Quick Take

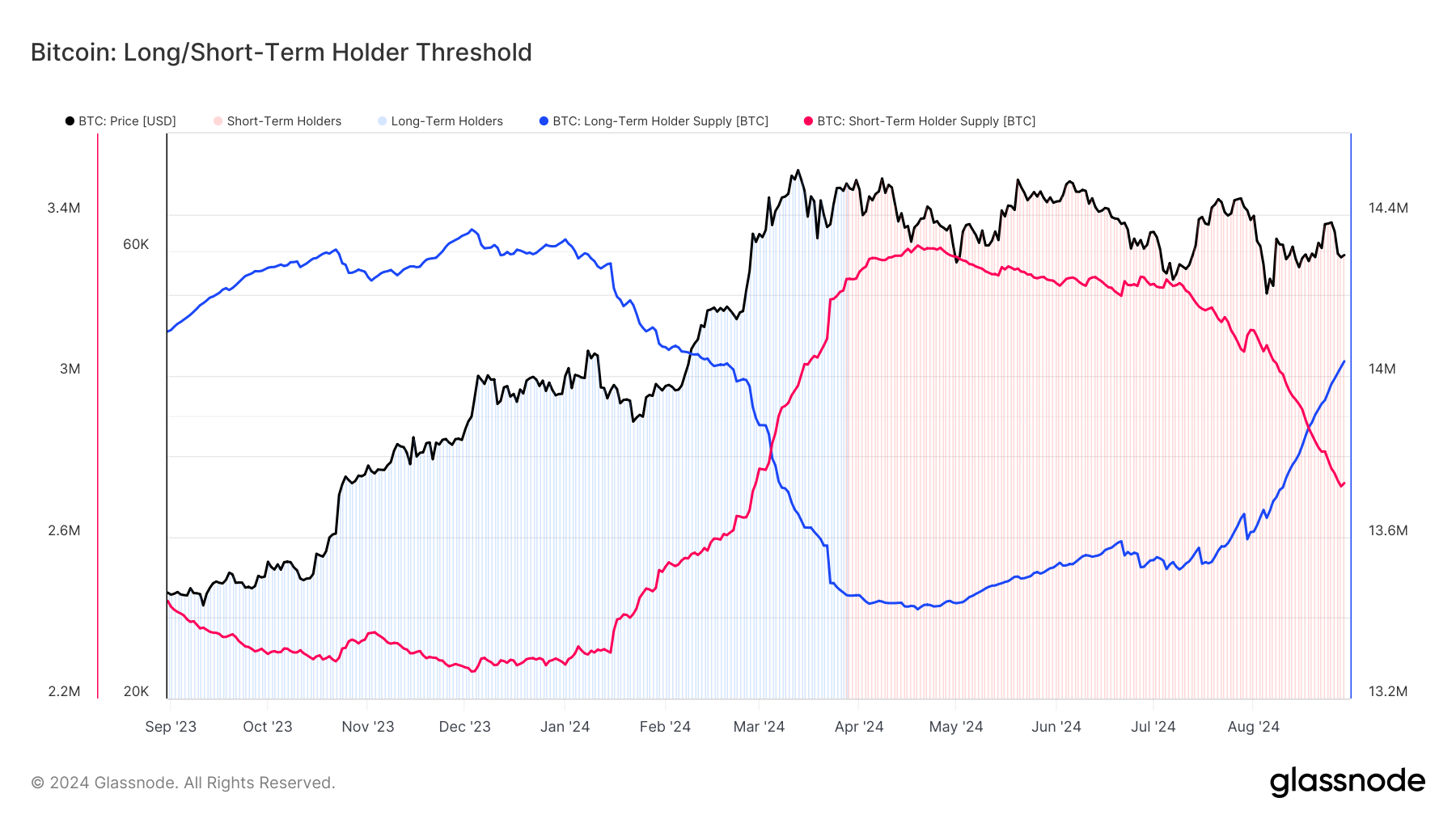

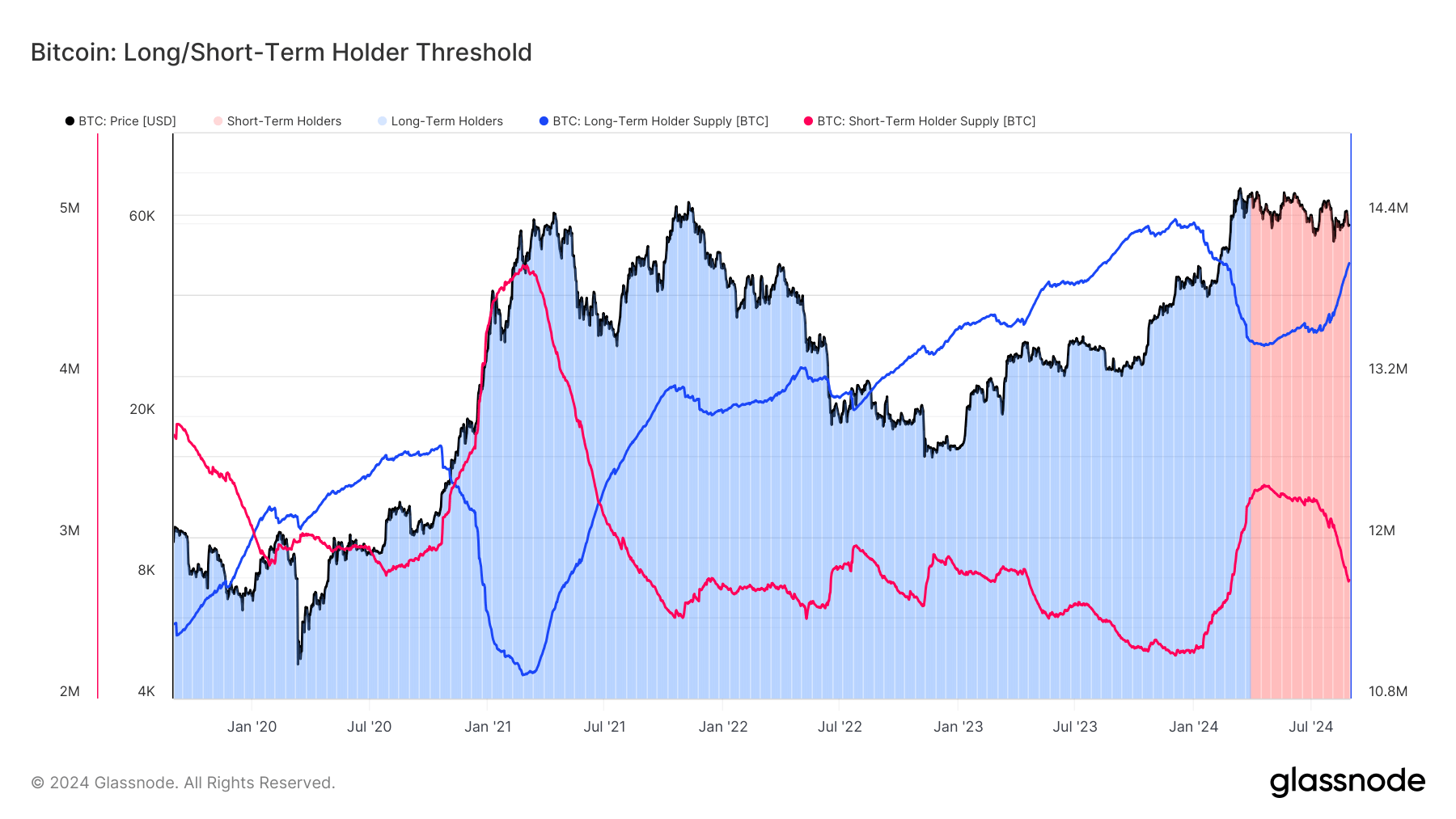

Recent data from Glassnode reveals significant insights into the behavior of Bitcoin holders, particularly those classified as long-term holders (LTHs) and short-term holders (STHs). LTHs, defined as investors who have held Bitcoin for more than 155 days, now control over 14 million BTC, which accounts for 71% of the circulating supply.

This milestone indicates that this surge in holders acquired their Bitcoin at or before the all-time high (ATH) of $73,000, reached on March 13. Despite market fluctuations, this group has largely maintained its position, with just a drop of 300k BTC, and is holding on to its investments.

However, it’s noteworthy that the LTH supply decreased by approximately 1 million BTC at the start of 2024. This drop was attributed to LTHs who purchased Bitcoin for around $25,000 in 2023 and have since taken profits during the bull run into March.

On the other hand, STHs, those holding Bitcoin for less than 155 days, currently hold about 2.7 million BTC, down from 3.3 million BTC at the market peak in March. This 600,000 BTC reduction reflects the impact of Bitcoin’s downward volatility. For Bitcoin to stabilize and prevent further declines, an increase in STH supply would be a crucial indicator of renewed buying interest among short-term investors.

The post Long-term holders currently possess more than 14 million BTC appeared first on CryptoSlate.