Ethereum is the home of decentralized finance (DeFi), looking at the over $100 billion in total value locked (TVL). Even though the figure fluctuates, mainly depending on the performance of ETH, it is clear that DeFi has proven revolutionary, opening up new use cases spanning multiple sectors, including finance and insurance.

Are Ethereum DeFi Protocols Undervalued?

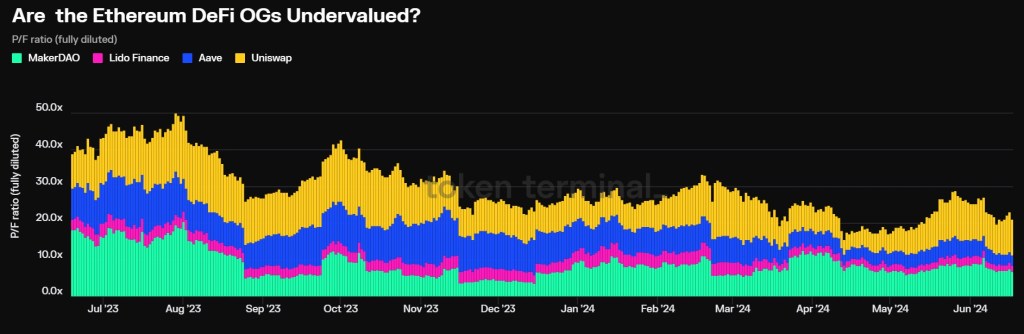

Taking to X, one analyst is now convinced that a group of established DeFi protocols on Ethereum, including Uniswap and Aave, are highly likely to be grossly undervalued.

To put it in context, DeFiLlama data shows that Uniswap, a decentralized exchange, Aave–a decentralized money market, and Lido Finance–a liquidity staking platform, are among the largest by TVL.

The analyst noted that these protocols’ price-to-fees ratio, a metric used to gauge financial health, is unusually high and way better than top traditional finance platforms listed on bourses across the United States.

Of the identified, Uniswap has a price-to-fees ratio of 9.6x from the $807 million in fees collected over the past year. However, according to LinkedIn data, the DEX employs roughly 137 people.

Meanwhile, Maker, a lending and borrowing platform and the issuer of the algorithmic stablecoin DAI, has a price-to-fee ratio of 6.9X. The protocol generated $252 million in fees last year from a team of roughly 100 employees.

The same trend can be seen in Aave and Lido, where their price-to-fees ratio stood at 2.8X and 1.5X, respectively, though their team remains relatively small.

To understand the potential undervaluation of DeFi protocols, the analyst then compared these price-to-fee ratios with TradFi giants. The AI giant Nvidia has a price-to-sales ratio of 40X–higher than Uniswap’s.

However, the Wall Street giant employs a larger workforce of approximately 32,000. The same trend can be seen in Robinhood. Though the brokerage has a price-to-sale ratio of 9.8X, it generated $2 billion in revenue but with a larger workforce of over 3,300 employees.

Potential For Growth, Regulatory Clarity, And Continuous Scaling

Though Nvidia could have a higher ratio than Uniswap, DeFi protocols are inherently more scalable than traditional financial institutions. Accordingly, as Ethereum finds regulatory clarity, it will likely continue to rake in more fees and scale to serve new vectors.

Besides the regulatory clarity that comes with the United States Securities and Exchange Commission (SEC) approving a spot Ethereum exchange-traded fund (ETF) and deciding to stop their investigation into Ethereum 2.0, the broader Ethereum ecosystem is scaling.

According to on-chain data, the mainnet, layer-2, and layer-3 solutions process around 300 transactions per second (TPS).