Bitcoin (BTC), the largest cryptocurrency in the market, recently touched the crucial $70,000 level, proving to be a significant hurdle for its price consolidation in recent months.

Despite surpassing its previous high and reaching a record all-time high (ATH) of $73,700 in March, BTC experienced a 20% price correction to around $56,500 at the beginning of May. However, this correction marked the start of a renewed bullish momentum, with BTC currently trading at approximately $69,300.

While Bitcoin’s price has seen some volatility and a lack of sustained bullish action, venture capitalist and market expert Chamath Palihapitiya has provided optimistic predictions for the cryptocurrency’s future.

Bitcoin Price And Halving Analysis

In a recent episode of the All In Podcast, Palihapitiya analyzed BTC’s historical patterns about the Halving event, which occurs approximately every four years and reduces the block reward given to miners.

The venture capitalist noted that after a Halving, investors typically spend the first three months reassessing the price and the overall market situation. However, significant price appreciation has historically occurred within six to 18 months.

To support his analysis, Palihapitiya referred to the previous Halving events. For further context, the first Halving took place on November 28, 2012, reducing the block reward from 50 BTC to 25 BTC. At the time of the Halving, Bitcoin was priced at $13, and within a year, it peaked at $1,152.

The second Halving occurred on July 16, 2016, reducing the block reward to 12.5 BTC. Bitcoin’s price at that time was $664, and within a year, it peaked at $17,760.

The most recent Halving occurred on May 11, 2020, reducing the block reward to 6.25 BTC. During that halving, Bitcoin was priced at $9,734, and within a year, it reached an all-time high of $69,000.

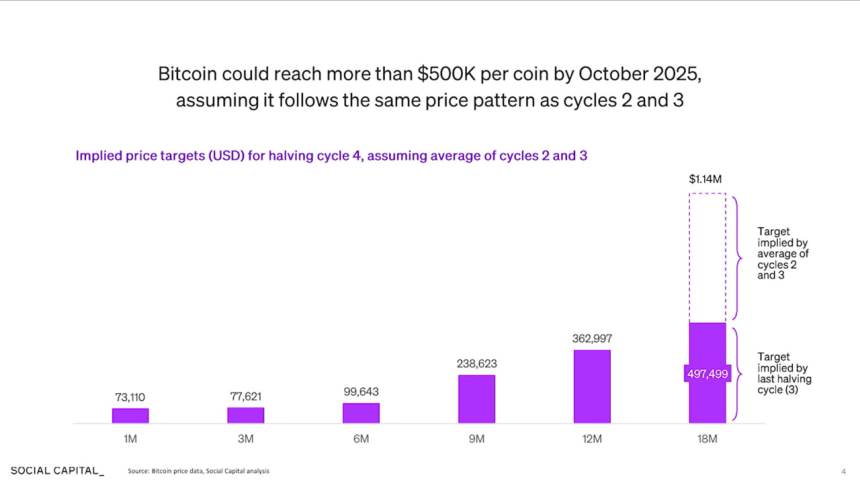

Based on these historical patterns and applying the average increases from previous Halvings, Palihapitiya suggests that if Bitcoin continues to follow its performance from the last market cycle, it could skyrocket to around $500,000 by October 2025, as seen in the chart above.

Notably, the expert believes that as Bitcoin’s value appreciates to such levels, it has the potential to replace gold and serve as a transactional utility for hard assets. This scenario, combined with concerns about the debasement of fiat currencies, presents intriguing opportunities for Bitcoin’s future.

Increased Demand For BTC?

Palihapitiya further argued during the interview that as more countries adopt a dual-currency approach, with Bitcoin being recognized as a valuable asset alongside their local currency, the demand for Bitcoin will increase.

This shift would only occur as people recognize the need for Bitcoin in daily transactions for goods and services and as a store of value for permanent assets.

Overall, Palihapitiya’s analysis of Bitcoin’s historical patterns following the Halving events provides an optimistic outlook for the cryptocurrency’s price.

The potential for Bitcoin to reach $500,000 by October 2025 and its growing recognition as a dual-currency asset alongside fiat currencies offers renewed prospects for investors and the broader cryptocurrency market.

Featured image from DALL-E, chart from TradingView.com