The Bitcoin market has witnessed significant shifts recently, influenced by macroeconomic factors and changing investor sentiments. Last week, digital asset investment products saw substantial outflows, which CoinShares attributed to several key economic updates.

These included the release of US CPI data, the Federal Open Market Committee (FOMC) meeting, and Producer Price Index (PPI) figures. These events seemed to spark a rapid surge in Bitcoin price, pushing it briefly towards the $70,000 mark before a swift downturn adjusted the valuation back to around $65,000.

Market Shifts: BTC Faces Major Outflows While Some Altcoins Attract Investment

So far, this fluctuation in Bitcoin’s price is part of a broader pattern of volatility that has characterized the digital currency market. Just last week alone, institutional and retail investors pulled back approximately $600 million from crypto funds, marking a significant retreat.

CoinShares suggests that this could signal a growing trend of caution, amplified by a “hawkish stance” at the recent FOMC meeting, which may have encouraged investors to reduce their exposure to volatile assets like cryptocurrencies.

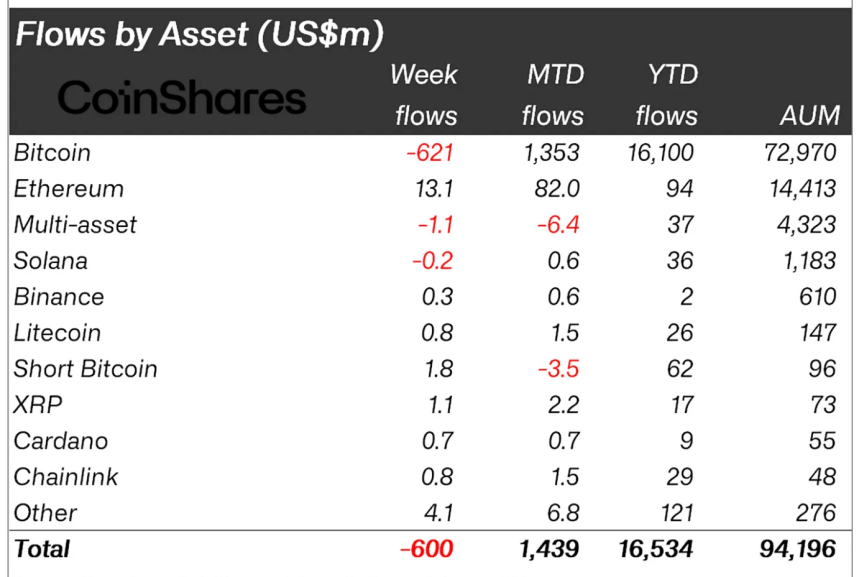

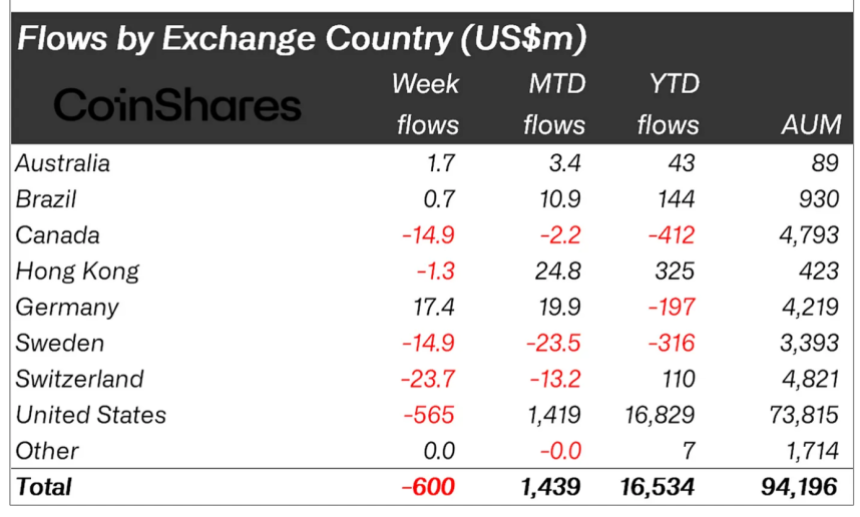

Bitcoin, notably the most impacted, faced outflows totaling $621 million. Despite this, there was a silver lining as altcoins like Ethereum, Litecoin, and others saw minor inflows. Ethereum led with a $13 million increase, suggesting divergent investor confidence in altcoins compared to Bitcoin.

This scenario presents a mixed view where Bitcoin struggles under selling pressure while select altcoins gain marginal traction. Meanwhile, the overall impact on the market has been palpable, with total assets under management dropping from over $100 billion to $94 billion within a week.

Trading volumes also dipped significantly from their annual average, indicating a cautious approach by traders across the board. Regionally, while the US experienced the brunt of the outflows, countries like Germany saw inflows, suggesting a varied global response to the current economic climate.

Bitcoin ETFs See Mixed Fortunes

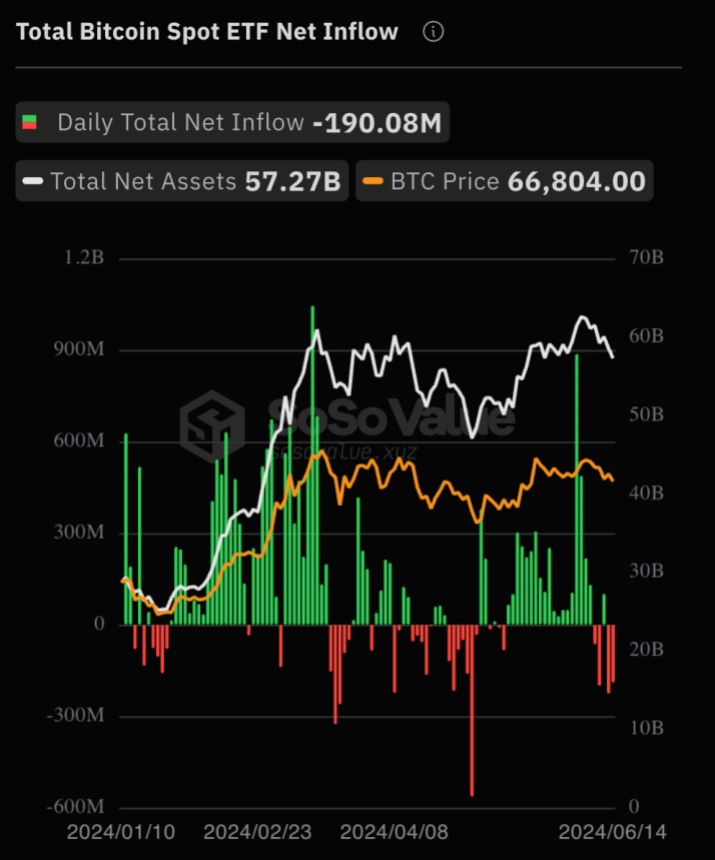

Despite a steady increase in the overall net inflows into US spot Bitcoin exchange-traded funds (ETFs), which reached $15.11 billion in recent weeks, the sector experienced a downturn last week with a net outflow of $190 million per day, based on data from SoSoValue.

In terms of market performance, Bitcoin’s value sharply declined, hitting a low of $65,398 last Friday. However, as of today, Bitcoin’s price has slightly recovered to $65,552, though it still shows a decline of 1.1% in the past day and 5.5% over the week.

Speaking on Bitcoin spot ETFs, BlackRock’s Chief Investment Officer, Samara Cohen, has observed a gradual but steady interest in them despite their slower-than-expected uptake.

According to Cohen, currently, the majority of Bitcoin ETF transactions, approximately 80%, are conducted by “self-directed investors” using online brokerage platforms.

Cohen added that the iShares Bitcoin Trust (IBIT) is one of the ETFs launched this year, attracting attention from individual investors and hedge funds and brokerages, as indicated in the recent 13-F filings.

However, participation from registered investment advisors remains comparatively low, Cohen discussed during the recent Crypto Summit.

Featured image created with DALL-E, Chart from TradingView