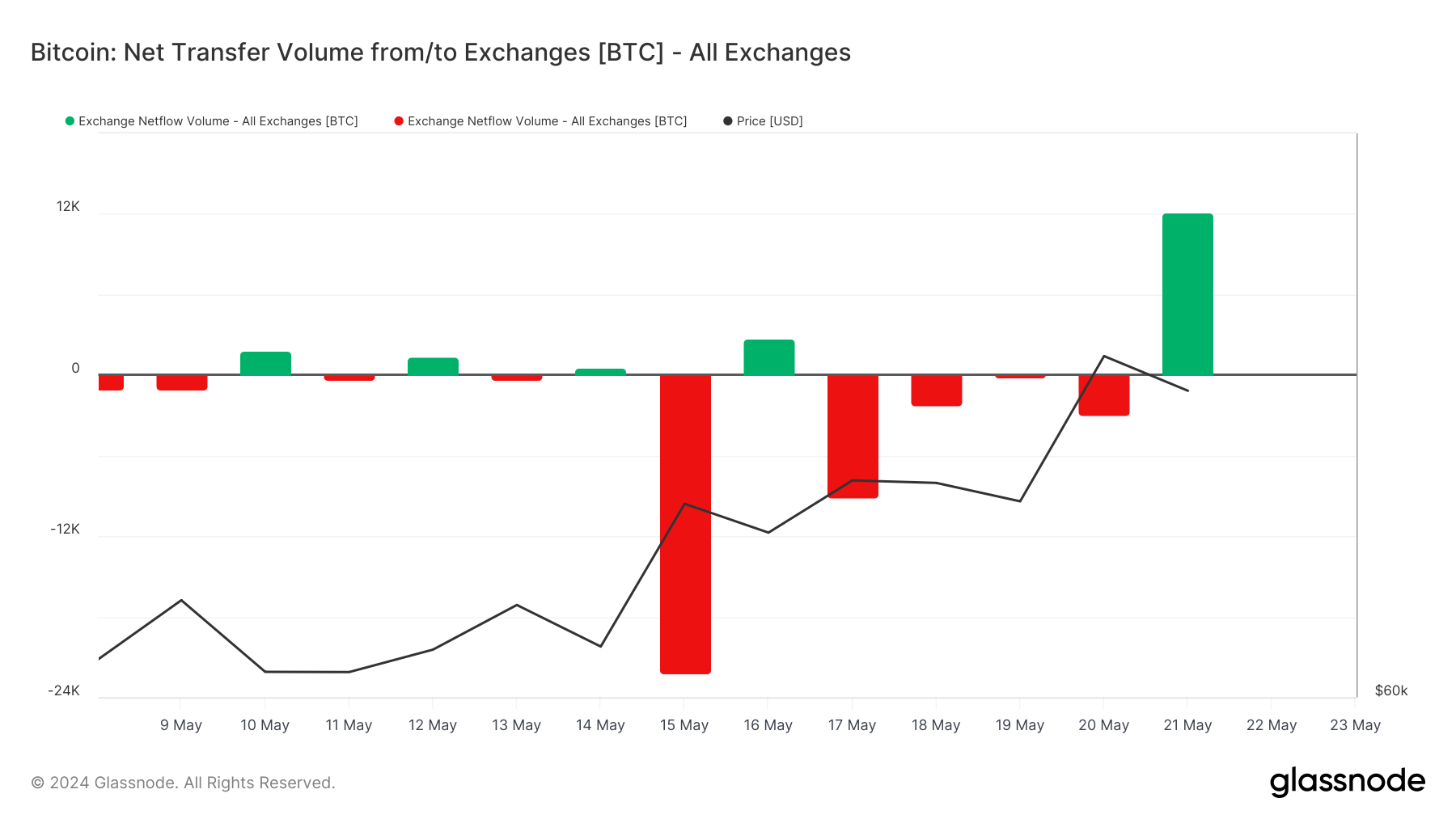

Before the price surge, from May 15 to May 19, Bitcoin’s price remained relatively stable with minor fluctuations. During this period, the net transfer volume generally leaned towards outflows, indicating holders’ reluctance to move assets into exchanges, possibly anticipating a price rise. The price surge and its aftermath on May 20 and 21 led to a notable change in investor behavior.

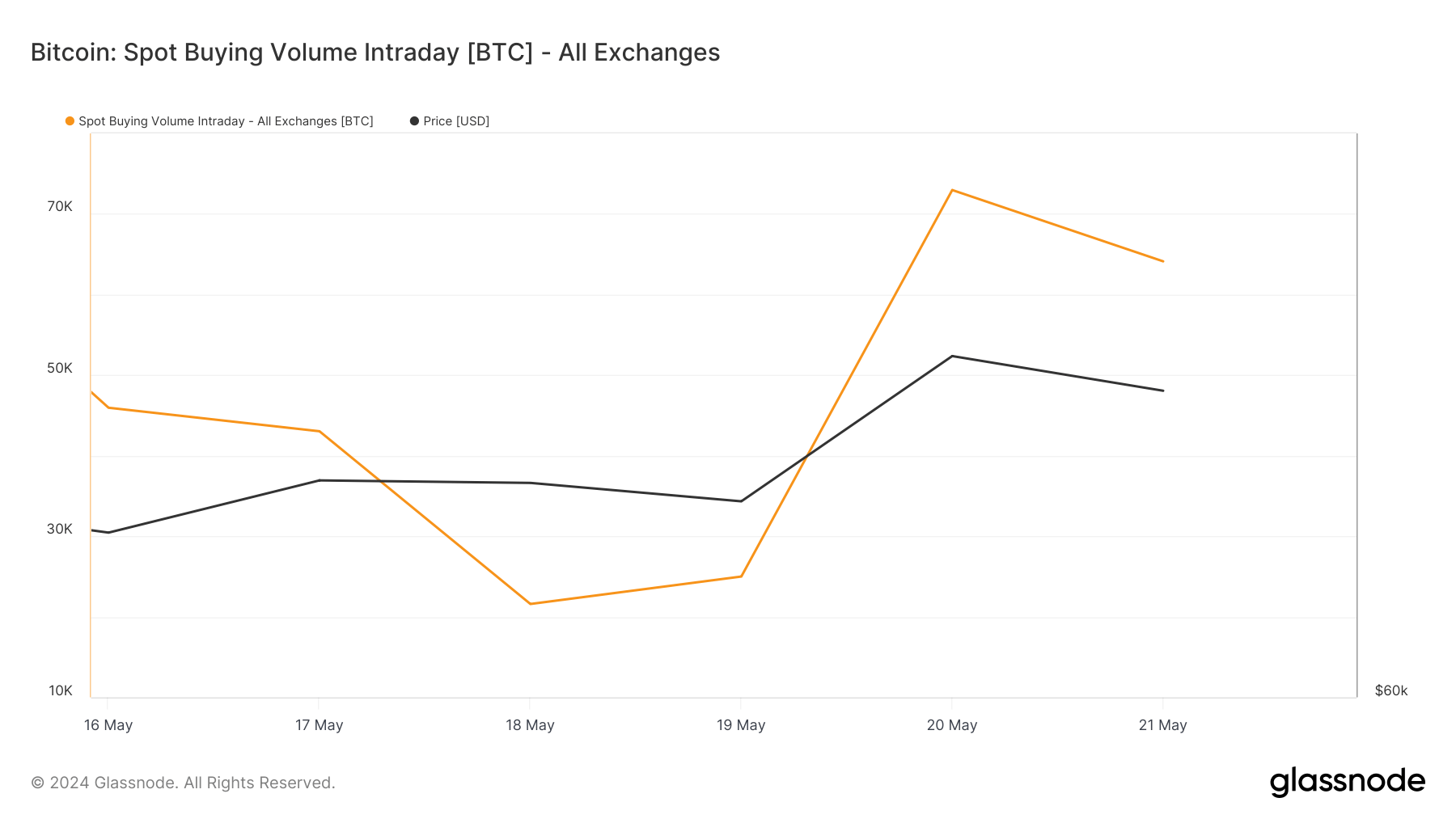

On May 20, Bitcoin’s price surged to $71,409, leading to the increased transfer volume to exchanges (33,484 BTC) and a high spot buying volume (72,971 BTC). However, there was also significant outflow from exchanges (36,468 BTC), showing that while some investors capitalized on the price surge by selling, others continued buying, driven by bullish sentiment. On May 21, the trend reversed with a net inflow of 12,159 BTC.

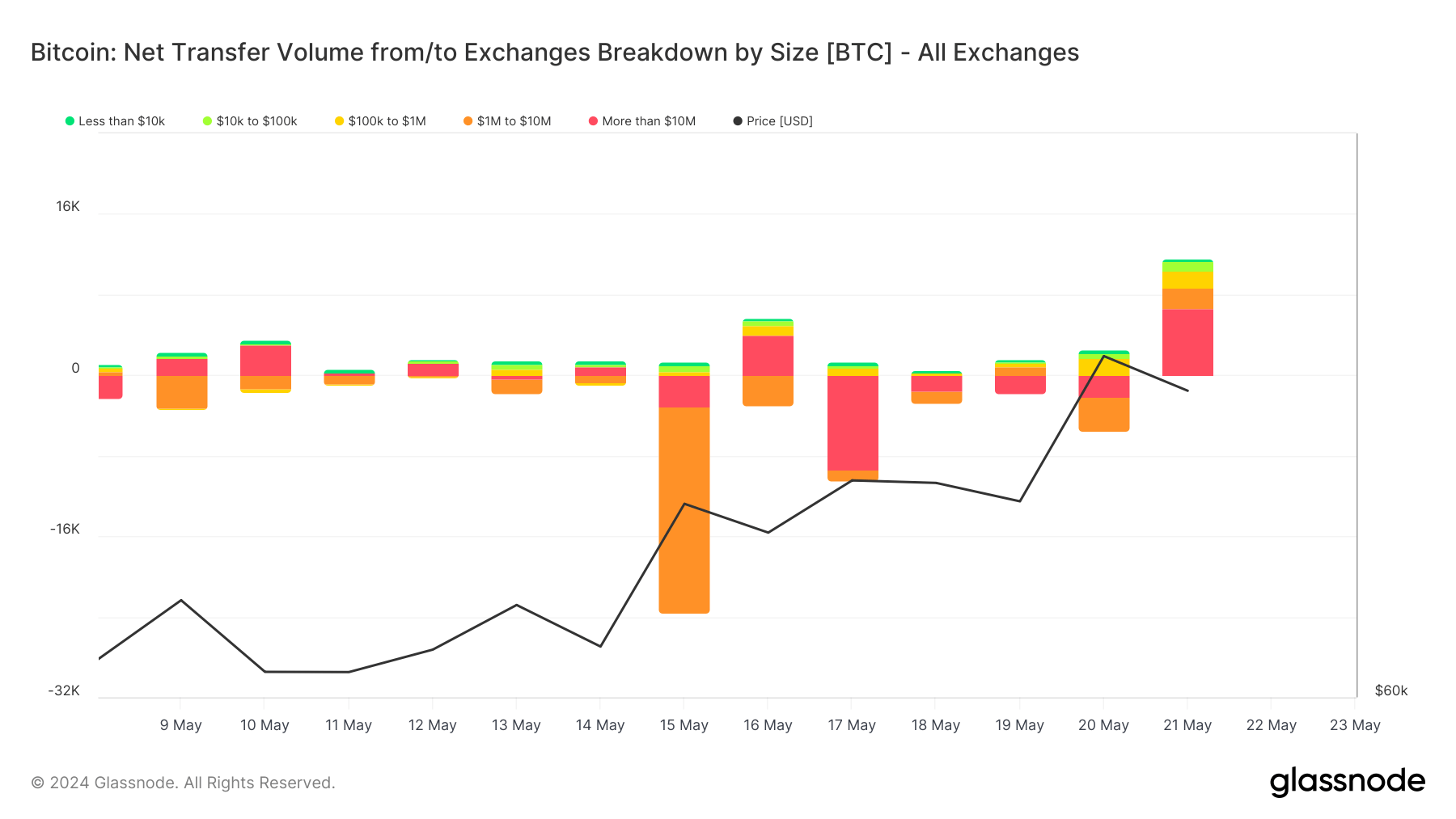

The size breakdown of exchange transfer volumes helps us better understand what kind of traders are moving the spot market. The relatively small net inflows in transfers of less than $100,000 suggest that retail investors were cautious but gradually increased their holdings, reflecting growing confidence in the price stability or potential for future gains. Consistent inflows in the $100,000 to $1 million category on both May 20 and May 21 show active participation from larger retail and smaller institutional investors, who likely perceived the surge as a buying opportunity.

The net outflow of -3,336 BTC in the $1 million to $10 million category on May 20 implies that some large holders took advantage of the price peak to liquidate portions of their holdings. However, the reversal to a net inflow of 2,109 BTC on May 21 suggests that other large investors or the same entities reinvested, possibly indicating a brief profit-taking period followed by renewed accumulation. The significant net outflow of -2,183 BTC in the transfers above $10 million on May 20 contrasts sharply with the substantial inflow of 6,604 BTC on May 21. This dramatic shift highlights strategic repositioning by very large investors, who initially sold into the price peak but quickly moved back into the market, possibly signaling long-term bullish sentiment or the use of sophisticated trading strategies to maximize profits.

The market’s reactions to these flows are evident in the intraday spot buying and selling volumes. On May 15, the spot buying volume was 69,519 BTC, decreasing to 21,585 BTC on May 18. A significant increase occurred on May 20, with the spot buying volume peaking at 72,971 BTC before slightly decreasing to 61,119 BTC on May 21.

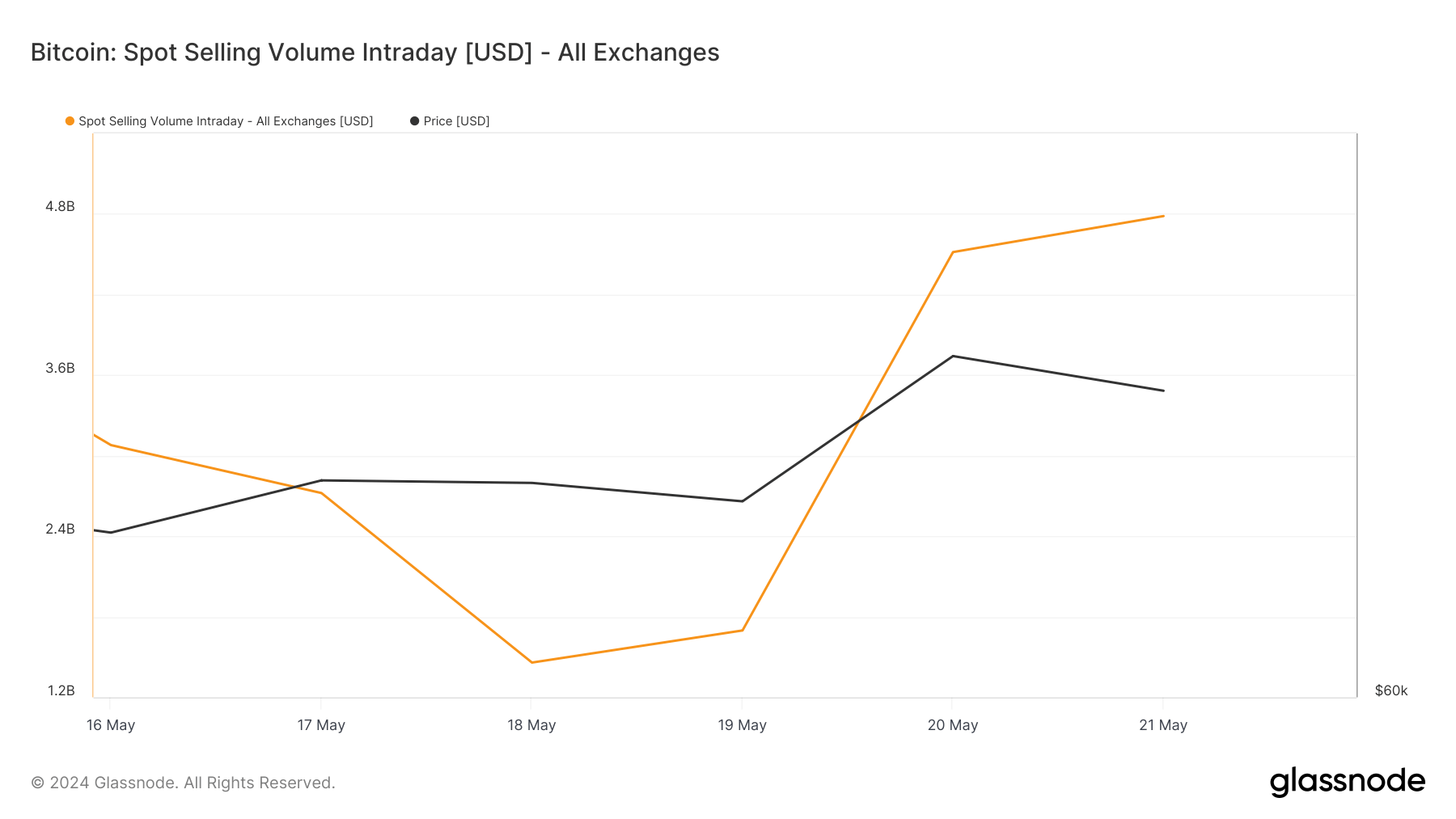

Spot selling volumes decreased from just over $4 billion on May 15 to $1.458 billion on May 18. By May 20, the spot selling volume increased significantly to $4.516 billion and further to $4.784 billion on May 21. While the increased spot buying volume reflects a rise in bullish sentiment, the corresponding high selling volumes show that a considerable part of the market capitalized on the price increase.

Glassnode’s data shows the market is tense and ready to react quickly to minor changes in Bitcoin’s price. While this reaction is typical for the derivatives market, we’ve also begun seeing a similarly aggressive response in the spot market. The swift reentrance to the market from large holders shows it only takes a little upward volatility to reignite the belief in Bitcoin’s potential. Retail investors’ cautious accumulation points to a gradual build-up of confidence, potentially setting the stage for more sustained price movements in the future.

The post Bitcoin’s surge above $70k sparked exchange inflows appeared first on CryptoSlate.