Onchain Highlights

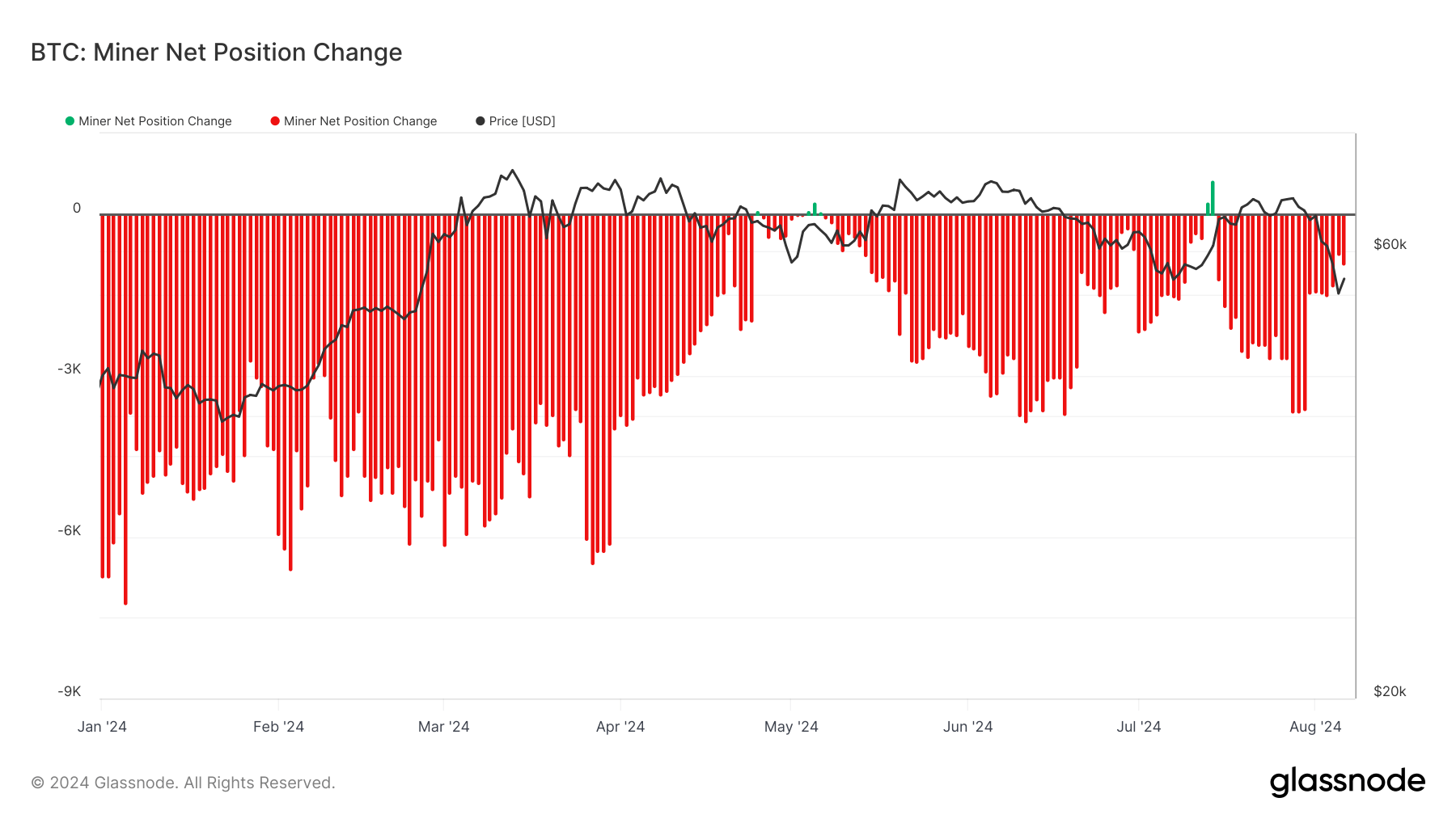

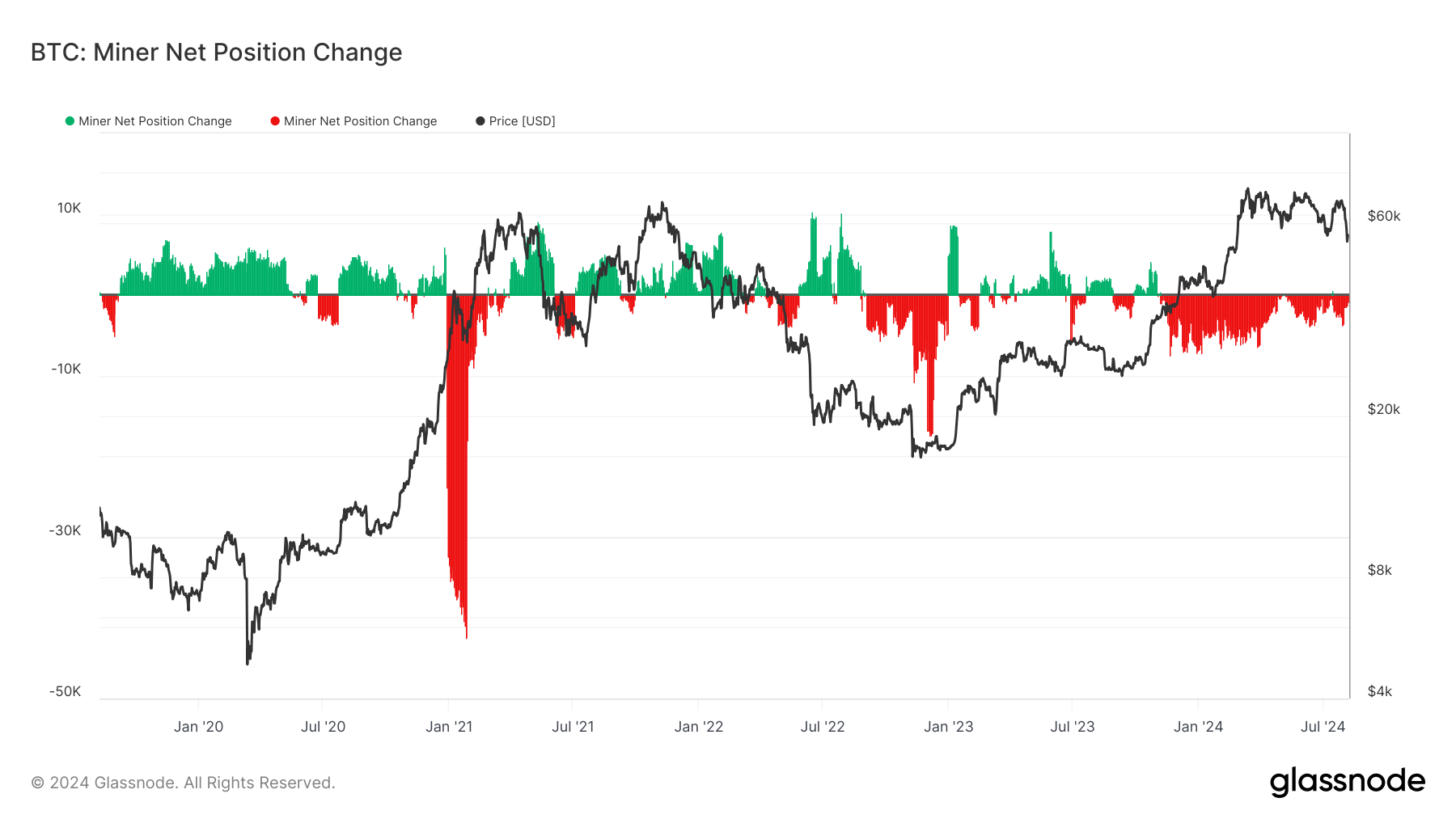

DEFINITION: The 30d change of the supply held in miner addresses.

Bitcoin miner net position change reveals continuous net selling in 2024. Analyzing the data from Glassnode, the miner net position has predominantly shown red bars, indicating a persistent trend of miners offloading their holdings. However, selling has started to decline since April.

Selling pressure has been a key factor influencing Bitcoin’s price, which has oscillated around $50,000- $70,000 since the April 2024 halving. This ongoing trend is in stark contrast to the past five years, when periods of net accumulation often coincided with price rallies, such as the significant buildup observed during the 2020-2021 bull run.

The consistent selling by miners in 2024 spotlights a possible reaction to increased prices ahead of the halving followed by post-halving market conditions, where reduced block rewards may compel miners to liquidate portions of their reserves to cover operational costs. This ongoing trend is critical for market participants to monitor, as it could signal continued downward pressure on Bitcoin’s price if the selling persists.

The post Bitcoin miner sell-off trend continues post-2024 halving appeared first on CryptoSlate.