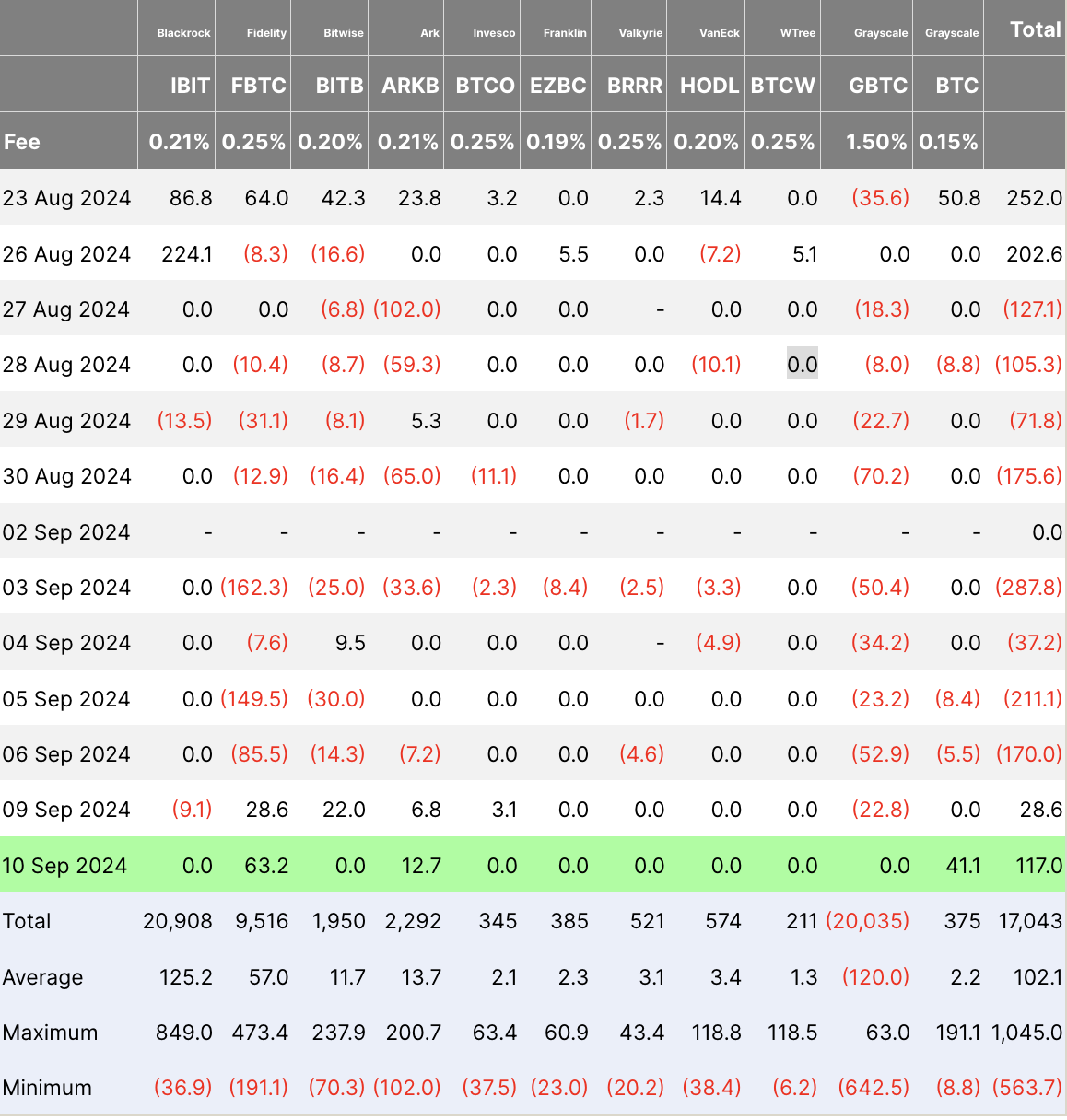

On Sept. 10, data indicated mixed Bitcoin ETF activity across several major issuers. Fidelity’s FBTC ETF saw the most significant inflow, recording $63.2 million. Ark’s ARKB ETF followed with $12.7 million. Grayscale’s mini Bitcoin ETF BTC saw $41.1 million in inflows.

Other major players, including Grayscale’s GBTC, BlackRock’s IBIT, Bitwise’s BITB, Invesco’s BTCO, Franklin’s EZBC, Valkyrie’s BRRR, VanEck’s HODL, and WisdomTree’s BTCW, showed no activity, with reported flows at zero.

Overall, total flows for the day reached $117 million, primarily driven by Fidelity and Ark. Grayscale’s holdings, while unchanged, continued to represent a significant portion of the market’s total ETF-backed Bitcoin. These flows indicate a selective but steady movement of institutional interest, with certain ETFs attracting more inflows than others as market participants adjust their exposure to Bitcoin.

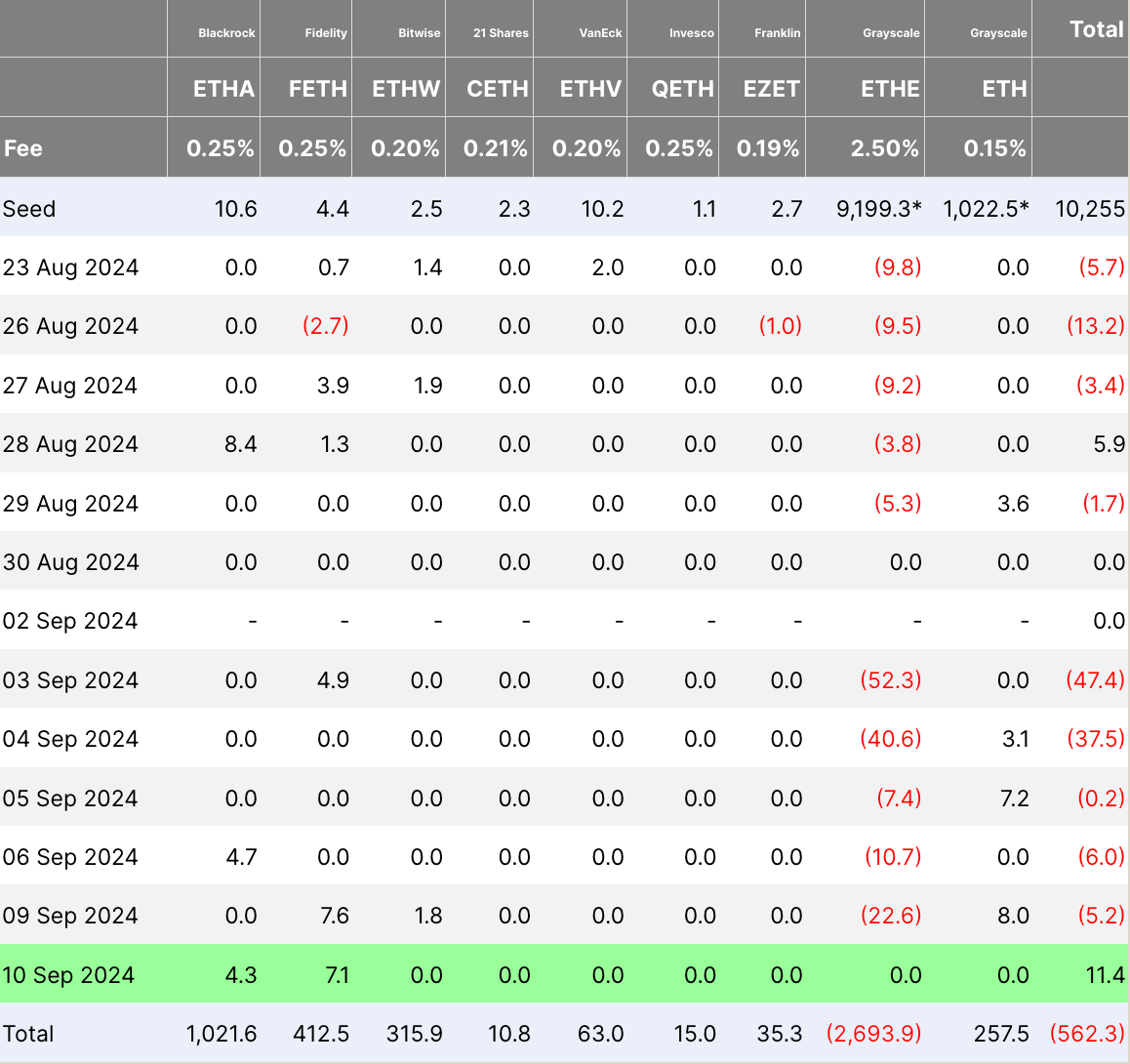

Ethereum ETFs

Ethereum ETF flows were relatively subdued, with only two major funds reporting inflows. Fidelity’s FETH ETF led the market, recording $7.1 million in inflows. BlackRock’s ETHA ETF followed with a smaller but notable inflow of $4.3 million.

Other ETFs, including Bitwise’s ETHW, 21Shares’ CETH, VanEck’s ETHV, Invesco’s QETH, Franklin’s EZET, and Grayscale’s ETHE and ETH funds, showed no activity, with flows recorded at zero.

In total, Ethereum ETF flows amounted to $11.4 million for the day. This limited movement suggests a cautious approach from institutional investors, with only a few funds seeing new inflows while others remained static.

The post Bitcoin sees $117 million inflow into ETFs, Ethereum ETFs continue minor inflows appeared first on CryptoSlate.