Quick Take

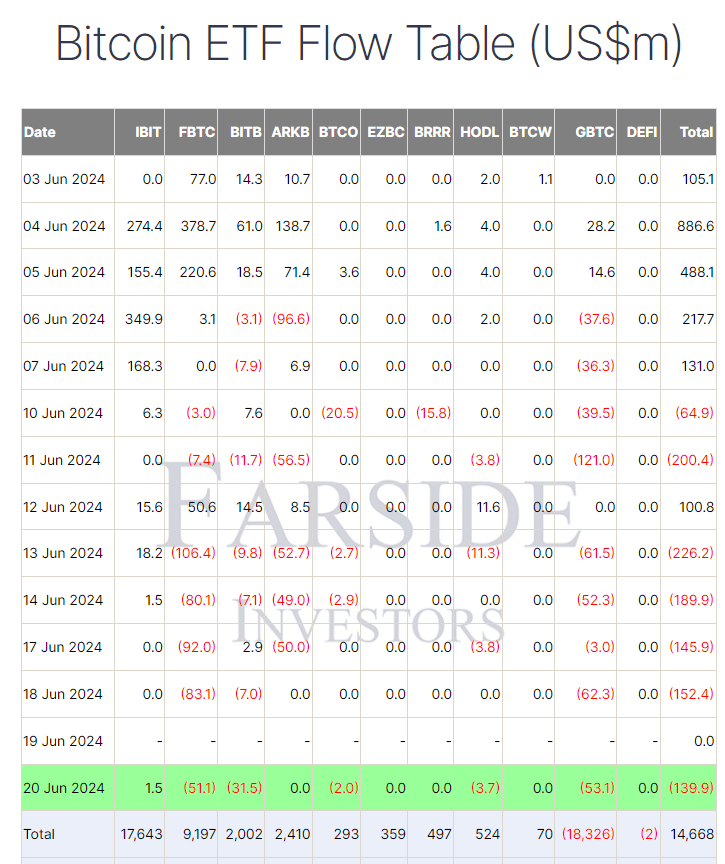

Farside data shows that on June 20, Bitcoin (BTC) exchange-traded funds (ETFs) experienced a net outflow of $139.9 million, marking the fifth consecutive day of outflows and the seventh outflow in eight trading days. Among the ETF issuers, BlackRock’s IBIT stood out as the only fund to record an inflow, albeit a modest $1.5 million, pushing their total net inflow to $17.6 billion.

Conversely, five other ETF issuers reported outflows. Grayscale’s GBTC led the outflow trend with $53.1 million, bringing its total outflow to $18.3 billion. Fidelity’s FBTC followed closely with a $51.1 million outflow, reducing its total net inflow to $9.2 billion. Bitwise’s BITB also saw a notable outflow of $31.5 million, lowering its total inflow to $2.0 billion. Despite these significant outflows, the total net inflows to Bitcoin ETFs remain substantial at $14.7 billion, according to Farside data.

The post Fifth consecutive trading day of Bitcoin ETF outflows totals $139.9 million appeared first on CryptoSlate.