Bitcoin is stable when writing, in an uptrend, and technically around all-time highs, looking at how prices have evolved over the past five years. Despite the recent contraction forcing the world’s most valuable coin to spot rates, exciting trends are developing, pointing to confidence, especially among whales.

Whales Rapidly Accumulating Bitcoin

According to the IntoTheBlock data on July 19, whales are doubling down. As data shows, the number of addresses holding at least 1,000 BTC are rapidly buying, scooping more coins and pushing the figure to a two-year high. This swell in buying pressure means that whales, mainly comprising institutions and deep-pocketed investors, are confident of Bitcoin’s long-term prospects.

Interestingly, as whales accumulate, spot Bitcoin ETF issuers in the United States are not giving up. After the contraction in June through early July, when prices contracted, these issuers have been scooping up more coins as directed by their clients.

According to SosoValue, BlackRock is the largest spot ETF issuer with over $20 billion of BTC under management. On July 19, the asset manager bought over $102 million of the coin.

As prices rise above $60,000, the demand for BTC from institutions will only increase, funneling even more capital to spot Bitcoin ETF issuers and lifting prices.

Why Is Retail Demand So Low Despite Trump’s Crypto Support?

Bitcoin could also edge higher because of politics. In the highly charged political campaign in the United States, Donald Trump seems to have a lead over the incumbent. Trump, who has changed his stance on crypto and has even accepted Bitcoin donations, plans to make the United States a hub of crypto mining. Moreover, rumors abound that the administration should consider making Bitcoin a strategic asset if the former president takes over. If this is the case, there will be a network effect, and every other country will want to follow the United States in holding BTC.

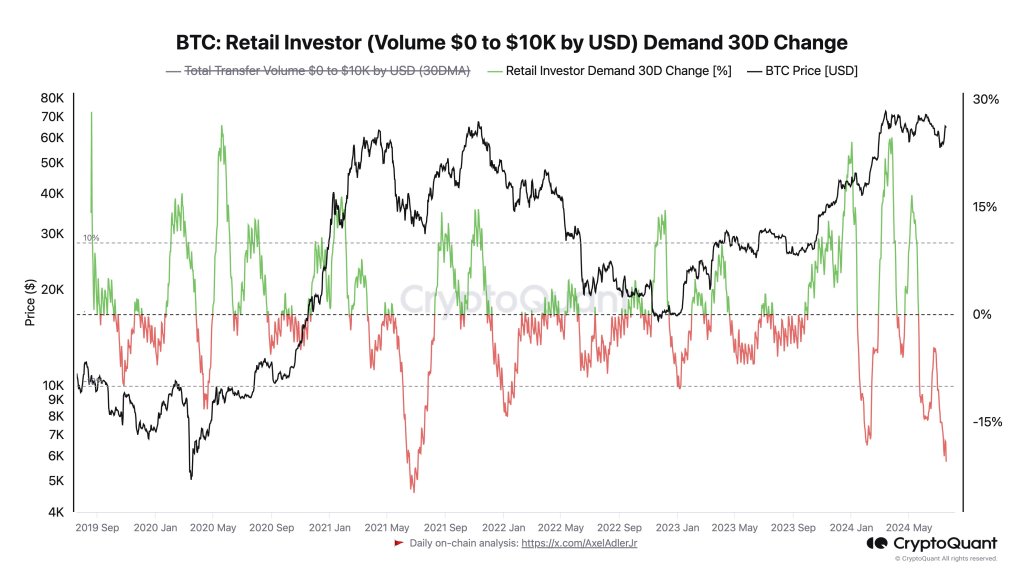

Nonetheless, amid the optimism, one analyst observes that retail demand for Bitcoin is at a three-year low. Historically, major crypto bull runs have preceded a sharp uptick in retailer buying activity.

That their action is muted could be a concern. However, it could also mean that the market dynamics have changed, and institutions are in the driving seat.