Network activity on the Bitcoin (BTC) blockchain seems to have stalled while it is dwindling on Ethereum (ETH), a report by Citi says.

Network Activity Lukewarm On Bitcoin And Ethereum

One of the key metrics used to ascertain user interest in a blockchain project is the measurement of its network activity. High network activity – unless propped up by trading bots – typically signals more users are transacting on the underlying blockchain network, enabling block miners to earn more rewards for confirming transactions. However, the vice-versa doesn’t paint as encouraging a picture.

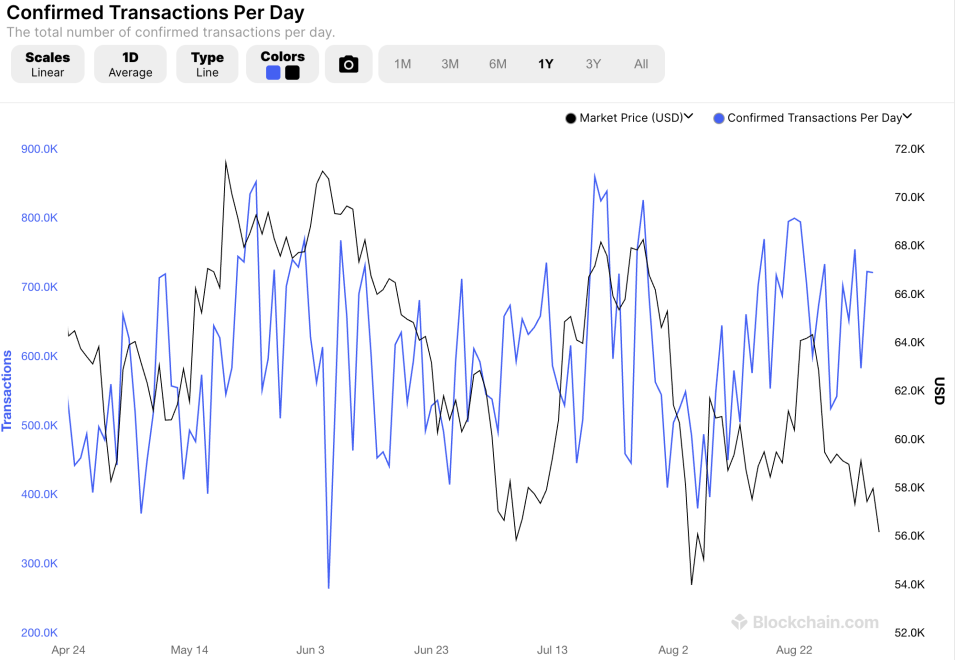

According to a report by Citi, the activity of the Bitcoin network seems to have stalled. Data from blockchain.com confirms Citi’s assessment. From the chart presented below, we can see that the number of confirmed transactions per day on the Bitcoin network seems to be oscillating in a range since April 2024.

At the same time, BTC prices have steadily been trending downwards, making lower highs after each rebound from range lows of around $56,000.

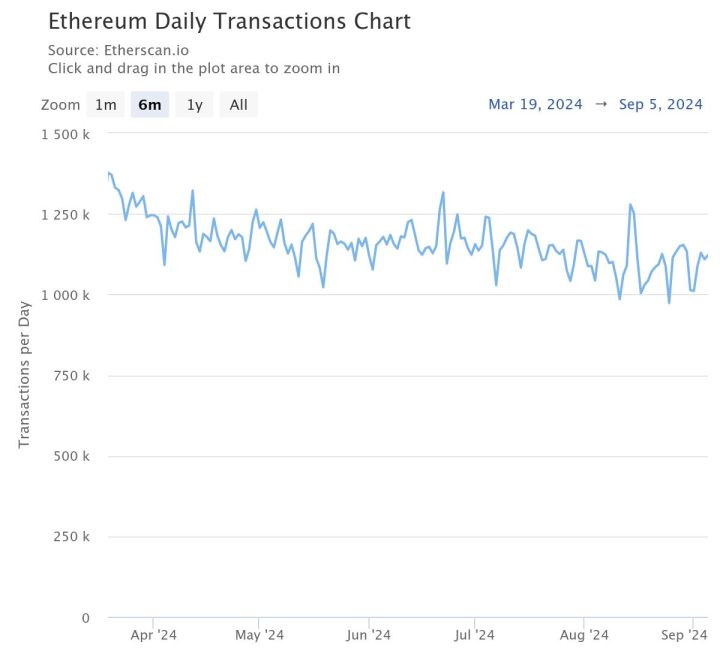

Pivoting to Ethereum data, we see a similar trend. The Ethereum daily transactions chart shows a slight decline in daily transactions, from approximately 1.37 million on March 19, to 1.12 million on September 5.

Network activity on any blockchain is largely dependent on the number of users or unique wallet addresses used on the concerned network. Looking at unique addresses used on the Bitcoin network, we see that it is down to 539,154 addresses on September 4, 2024, from 1,017,545 addresses on September 14, 2023. Interestingly, the number of unique addresses on Ethereum has remained steady.

However, it’s worth highlighting that sometimes, many users may have more than one wallet address, which might slightly reduce the reliability of this data point.

Adding, the report says that Bitcoin and Ethereum exchange-traded funds (ETFs) have witnessed net outflows, indicating weak conviction among investors to hold digital currencies during economic uncertainties. Specifically, Bitcoin ETFs experienced outflows to $305 million on August 31, 2024.

Crypto Market To Remain Highly Correlated With Stock Market

The report by Citi notes that the digital assets market is expected to remain highly correlated with equities. In contrast, however, a recent post by Santiment on X stated that Bitcoin is becoming less sensitive to trends in the stock market and, over time, could finally decouple from it.

That being said, Bitcoin permabulls like Michael Saylor, CEO of MicroStrategy, continue to place their bets on the leading digital currency. Recently, it came to light that Saylor had pocketed approximately $400 million on the back of planned daily sales of about 5,000 MicroStrategy shares.

At press time, Bitcoin trades $54,097, down by 3.3% in the last 24 hours. Ethereum is trading at $2,292, down by 3.2% in the same duration.