Onchain Highlights

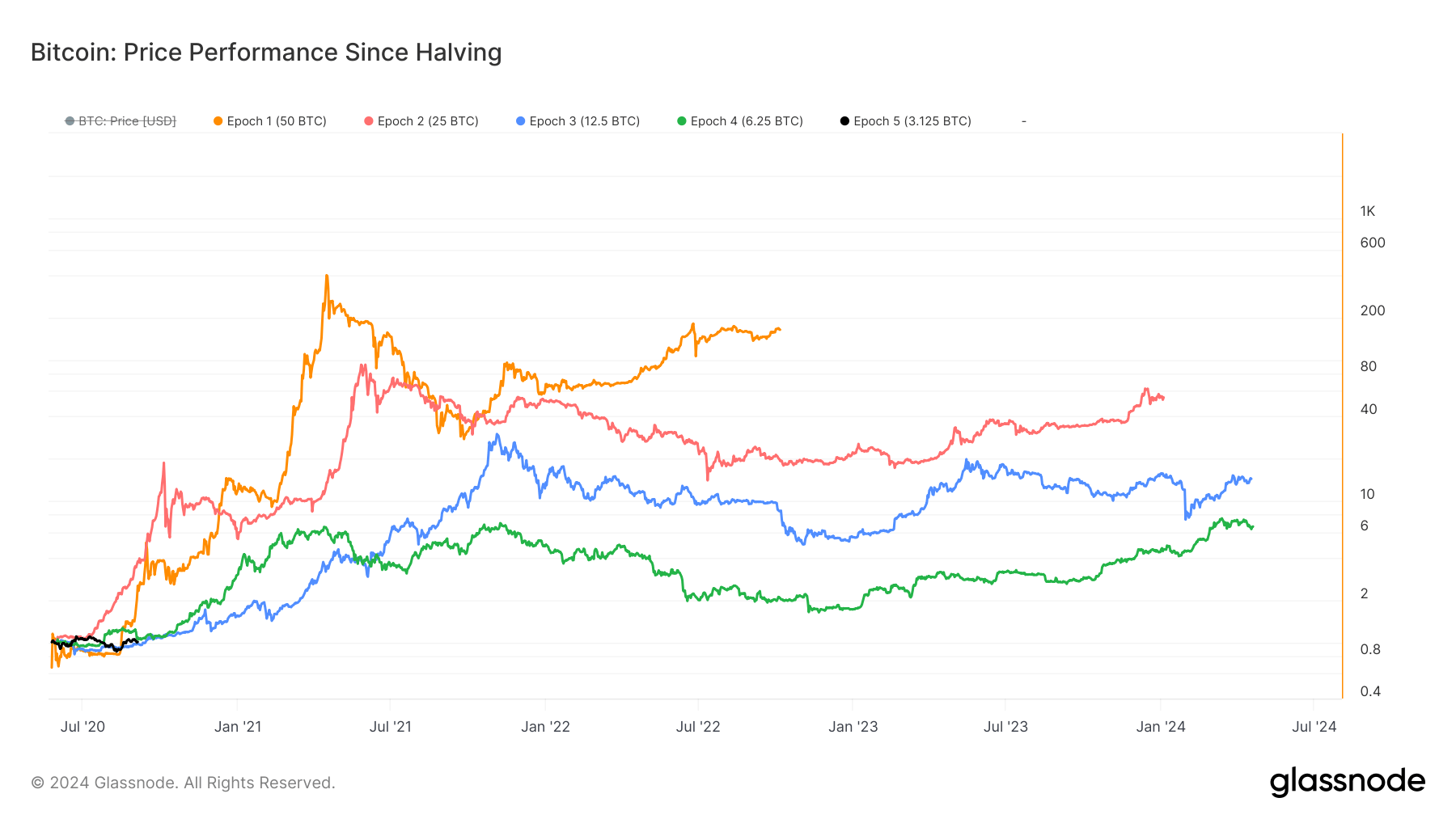

DEFINITION: Bitcoin price performance since the halving against previous cycles.

Bitcoin’s price performance since the most recent halving in April has followed a distinct trajectory compared to previous halving events. Observing the historical price patterns, each halving epoch demonstrates unique price movements, reflecting varying market dynamics and investor sentiments.

The first halving epoch (50 BTC reward) shows a sharp and sustained price increase, peaking at an extraordinary level, suggesting high early adoption and enthusiasm. The second epoch (25 BTC reward) exhibits a similarly strong upward trend, albeit with more pronounced volatility, reflecting increasing market maturity and speculative activity.

In contrast, the third epoch (12.5 BTC reward) presents a more tempered rise, indicating a shift toward a more stabilized growth pattern as the market adjusted to reduced mining rewards and broader participation. The fourth epoch (6.25 BTC reward) reveals relatively lower volatility and a more steady price increase, highlighting a more mature market with diverse institutional and retail participation.

The current fifth epoch (3.125 BTC reward) reflects these cumulative effects, displaying moderate growth and stability. This suggests that Bitcoin’s market dynamics have evolved with increased regulatory scrutiny, institutional adoption, and macroeconomic factors influencing its price trajectory.

The current Epoch 5 is tied with Epoch 3 as the worst-performing cycle at this stage since the halving. If Epoch 5 follows the same pattern as Epoch 3, the peak of this cycle would likely occur around the fourth quarter of 2025.

The post Bitcoin’s price evolution post-halving: Examining five distinct epochs appeared first on CryptoSlate.