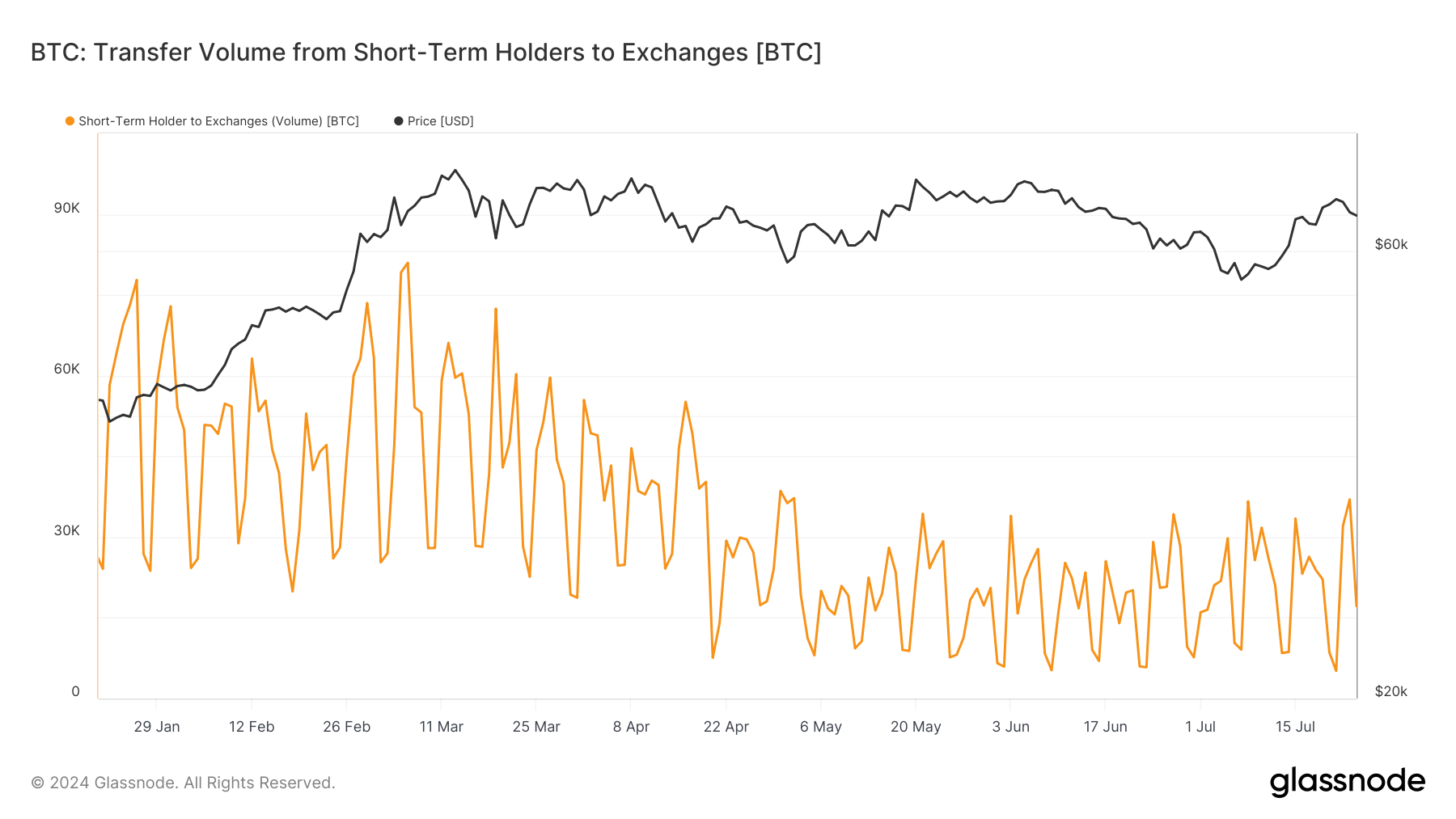

The overall volume of short-term Bitcoin holders transferring funds to exchanges peaked on Ethereum ETF launch day, July 23, at the highest level since May.

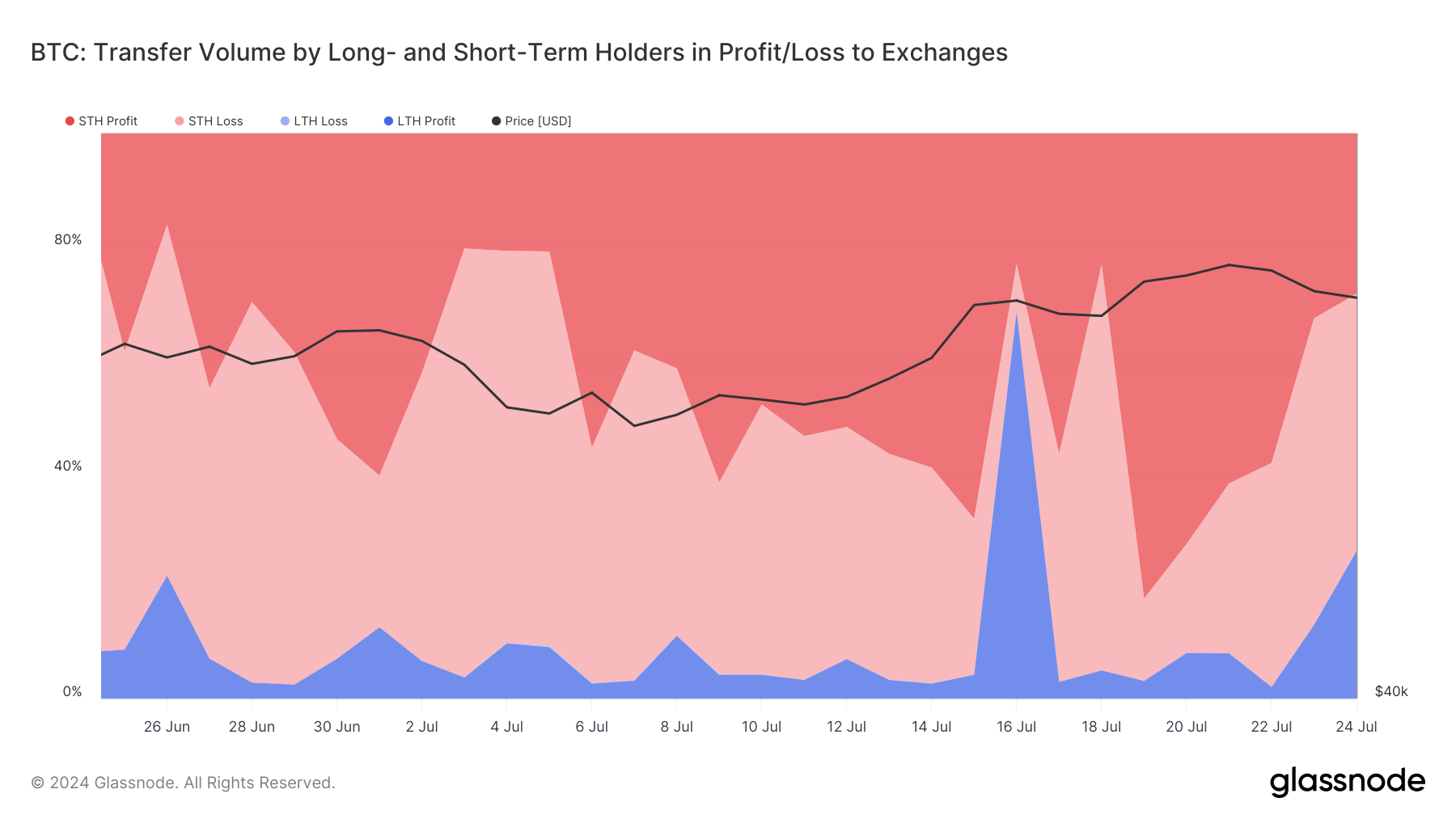

Overall, Bitcoin transfer volumes for both long-term and short-term holders to exchanges showed short-term holders in loss represented a significant portion of transfer activity at 54%, and short-term holders in profit constituted 32%.

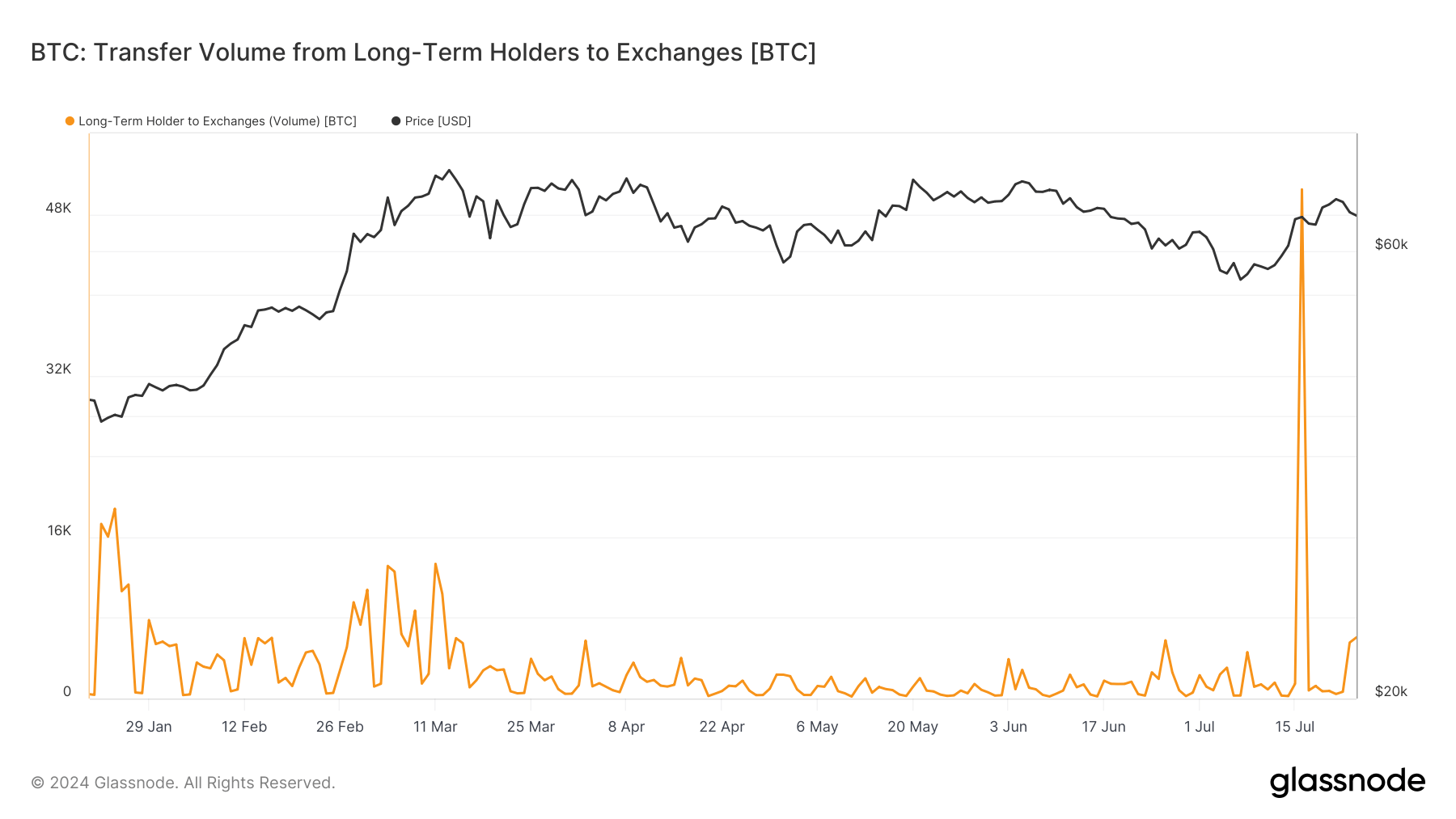

Conversely, long-term holders exhibited a more cautious stance at just 13%. Their transfer volume remained low and stable, suggesting a reluctance to sell despite unknown market conditions.

Throughout Bitcoin’s history, short-term holders consistently show more active trading behavior and higher transfer activity than long-term holders. July 24 saw a small 6,000 BTC spike compared to the rest of 2024

This data points to exhibiting short-term profit-taking strategies and cautious long-term investment behavior.

The post Short-term Bitcoin holder transfers to exchanges peak on Ethereum ETF launch day appeared first on CryptoSlate.