On-chain data shows Bitcoin HODLers are still able to sell at a profit while the weak hands are going through a major capitulation event.

Bitcoin Diamond Hands Still Comfortably Selling At A Profit

As pointed out by CryptoQuant Head of Research Julio Moreno in a new post on X, the BTC short-term holders have capitulated during this latest downturn in the market.

The “short-term holders” (STHs) make up for one of the two main divisions of the Bitcoin userbase done on the basis of holding time, with the other group being called the “long-term holders” (LTHs).

The cutoff between the two groups is 155 days, with investors who have been holding since less than this time falling into the STHs and those with more qualifying as LTHs.

Statistically, the longer an investor holds onto their coins, the less likely they become to sell or transfer them at any point. As such, the STHs represent the weak-minded side of the market, while the LTHs include the HODLers.

During the latest crash, both of these cohorts have shown a reaction, but this reaction has been very different between the two. To showcase this difference, Moreno has made use of the “Spent Output Profit Ratio” (SOPR) indicator.

The SOPR basically tells us about whether a given group is selling Bitcoin at a profit or loss right now. The metric being above 1 implies members of the group are realizing profits, while it being under suggests loss-taking is the dominant mode of selling.

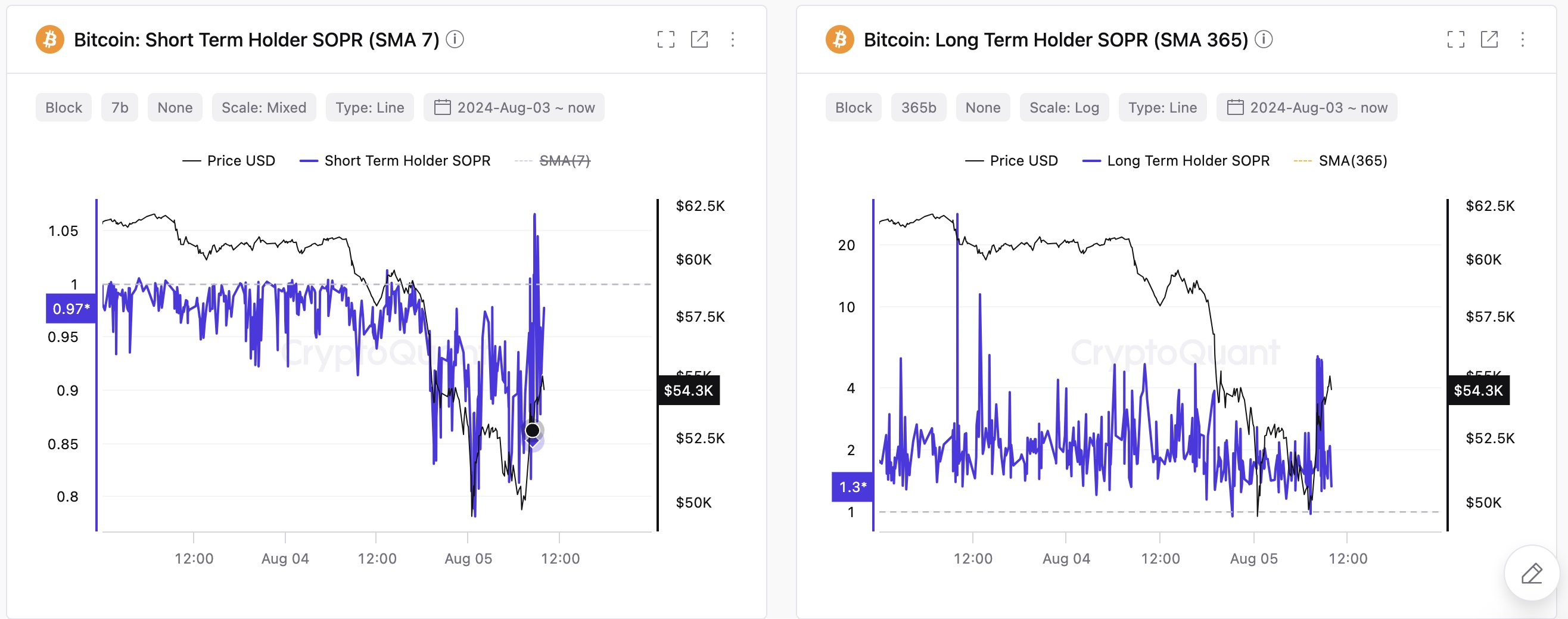

Now, here is a chart that shows the recent trend in the Bitcoin SOPR for the STH and LTH cohorts:

As displayed in the graph, the Bitcoin STH SOPR has been mostly at levels under 1 during the latest drawdown in the price, implying that these investors have been selling at a loss.

At its worst, the indicator had even fallen under the 0.8 mark, suggesting that the cohort had been taking a loss of more than 20%. Clearly, these fickle-minded hands were thrown into quite a panic by the crash.

While the STHs have been capitulating, the LTHs are still participating in net profit-taking, as the SOPR for them has remained strong above the 1 level. The indicator even reached a notable level during the rebound BTC saw following its lows, suggesting that these diamond hands had sold for significant gains.

Some STHs, too, had managed to take profits in this recovery, but as is visible in the chart, the metric had only slightly breached the 1 mark and that too just briefly, meaning that the profit realization hadn’t been anything significant and had lasted for only a moment.

BTC Price

At the time of writing, Bitcoin is trading at around $55,000, down more than 17% over the past week.