Quick Take

Semler Scientific (NASDAQ: SMLR), a leading developer and marketer of technology products and services for combating chronic diseases, has unveiled the purchase of 581 Bitcoins for a total of $40 million, including fees and expenses. This bold decision emphasizes Semler Scientific’s confidence in Bitcoin as a reliable store of value and an attractive investment opportunity.

Eric Semler, Chairman of Semler Scientific, articulated the company’s new direction:

“Our bitcoin treasury strategy and purchase of bitcoin underscore our belief that bitcoin is a reliable store of value and a compelling investment.”

Semler also alluded to Bitcoin being an inflation hedge and safe haven asset and compared Bitcoin to gold:

“We believe it has unique characteristics as a scarce and finite asset that can serve as a reasonable inflation hedge and safe haven amid global instability. We also believe its digital, architectural resilience makes it preferable to gold, which has a market value of approximately 10 times that of bitcoin. Given the gap in value between gold and bitcoin, we believe that bitcoin has the potential to generate outsize returns as it gains increasing acceptance as digital gold”.

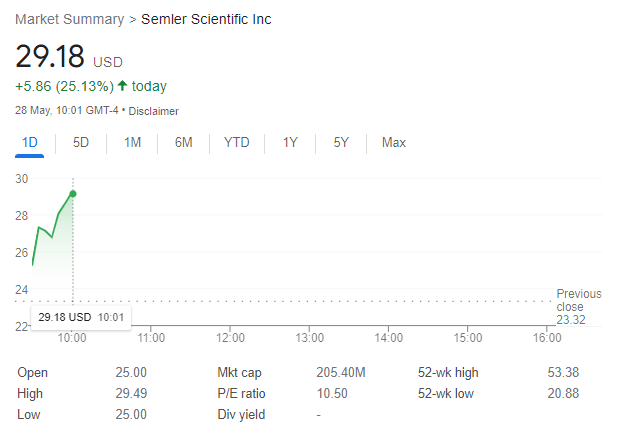

Semler Scientific’s share price is up 25% on the announcement, with a market cap of roughly $205 million.

The post Semler Scientific embraces Bitcoin treasury strategy, shares surge 25% appeared first on CryptoSlate.