Data shows the Bitcoin futures-to-spot trading volume ratio has decreased by 63% since the peak of the last bull market. Here’s what it means.

Bitcoin Futures Market Occupying Lower Volume Share This Rally

As explained by CryptoQuant founder and CEO Ki Young Ju in a new post on X, the BTC market has appeared to be less futures-driven than it was during the previous bull run.

The metric of interest here is the “futures-to-spot trading volume ratio,” which, as its name suggests, keeps track of the ratio between the Bitcoin futures and spot trading volumes.

The trading volume naturally refers to a measure of the total amount of cryptocurrency getting involved in trades on the various exchanges in the sector.

When the ratio value is high, the futures market observes more trading volume than the spot. Similarly, low values imply the dominance of spot trading in the sector.

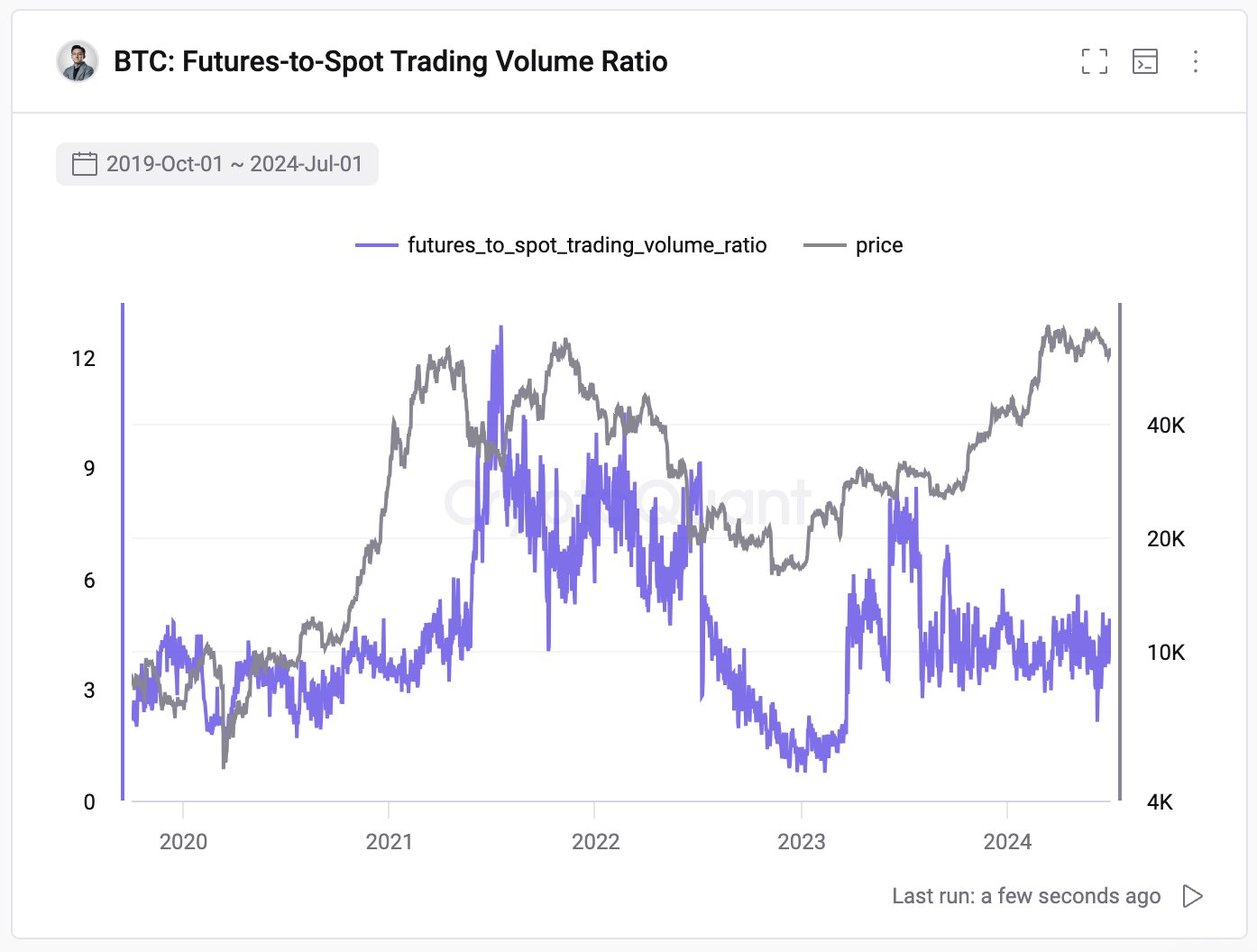

Now, here is a chart that shows the trend in the Bitcoin futures-to-spot trading volume ratio over the last few years:

The above graph shows that the Bitcoin futures-to-spot trading volume ratio surged to pretty high levels during the 2021 bull run. More specifically, the indicator had broken above the 12 mark during its peak, implying futures volume had outweighed spot trades by more than twelve times.

Following this top, the metric had cooled down during the second half of the 2021 bull run, but it remained at high levels. These high levels then continued into the first half of 2022.

As the bear market lows had approached, though, the metric had plunged, as interest in speculative activity around the cryptocurrency had died off. With the 2023 recovery run, the indicator saw some revival and touched the same levels as in the first half of 2022 during June.

Since then, though, the ratio has slumped back to relatively low levels and has continued to consolidate around them thus far. Compared to the 2021 peak, the indicator’s value is down around 63%.

Futures trading volume is still the dominant force in the market, but it’s much less so than in the 2021 bull run, implying that speculative interest has been relatively cool in the rally. The CryptoQuant founder believes this development towards higher spot trading volume to be good for the market.

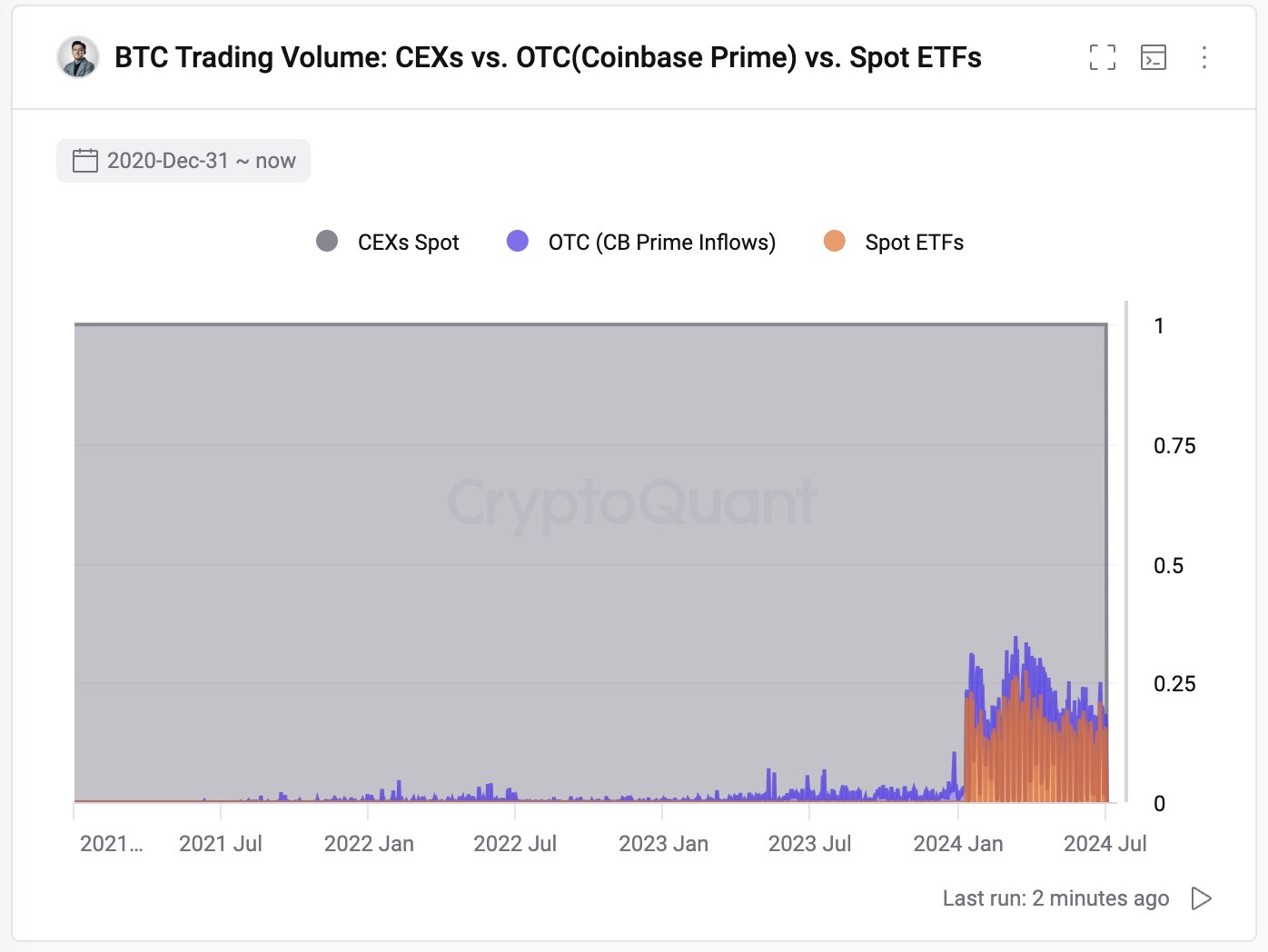

In this latest cycle, though, there is also something different: the emergence of a new way to trade Bitcoin: spot exchange-traded funds (ETFs). So, how does the volume of these financial instruments compare against the spot market?

As Ju pointed out in another X post, these ETFs currently make up for almost a quarter of the total spot trading volume.

BTC Price

Bitcoin has suffered from a plunge of more than 4% in the past 24 hours, which has taken its price to $57,300.

![[VIDEO] Unicorn Hunters TV Show launch centralized asset-backed token Unicoin paying dividends](https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2022/03/moe-vella-internview.jpg&w=600&h=315&q=75)